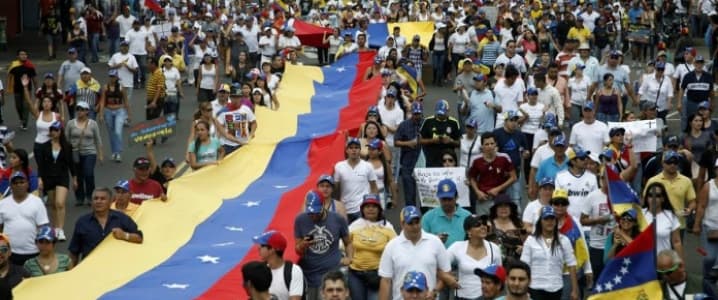

Hundreds of thousands of protesters took to the streets in Caracas on September 1, demanding the removal of Venezuelan President Nicolas Maduro. Estimates peg the number of protesters at about 1 million, clogging the capital’s streets amid the country’s worst economic crisis in its modern history.

"We are going to defeat hunger, crime, inflation and corruption. They've done nothing in 17 years. Their time is finished," one protester said according to a Reuters report.

Venezuela’s economic crisis has morphed into a political and humanitarian disaster. The collapse of oil prices has hollowed out the country’s sole source of export revenue.

But the problem for Venezuela is that a spiral of debt and deprivation will simply fuel further desperation. Oil exports have already declined by about 300,000 barrels per day as of June from a year earlier as PDVSA fails to keep up with maintenance and electricity blackouts knocked refineries offline. After counting for domestic consumption and the oil that is set aside for loan repayments to China, Venezuela only has about 900,000 barrels per day left for exports, according to Russ Dallen of Caracas Capital Markets, cited by Bloomberg in an alarming September 1 article on Venezuela’s predicament.

However, as Luisa Palacios said in an August report published by the Columbia University’s Center on Global Energy Policy, “the most severe risks to oil markets…still lie ahead.” PDVSA is struggling to pay for the needed imported diluents to mix with its heavy crude oil, without which, production could fall. PDVSA has also fallen deeply into arrears with oilfield service companies, firms that have cut back on operations because of lack of payment. And while production has already declined by 230,000 barrels per day this year, the Columbia University report says, exports have not yet seen a corresponding drop off because of the meltdown in domestic demand. As such the problems with Venezuela’s oil is worse than the headline export figures suggest. Related: Slave Shipyards: The Oil Industry's Shocking Secret

Thus far, Venezuela has prioritized debt payments, even above the needs of its populace, a seemingly cold and self-defeating strategy. But the Venezuelan government appears intent on keeping access open to international debt markets, so it continues to use its shrinking pile of cash to meet its bond payments. However, it faces its toughest challenge yet in the next two months. Venezuela – both the sovereign and the state-owned oil company PDVSA – has large debt payments falling due. In October, it must meet a $1.8 billion payment followed by another $2.9 billion due in November. Even if it can somehow make those payments, next year things only get worse. In April 2017, for example, it has to repay $3.8 billion in maturing debt.

Even with Venezuela’s determination to meet those deadlines, it may not have the cash to do so. That could force a restructuring or some sort of negotiated settlement or refinance agreement with creditors. But so far no deal has been struck despite rumors. “Perhaps signaling more precarious finances, PDVSA continues to insist on the need for debt re-profiling of the 2017 maturities,” Siobhan Morden of Nomura Holdings Inc., said in a recent research note to clients, according to Bloomberg. “Though more worrisome is the nine months of headlines without any follow-through.” Related: The Coming Revolution in LNG Pricing

The implied probability of a default based on credit default swaps suggests that the markets are predicting a 50-50 chance that Venezuela fails to pay over the next year. Over the next five years, the markets are more certain – there is a 91 percent chance of default based on credit-default swaps, Bloomberg says.

And while diverting increasingly scarce resources to pay international creditors while people go hungry in the streets is an absurdity, Venezuela has only bad options at its disposal. Oil production could be crippled even further if it were to default on bond payments, Luisa Palacios of Columbia University says. Another 200,000 to 300,000 barrels per day could be lost if Venezuela is unable to import diluents, a disruption that could occur from a credit event.

“The downside risks to the production outlook in 2016 are already materializing. But if there is no political and economic stabilization in the country, the risks to oil production and exports will continue well into 2017,” Palacios wrote in August. “So while Venezuela has already become a headline risk for global oil markets, the true magnitude of its supply risks might lie ahead.”

ADVERTISEMENT

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- How Millennials Could Bring The Oil Industry To Its Knees

- Saudi Arabia Just Boosted The Odds Of An OPEC Deal

- Putin Has The Middle East In His Sights And It’s Not Just about Oil