For many years it seemed that Liberia has missed out on the West African oil bonanza – whilst Nigeria has already established itself as the leading oil producer in the Gulf of Guinea and Ghana was about to celebrate the discovery of Jubilee, Liberia was still bleeding from a 14-year civil war. Having allocated substantial parts of its offshore areas to leading majors in the 1st and 2nd licensing rounds, it took several years to iron out all the technicalities of Liberia’s exploration and production terms, a period which was dampened by rather pessimistic exploratory drilling results. There is a strange irony in that following more than a decade of leisurely political decision-making Liberia is to push forward with its offshore licensing round with the COVID-19 pandemic raging on and oil prices being at multi-year lows but that is exactly what is going on.

The Liberia Petroleum Regulatory Authority (LPRA) launched the Harper Basin licensing round on April 10, opening the bidding procedure for nine blocks in the country’s western offshore zone. Despite not being able to conduct the usual upstream roadshow, compelled to launch the licensing round online, LPRA did not delay the licensing round altogether and has instead set February 28, 2021 as the bidding deadline (originally October 2020 was assumed to be the cutoff date). Liberia is more confident that it can attract foreign investment – the government has amended the Petroleum Law and can now offer bigger and newly delineated offshore blocks. But first it might need to convince investors that the oil is genuinely there. Related: U.S. Shale Could Crush The Oil Market Recovery

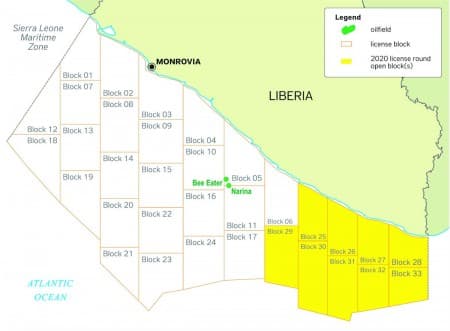

Graph 1. Liberia’s Offshore License Block in 2020.

Source: Petroleum Economist.

Heretofore no discoveries in Liberia’s offshore were turned out to be of commercial nature, despite a steady ramp-up of drilling activity in the early 2010s. African Petroleum spudded a dry well with Apalis in 2011, only to encounter 21 meters of net oil pay with its Narina well. African Petroleum (AP) followed through with a third well, claiming that the 2012 Bee Eater discovery also hit a net oil pay. AP initially estimated that the two discovered sites would contain around a total of 1.2-1.3 Bboe of reserves, yet due to a lower-than-expected permeability this was reconsidered to 0.1-0.2 Bboe. The US major Chevron also joined the drilling game, having spudded two offshore wells but no results were made public, suggesting that their recoverable reserves were relatively minor. This might of course point to a general tendency of the Liberian offshore being less oil-prolific than that of Ghana, yet not necessarily. Related: The State Hit Hardest By The Oil Crash

Up to now most of the drilling has been done in the central part of Liberia’s offshore, the Harper Basin on its western part is reportedly the least explored offshore hydrocarbon frontier in West Africa and as such might bring about a series of surprises for oil drillers. It also lies geographically closer to the well-established basins in Ghana and Nigeria. Having redrawn the license block map and boosted the licensing round with new seismic and magnetic data of the Harper Basin, LPRA has concurrently been lauding its fiscal upstream terms as being very competitive not only in a West African context but also internationally. Neighboring Sierra Leone (similarly untapped) moved to direct negotiation for all of its offshore blocks, going as far as to allowing potential investors to reshape the prospective blocks, so the pressure is on Liberia to perform.

Liberia’s upstream terms are quite favorable, an assertion rendered even more obvious by Nigeria’s tinkering with its tax code to maximize government revenue. All upstream agreements are signed under production sharing contract terms, yet it need not necessarily be via competitive licensing – direct negotiations with the Liberian oil regulator are also an option. Under the 2016 Petroleum Law the cost recovery level is fixed at 70%, with the production allocation split into three categories depending on the internal rate of return. If the IRR is higher than 25% then the Liberian state would take over 70% of production, whilst if the IRR is 19% or less than that the state would be allotted only 25% of oil output.

But much will depend on how well Liberia fares with the manifold impacts of Covid-19. To take just one recent episode from the African nation’s history, in 2014 the rapid spread of Ebola has upended the drilling schedules of ExxonMobil and Anadarko, which were forced to evacuate all workers and postpone their activities. When ExxonMobil returned to Liberia to drill the Mensurade-1 well in 2016, it found no commercial hydrocarbon reserves. This was effectively tantamount to a lethal hit, all the more so as Liberia’s national oil company (NOCAL) released in 2015 all of its staff to save on expenses amidst falling oil prices, albeit on the promise to take them back once the financial crisis ends.

Corruption might be one of the most important roadblocks to overcome for the Liberian government – before the offshore drilling died down in 2015-2016, much of Liberia’s media coverage revolved around the 2013 ExxonMobil acquisition of an oil block from a seemingly shady company called Broadway Consolidated/Peppercoast (BCP). According to NGO reports the deal involved bribing of Liberian officials who were alleged to stand behind BCP. Liberia’s President George Weah came to power in 2018 with a powerful pledge of eliminating government graft, however could so far achieve relatively little, after hitting the institutional cold shoulder repeatedly. Launching the next licensing round fully online, in times of high inflation and depressed commodity prices, is a brave and laudable step – one that needs to be fully backed by the Liberia domestically.

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Spikes Despite Pandemic Uncertainty

- How Accurate Are EIA And API Inventory Reports?

- Tesla Could Launch A Million-Mile Battery This Year