Tesla will cut the prices of its solar panels by as much as 38 percent below the national average in a bid to regain ground in the solar market, the New York Times reported today, noting the official announcement will be made later in the day.

Tesla entered the solar power with the acquisition of SolarCity in 2016, sparking concern among investors and industry observers that it was stretching itself too thin.

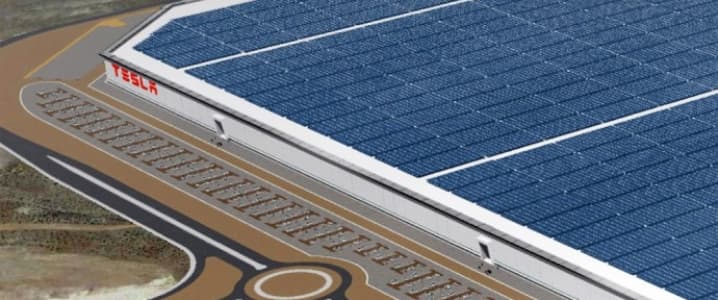

Tesla acquired SolarCity for US$2.6 billion plus the assumption of another US$3 billion in SolarCity debt in 2016. At the time, many questioned the wisdom of such an acquisition given that SolarCity was a cash burner, but since then Tesla has streamlined the company’s operations as it pursued its plan of growing into a one-stop shop for energy solutions, from batteries to solar rooftops. Still, the concern about the luxury carmaker’s solar business has deepened but, according to company executives who spoke to the New York Times, the price cut move should put these to rest.

This is not the first time Tesla has cut prices for its solar energy products. Last November, the company reduced the prices for its household solar power systems to improve sales, Reuters reported at the time, citing the company’s senior vice president for energy operations, Sanjay Shah. The price cut was substantial, at 15 to 25 percent, which translates into US$3,000-5,000 per system. The move is part of an ongoing restructuring of SolarCity.

The acquisition of the solar panel maker was part of Tesla’s strategy to one day become a one-stop shop for everything energy, allowing households to become as self-sufficient as possible with its roof tiles, battery packs, and, of course, cars. However, accomplishing this goal has proved tricky as the company repeatedly fails to keep its own deadlines for product releases, most notoriously with the flagship Model 3 that is planned to turn Tesla into a mainstream carmaker rather than a luxury brand only.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- 19 Historical Oil Disruptions, And How No.20 Will Shock Markets

- A New Mega Cartel Is Emerging In Oil Markets

- Why An OPEC Oil Supply Surge Won’t Happen