Oil prices recouped some losses on the last trading day of the year with Brent crude set to close well below $80 per barrel.

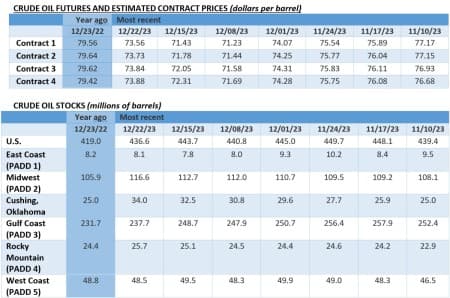

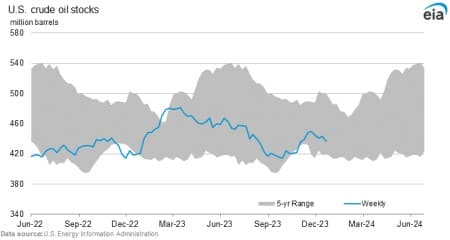

The slowing down of industry news into the Christmas period has stemmed the recent uptick in oil prices. Brent futures have marginally declined to $78 per barrel after Maersk and CMA CGM announced their resumption of transit through the Suez Canal, widely seen as a sign of impending normalization. At the same time, the few market participants still trading before New Year’s Eve shrugged off the seemingly bullish 7-million-barrel draw is US oil inventories, most likely a consequence of year-end inventory clear-out rather than a notable improvement in demand.

March to See Another SPR Delivery. Following up on January and February purchases, the US Department of Energy awarded SPR replenishment contracts for almost 3 million barrels of sour crude in March, awarding them to the same lineup of participants, Sunoco, Phillips 66 and Macquarie.

Milei to Pay Off YPF Lawsuit With New Bond. Argentina’s President Javier Milei is considering issuing a perpetual bond to pay for the $16 billion lawsuit award stemming from the 2012 nationalization of state oil company YPF (NYSE:YPF), however the punitive yields would make the presumed bond unlikely.

China Eases Limits on Fuel Oil Refining. The Chinese government has set its 2024 fuel oil import quota at a total of 20 million tonnes, up 4% from last year’s 19.2 million tonne tally, acquiescing to teapot refiners’ calls to relax controls on fuel oil that is frequently used as refining feedstock in Shandong.

Spain Cracks Down on Its Largest Oil Firm. Spanish oil major Repsol (BME:REP) is under investigation by the European country’s antitrust watchdog for allegedly abusing its dominant position in the wholesale fuel market, mere weeks after the company’s fierce criticism of a proposed 1.2% tax on energy companies’ turnover.

Finland’s Refining Faces Industrial Action Risk. Workers at Finland’s Porvoo refinery operated by Neste Oil (HEL:NESTE) announced a two-day strike on February 1-2, 2024 unless the government scraps its proposed labour market reforms that limit political strikes and make it easier to terminate contracts.

Qatar Expands into Oil Trading. QatarEnergy has signed a 5-year term supply deal with UK-based energy major Shell (LON:SHEL) to sell it some 50,000 b/d of Qatar Land and Marine crudes into the latter’s Singaporean refining system, the first ever five-year contract for thre Qatari national energy company.

Total Paves Way for Rio Grande Departure. US LNG developer Nextdecade (NASDAQ:NEXT) filed a shelf registration that would allow French oil major TotalEnergies (NYSE:TTE) to sell its 17.5% stake in the company, 5 months after its $15 billion Rio Grande LNG export project saw a final investment decision.

US Natural Gas Consolidation Sees First Deals. US natural gas midstream major Williams (NYSE:WMB) agreed to buy $1.95 billion worth of gas storage assets from Hartree Partners, with a total storage capacity of 115 billion cubic feet for six sites across the states of Louisiana and Mississippi.

Copper Perks Up on Lower Supply, Fed Promise. Copper futures have risen to the highest since August, with the three-month contract ending December above the $8,600 per metric tonne mark, notably buoyed by the promise of Fed cuts in 2024 and the halt of production at Panama’s Cobre Panama mine.

Angola Hands Out Exploration Contracts. Demonstrating Luanda’s commitment to revive its upstream industry, Angola has handed out two new offshore exploration blocks to a European consortium comprising Eni, BP and Equinor, with both Blocks 46 and 47 located in the untapped Lower Congo basin.

US Diesel Moves into Europe. Europe’s imports of middle distillates from the Middle East have been limited to the Red Sea crisis, however, according to Kpler data US exporters have shipped some 470,000 b/d of diesel to Europe, the highest ever monthly level of transatlantic arbitrage.

Spain Commits to Full Nuclear Phaseout. Despite some European countries changing course and revisiting their nuclear policy, Spain’s Sánchez government confirmed its commitment to close all nuclear plants by 2035 for a cost of $22 billion with dismantling works to start as soon as 2027.

Saudi Arabia Discovers Vast Gold Deposits. Saudi Arabia’s mining company Maaden announced the discovery of several gold deposits in the central regions of the country, promising an aggressive escalation of drilling activities into 2024 as the kingdom seeks to diversify away from oil production.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Oil’s Mega Acquisition Spree Might Not Be Over Yet

- Petrobras Returns to Africa with Shell Asset Acquisition

- Two Elections that Will Impact Energy and Geopolitics in 2024