BRAZIL C&C PRODUCTION

Brazil and Petrobras show something in common with U.S. LTO: even with a lot of debt and desire, and a strong resource base it is difficult to raise production in the face of high decline rates. It may also be a lesson for the world as oil prices rise and activity picks up; it is by far the most active conventional oil region with many major projects at various stages of completion, but facing delays and schedule crowding so oil production has continued a slow decline, contrary to expectations from last year. In July new production again did not quite match overall decline, mostly because of delays in start-ups of FPSOs planned for this year, and at 2575 kbpd was down 14 kbpd or 0.5% m-o-m and 48 kbpd or 1.8% y-o-y (data from ANP).

(Click to enlarge)

Two FPSOs were started in 2017: Lula Extension Sul (P-66) at 150 kbpd nameplate and Pioneiro de Libra, an extended well test project on the Mero field, at 50 kbpd. Both are now about at design throughput. Two other FPSOs completed ramp up in 2017. In 2018 three FPSOs have started up: Atlanta a small early production system at 20 kbpd, Bezios-1 (P-74) in the Santos basin at 150 kbpd and FPSO Cidade de Campos dos Goytacazes on the Tartaruga Verde field in Campos, also at 150 kbpd. There were three other FPSOs due for the Buzios field (P-75, 76 and 77) but at least one is delayed till next year. There are now four planned FPSOs remaining to be started up this year, all in the fourth quarter: P-75 and P-76 plus P-67 (Lula Norte) and P-69 (Lula Extremo Sul) in the Lula field (each 150 kbpd nameplate). Even for a company the size of Petrobras that seems a very tight schedule for commissioning large, complex plant, so one or two may slip to next year and all may be so late as to make little difference to this year’s numbers. See Reuters for more details.

Into next year there may be problems with shortage of deep water drilling rigs, Petrobras cancelled some following the price crash and there have been reports of them looking for available rigs now: no rig, no well, no oil, no matter what the available surface processing capacity. Offshore rig numbers, by Baker Hughes, have averaged around ten over the last couple of years, unless they add numbers then the overall ramp-up will remain as it has been and production will stay about flat.

FPSOs P-68 (Berbigao & Sururu) and P-70 (Atapu) are due next year, together with any delayed from this, but the ramp-up from this year’s FPSOs is likely to dominate production growth. There are none due for 2020. Note Petrobras projects have a hull name (P-), a vessel name (often named after a city), a field name (sometimes two or three) plus, often, a separate name (e.g. MV-) from the leasing company, and they often change these during development by reassigning hulls to different destinations, so my apologies if I’ve got some of the above wrong.

There’s been a lot of activity since 2016 despite the price crash and Petrobras debt and corruption problems, and yet production has slightly declined. Typically the large FPSOs at around 150 kbpd take 14 to 22 months to ramp up (see below), adding 8 or so production wells and 4 to 6 injection wells, but two are needed per year to overcome decline rates, and that may be increasing with higher overall production and some of the newer Santos vessels reaching end of plateau. It’s also noteworthy that the mature Campos fields have been showing accelerated decline and a marked jump in water cut recently, although the overall basin decline will be ameliorated by the start-up of the latest FPSO.

Petrobras production is falling faster than overall production, partly from sales of older fields but also because it has a lower ownership ratio of the new (growing) fields than of the mature (declining) ones.

(Click to enlarge)

The chart above shows how recent production wells have been added. I haven’t found any data for injection wells.

(Click to enlarge)

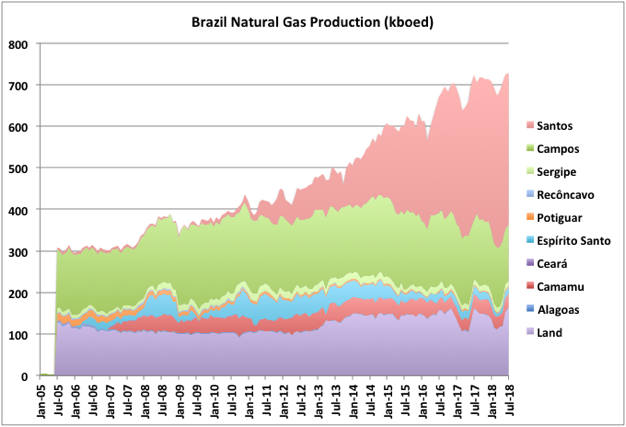

BRAZIL NATURAL GAS PRODUCTION

Brazil is not a large natural gas producer relative to oil, and what it does produce looks like it might be plateauing. The new pre-salt oil production has associated gas which is high in carbon dioxide: the Lula field is 15%, but is being produced commercially, while the Mero field (ex Libra) is 45%, which is not commercial and will be re-injected for pressure support. There are currently no rigs drilling for gas, and only about one or two since 2011, so near term, new gas production will be associated with oil, and gas imports are likely to be increasing. The largest recent gas discovery was the Jupiter field in the Santos basin, which was originally cited as having over 3 Gboe of gas, but it too is high in carbon dioxide and the current number looks to be around 1 Gboe, with gas re-injection being in the exploitation plan (e.g. for the recently approved Sepia FPSO).

