The Chinese Communist Party is well aware of the challenges its rise poses to the established order and primarily the United States. Beijing has, therefore, been following Deng Xiaoping’s famous dictum “hide your strength, bide your time.” The Chinese would like to avoid Thucydides’ trap from happening earlier then they’re prepared for, which means a conflict between a hegemon and a rising power.

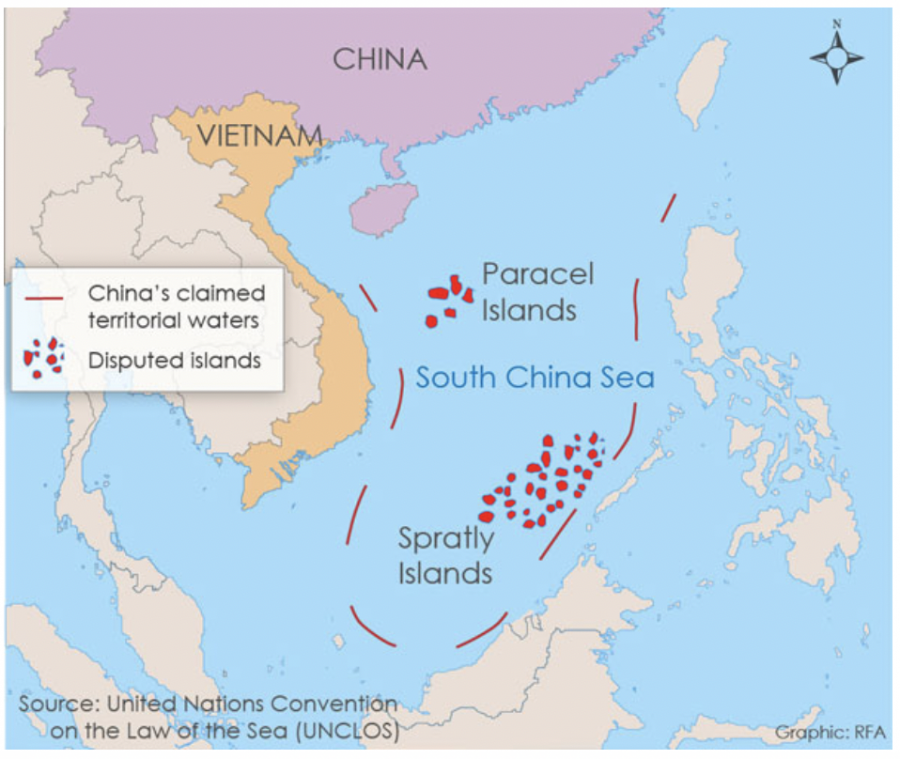

The growing tensions in the South China Sea are regarded by all involved parties as a test for the current balance of power in the region. Beijing claims much of the area based on the controversial ‘nine-dash line’ assessment. According to this assertion, China can claim large swaths of the sea, which could hold up to $2.5 trillion worth of oil and gas.

(Click to enlarge)

Vietnam is one of the countries which stands to lose the most if Beijing achieves its goal. Recently, Hanoi has become even more isolated as other littoral states are abandoning ASEAN’s united front against China. The Philippines is close to signing an agreement for joint oil and gas exploration, while Malaysia has agreed to set up a bilateral dialogue mechanism to defuse tensions.

Vietnam, however, maintains its overlapping claim with China on at least a part of the South China Sea. Despite the area’s promising geology concerning energy deposits, few companies dare to challenge Beijing as they would suffer sanctions and limited access to the world's second-largest economy. Repsol, for example, was ordered to suspend drilling following Chinese threats. In recent months rumors of ExxonMobil leaving Vietnam have stirred the Asian country, which has compelled the foreign ministry to dispel the reports.

The American energy giant acquired several blocks of the coast of Vietnam from BP in 2009. Drilling started in 2010 and led to positive results two years later. Political tensions with China, however, have lowered the area’s priority to Exxon, but on January 16 the company signed a highly anticipated project framework agreement with PetroVietnam to develop the massive gas field.

The Ca Voi Xanh or Blue Whale gas field lies 50 miles of the coast from Danang and could produce 150 bcm of natural gas over the lifetime of the program. A total sum of $10 billion is required to start production in 2022, which could earn the Vietnamese government approximately $20 billion over several decades. Even more important, the Asian country can avoid a looming energy crunch which potentially could cause major blackouts due to Vietnam's rapidly increasing energy consumption.

Despite the looming threat, analysts assumed that Exxon’s position was strong enough to withstand Chinese pressure due to three reasons: first, it is expected that the company enjoys the backing of the U.S. government. Second, it is assumed that Beijing wouldn’t want to disrupt the fragile global energy industry especially due to its dependence on imports. Lastly, the Blue Whale project is located outside the ‘nine-dash line' area where China hasn’t got a claim on. Related: An Unusual Development In Natural Gas Markets

According to Carl Thayer, emeritus professor and South China Sea expert, “Vietnamese sources indicate that China and Vietnam reached an informal understanding that they will not interfere in activities by the other party if it falls on their side of a hypothetical median line. This understanding should reduce the risk of ExxonMobil in its present operations.”

Other analysts, however, estimate the likelihood of Exxon exiting the project higher due to other reasons than Chinese pressure. The energy giant is currently engaged in several high stake projects across the world from Papua New Guinea to Texas and Brazil. Exxon could choose to raise money by selling its stake in the Blue Whale project.

But the question is, who will be willing to buy it if the most likely candidate is opting to sell its involvement in Vietnam’s most promising energy enterprise? If Exxon leaves the project, that would be a blow to Vietnam’s oil and gas sector and a sign to the rest of the industry that China blows the shots in this area of the world. Therefore, the coming months are a test of resilience for the Asian country’s hopes for energy security.

ADVERTISEMENT

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Did Trump’s ‘Plan B’ For Iran Just Fail?

- Growing Fear Of Global Economic Slowdown Caps Oil Price Gains

- A Serious Contender To Lithium-Ion Batteries

How apt his mantra has been during the trade war between the United States and China. China has won the trade war by keeping calm when confronted by US provocations, speaking softly even when retaliating against US tariffs blow for blow and never threatening to use what has been dubbed as its nuclear options, namely dumping $1.3 trillion of US Treasury bills and declining to supply the United States with its rare earth metals. Moreover, China is refusing to overreact when it is fully aware that the United States was involved in stirring the recent troubles in Hong Kong. Instead, China, efficiently and calmly, published a photo of a US diplomat talking to the opposition in Hong Kong just to let the Americans know that it is aware of their dirty work in Hong Kong.

Still, I disagree with the Thucydides’ Trap coined by Harvard Professor Graham Allison to capture the idea that rivalry between a pre-eminent power and its challenger often ends in war. In the nuclear age, it is not inevitable that this could be the case. Both great powers are fully aware that a war between them could mean the annihilation of both. That is why both China and the United States will opt for some form of accommodation. The state of affairs between the former Soviet Union and the United States is a case in point. Still, China’s position is vastly strengthened by its strategic alliance with Russia.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

IF this is correct, it is significant, since it would represent the Chinese government's tacit acknowledgement that their "9-Dash Line" claims are not sustainable.

Median Line claims are all that the other South-east Asian countries have been pushing for. And all that exist under in international law.