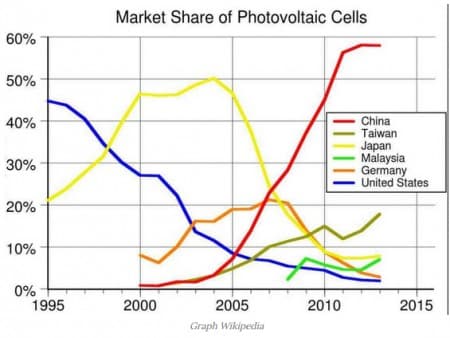

Not so long ago the energy transition was primarily an idealistic concept driven by environmentalists and researchers. The most important impediment was the high costs of clean technologies. The drastically reduced price of PVs, for example, has ensured global attention for the solar industry. A similar situation could enfold concerning emissions-free hydrogen production as China and the EU are getting ready to dominate the market.

Germany’s trauma The solar industry in Europe’s biggest economy, Germany, experienced a spectacular boom in the mid-2000s. Renewables were high on Berlin’s agenda who supported businesses with generous subsidies. The success of these policies resulted in the strong presence of German companies on the global stage when a fifth of all photovoltaic cells was produced in the European country.

The situation changed, however, when China's formidable industrial complex adopted Beijing's strategy concerning the establishment of a domestic PV-sector. Since the mid-2000s, the Asian country has seen a remarkable rise. Several factors underpinned Beijing's success: public support, a large domestic market, and a major industrial complex. The EU and Germany have learned from their mistakes and from China’s success, which is being emulated towards the hydrogen economy.

The EU’s strategy

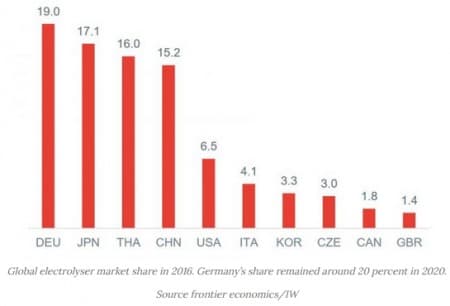

Despite the Covid-19 crisis, Europe has seen a flurry of public sector announcements concerning the kick-starting of a hydrogen-based economy both from national and supranational institutions. The guiding principle is Europe's current technological prowess and the realization that their dominant position could easily be hijacked again if the necessary policies are not enacted on time.

Germany's government has ensured a prominent spot for its future hydrogen economy in the economic stimulus packages intended to mitigate the financial fallout of the current health crisis. At least €9 billion will go towards stimulating the development of hydrogen-related technologies. Also, as Germany took over the six-month EU Council Presidency on July 1, Economy Minister Peter Altmaier devoted a significant portion of his speech to green hydrogen.

Related: The Sky Is The Limit For Clean Energy Subsidies In Europe

Furthermore, the EU’s ‘Green Deal’ is partly dedicated to kickstarting a continental zero-emissions economy. The strategy contains a three-step plan that starts with the implementation of green hydrogen production and consumption in industries such as steel, chemicals, and refineries by 2024. In the second phase, facilities will be connected to create 'hydrogen valleys' by 2030. In the last phase, the hotspot will be joined and a large European hydrogen infrastructure created.

The EU hopes to produce 1 million tonnes from 6 GW of electrolysis capacity by 2024. By 2030, this should have grown towards 10 million tonnes from 40 GW capacity. Germany alone would contribute 5 GW by 2030. Other countries, such as the Netherlands, also intend to contribute and profit from the new hydrogen economy. The Dutch are uniquely positioned with access to the North Sea for the installment of wind turbines and an existing gas network that could be reused for export purposes.

China in the rearview mirror

The EU’s strong support for the hydrogen industry is a welcome change from the past. Currently, European companies such as Siemens and Thyssenkrupp deliver a considerable number of electrolysers. Chinese companies, however, are not far behind.

Although the EU is still leading the industry in terms of knowledge and production capacity, it cannot afford to let up. For starters, the Chinese have proven that they can implement industrial policies with ruthless efficiency and dominate the market. A clear disadvantage is that Beijing has not yet set a clear goal for an emissions-free society by 2050 as the EU has.

According to a report by Cleantech Group, China’s electric vehicle strategy could be used as a warning sign to competitors. Two decades ago vehicle electrification became an industrial goal and national priority. Currently, Chinese companies lead in sales and production capacity.

While the EU is warned to implement the right policies this time, the increasing competition is good news for consumers and the environment in general. The current attention for hydrogen remains a hype that needs to be translated into actual results. The situation is highly promising as public support remains strong and the installment of wind and solar power is gathering pace, which is a precondition for green hydrogen production.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Vitol Employees And Execs See Massive $2.2 Billion Payday

- Saudi Arabia May Be Forced To Cut Oil Prices Once Again

- Oil Prices Rise Despite An Influx Of OPEC+ Crude

"Weichai Ballard Hy-Energy Technologies Co., Ltd. ("WBJV")

Established in November 2018, Weichai-Ballard Hy-Energy Technologies Co., Ltd. is a sino-foreign equity joint venture owned 51% / 49% respectively by Weichai Power and Ballard, formed as part of a major strategic transaction which saw Weichai become Ballard's largest shareholder. Weichai is a leading automotive and equipment manufacturer specializing in the production of powertrains, automotive, intelligent logistics, automotive parts and components, with over 74,000 employees and a global revenue of approximately $23 billion in 2017."

In 2019, we will focus on building out the WBJV organization and start on a multi-year technology transfer program for the exclusive rights to manufacturer Ballard's next generation LCS fuel cell stack and LCS-based modules for bus, commercial truck, and forklift markets in China. WBJV will be based on Weichai's global headquarters in Weifang, Shandong, and is expected to leverage Weichai's extensive expertise in design engineering, powertrain integration, supply chain management, and operational excellence to become a leading fuel cell product manufacturer for the heavy duty vehicle market in China.

Guangdong Synergy Ballard Hydrogen Power Technology Co., Ltd.

Established in 2016, this is a joint venture company owned 90% by Guangdong Nation-Synergy Hydrogen Power Technology Co. Ltd and 10% by Ballard. The company manufactures Ballard-licensed fuel cell stacks that are packaged into locally-assembled fuel cell engines and integrated into zero-emission buses and commercial vehicles in China."