(Click to enlarge)

BRAZIL RESERVES

OIL

Brazil reserves are issued by ANP each year. Unlike other regimes they give 1P (proven) and 3P (proven, probable and possible) numbers, but not 2P. As 2P is usually closest to what actually gets produced I’ve estimated it just as an average of the 1P and 3P numbers.

The reserves had big boosts from new field discoveries in 2010 and 2014 but since then estimated ultimate recovery has declined slightly, probably influenced by the oil price drop, but maybe also because of the results of appraisal drilling or performance from existing fields (e.g. The Buzios filed, just now coming on line, has been downgraded from original reserves of 4.5 Gb to 3.1 Gb).

(Click to enlarge)

NATURAL GAS

Remaining gas reserves peaked in 2014 and both 1P and 3P numbers have declined since. Estimated ultimate recovery has also declined slightly since 2014 (more so if the contingent numbers are taken out). The associated gas for the Mero (ex Libra) discovery in 2010 seems to be included, which I would have expected not to be the case given that the gas is non-commercial at the moment. Overall the reserve trends support there being a coming production plateau or peak.

(Click to enlarge)

BRAZIL C&C PROJECTION

I had a go at projecting Brail production based on production history, estimated 2P reserves and planned projects. The production for “Land” and “Other” basins is just a best-fit exponential decline with area matched to reserves. “Campos” is fitted with a generalized Verhulst equation, I used two cycles to try to capture the production dip in 2013, but it didn’t really work. Campos basin is mature so the 2P reserves should be fairly close to final recovery and most development opportunities have been identified, though there will likely be some future discoveries and extensions through redevelopments (a recent Wood-Mackenzie analysis found that “redeveloping the basin’s mature oil fields could extend the life of the basin and add more than 200,000 boed to its declining production by 2025” – I doubt if Wood-Mac have ever be accused of underestimating any number following the word “could”.

“Santos” is the main area for development at the moment and I’ve used a bottom up approach by identified FPSOs there (see below).

Future discoveries haven’t been included. Exploration is planned in various leases in the “Others” areas, including deep water Sergipe and Foz do Amazonas (which neighbours the Guyana area where ExxonMobil has had recent success but is also highly environmentally sensitive). There are also opportunities in Santos for extension to the new fields. A recent analysis by Jean Laherrere shows about 772 Gb remaining reserves (discovered and undiscovered) based on a Hubbert Linearisation method, which would imply there is around 50 Gb yet to be discovered (i.e. equivalent to four or five more Santos basins).

Note for comparing units 1000 mmbbls/year is about 2740 kbpd.

(Click to enlarge)

The chart below shows the bottom up estimate for the Santos basin. The FPSOs in the legend are shown in black if online, blue for under development, and green for planned and under appraisal. The numbers in brackets gives the nominal nameplate capacity. The total remaining reserve (area under the curve shown after 2017 plus run out after 2037) is equal to the 2P estimate of 11.8 Gb given above.

The curve is nicely symmetric but looks a bit squashed up so it might be that it gets flattened out a bit with delays or, equally, there will be some growth on the back end. It won’t be as smooth as shown either: this year might be flat or down before picking up and a heavy maintenance load or a couple of major accidents could show a clear dip for a year.

Petrobras has said it will be producing its own FPSOs after 2023, rather than leasing established designs (but like all companies, and not only those under heavy political influence, it says lots of things that don’t always pan out) and that would likely involve a learning period and slower developments; and would mostly be applicable only to new discoveries, a few of the last projects on existing fields or, possibly, some redevelopment projects There are possible upsides in the Mero and Buzios fields, but equally some Brazilian discoveries have disappointed and it’s still relatively early days in the pre-salt exploitation.

The big FPSOs seem to be developed for around 500 mmbbls of oil reserve each and to have about 25% decline rates coming off plateau, but there aren’t many that have reached late life yet so these could go either way. What is almost unique for Brazil compared with other countries is that the FPSOs hit plateaus that almost exactly match the nameplate, I have never seen any attempt to accelerate production by running above the nameplate in the early years, which would happen in a typical North Sea field; there do seem to be some projects that don’t achieve nameplate but relatively few. I don’t know if this is because the FPSOs are usually cloned rather than bespoke designs, or because of the nature of the wells, or something to do with the regulatory regime.

(Click to enlarge)

BRAZIL PETROLEUM IMPORTS AND EXPORTS

July showed a large and anomalous jump in crude exports and product imports (by dollar value), which looks like refinery availability issues but might turn out to be a reporting problem. Overall, though, Brazil is maintaining net export (by value) for petroleum goods and it looks like it is increasing internal refining capacity so crude exports and product imports have both been gradually decreasing. On that trend (ignoring July) net production of products would exceed local demand in the near future. On the other hand natural gas imports have been rising and that may need to accelerate.

(Click to enlarge)

By George Kaplan via Peakoilbarrel.com

More Top Reads From Oilprice.com:

- Iran Sends Record Amount Of Oil To China

- Oil Market Loses Its Bullish Edge

- What Killed The Oil Price Rally?