Most of India’s recent history can be characterized by economic isolationism and import independence. However, policy changes and reforms have unleashed the country’s potential leading to economic growth and higher energy consumption. India’s growing appetite for oil and gas is increasingly a strain on the climate. Fortunately, New Delhi is very much committed to the Paris Climate Agreement, and the country's ambitions and achievements eclipse even some developed countries’.

The per capita consumption of energy in India is one of the lowest in the world. According to the Global Carbon Project, Americans consume, on average, 10 times more than Indians. However, the Asian country’s massive population is the main reason for being the third-largest emitter of CO2 in the world after China and the U.S. Despite the challenges, renewables are still 22 percent of the total installed capacity of 357 GW. The Indian government is aiming for 175 GW of renewables by 2022 and a further 500 GW, or 40 percent of total capacity, by 2030.

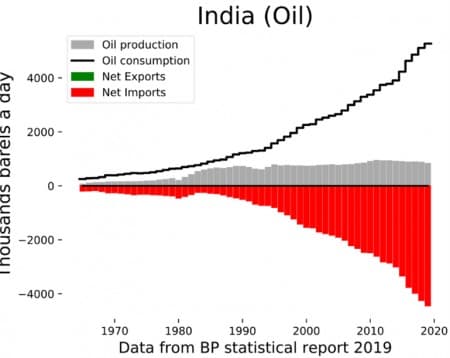

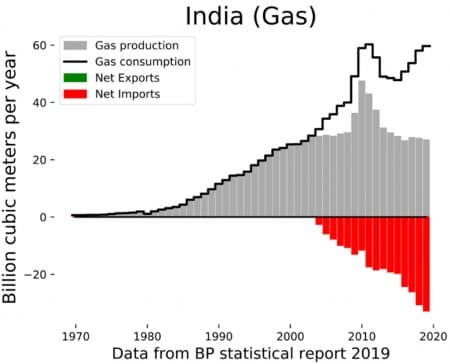

India’s 'phobia' for overreliance on foreign producers and the effects of climate change are the main reason for these ambitions. Ever larger quantities of oil, gas, and coal are required to fuel the country's development. Although India produces some oil and gas, import dependency has grown significantly. The energy bill negatively affects the country’s trade deficit when prices are high.

Coal is one of the few areas where India has the potential to maintain relative self-sufficiency. Prime Minister Narendra Modi announced in June that 40 state coal pits will be opened for commercial mining to increase efficiency and production which is the first time since the 1970s. This underscores the government’s commitment to boost electricity production from coal-fired power plants. Within the next decade, another 64 GW of coal plant capacity is planned. Related: Why Saudi Arabia May Be Forced To Start Another Oil Price War

These commitments stand in stark contrast with the same government’s intention to boost renewables by replacing coal. According to India’s energy minister, R.K. Singh, “many of those plants [coal] are getting retired. Some plants are already retired, and about 29 more plants are going to retire, and all that space will be occupied by renewable energy.”

Besides the obvious environmental advantage of renewables (especially solar in India), decentralized energy production has the advantage that it doesn’t require large transportation infrastructure. Especially in remote and rural India, consumers can leapfrog technological development and harness the power of the sun to improve their quality of life.

Furthermore, solar power in India has one of the lowest costs globally due to favorable environmental conditions. According to Wood Mackenzie, an energy consultancy, the levelized costs of electricity (LCOE), which is a standardized measure to compare different sources of electricity production, have fallen to $38 per MWh. This means that solar power is 14 percent cheaper than coal-fired power which historically has been the cheapest source of energy in India.

However, solar power’s favorable conditions could change in the near future as the energy mix changes. Integrating intermittent renewables and maintaining a stable energy system is a major challenge. The lack of affordable and scalable storage capacity means that an energy mix dominated by renewables is unrealistic at the moment.

Furthermore, the lower LCOE of renewables vis-à-vis coal does not include costs to facilitate integration in the grid and maintain stability. Infrastructure costs are usually higher for renewables due to their intermittent nature renewable power and sometimes decentralized property.

Also, approximately 80 percent of the components used in solar projects are imported from China. The difficult political relations with India’s northern neighbor have created the need for a domestic PV-industry to reduce dependence. However, these efforts have been relatively unsuccessful as Chinese manufacturers are still able to produce cheaper while delivering higher quality products. Increasing customs duties could spur a domestic industry, but it would hurt India's ability to reach its ambitious goals.

It remains likely that the world's second-most populous country will invest heavily in both renewables and coal. Therefore, expect more contradictory announcements from India in the coming years. However, the rapid development of renewable technologies and falling costs are a unique opportunity to leapfrog the development of the power systems of developed countries. Instead, India could become an example of modernization without pollution.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- The Next Couple Of Months Are Crucial For U.S. Oil

- Where Will the World’s Next Giant Gold Discovery Be?

- Is U.S. Shale Finally Bouncing Back?