Via AG Metal Miner

China’s major steelmakers recently warned of a “very challenging” H2 that could impact steel prices. As noted in news reports quoting the China Iron & Steel Association (CISA), this goes against earlier expectations of improvement in the sector.

According to a June 30 report from Bloomberg, officials from China Baowu Steel Group, Ansteel Group, Hesteel, and Hunan Iron & Steel Group cited low demand. Other factors include lagging profitability and pressure to cut costs for creating a “very challenging second half.”

CISA also quoted company leaders as saying that “The peak inflection point for steel demand has emerged, while the problems of insufficient end-user consumption and ongoing thin margins are particularly prominent.”

CISA also noted that Chinese mills operated at a loss during the first five months of 2023. However, the ongoing property crises and slowed economic growth continue to impact steel prices. It has also impacted demand across the world’s second-largest economy.

Steel Prices and Stocks Impacted

China’s Q1 GDP grew 4.5% year on year, exceeding previous expectations of 4%. However, as one analyst noted, this growth mainly applied to the service sector and not manufacturing or construction. Local property developer Evergrande’s late-2021 debt default, which totaled the equivalent of $300 billion, also helped curbed appetites in the Chinese real estate sector.

Manufacturing likewise contracted in June. Indeed, a July 3 report from Reuters indicated that June’s Caixin/S&P Global manufacturing purchasing managers’ index (PMI) eased to 50.5. This is a decline from the 50.9 seen in May,

The Bloomberg report quoted China Industrial Futures analyst Wei Ying as saying that the outlook for China also hinges on how the country carries out additional stimulus. Ying noted that a lot depends on whether the National Development and Reform Commission intervenes again.

In response to slowed growth, the People’s Bank of China started lowering its rates in June. This began with the seven-day reverse repo rate on June 13. The PBoC followed this with a 10-basis point decrease in its medium-term lending rate to 2.65% two days later.

Insufficient use has not helped struggling steel prices, though Chinese stocks did fall from May to June. In a July 3 report, CISA said that the country’s steel stocks totaled 9.24 million metric tons in late June. This reflects a 3.3% drop month on month from 9.56 million metric tons.

Europe Wary of China’s Troubles

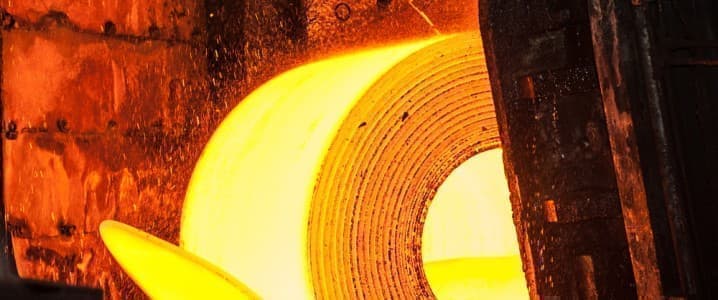

One analyst told MetalMiner that the poor outlook in China would likely impact Europe as well. “The market is bad enough as is,” that analyst said. An influx of Asian imports, partly due to Chinese mills overproducing in Q1, will likely pressure hot rolled coil steel prices across the continent. Meanwhile, back in February, the European Commission announced that it expects 2023 GDP growth in the 27-member bloc will be less than 1%.

Hot rolled coil in northern Europe averaged €680-690 ($740-750) per metric ton EXW, down from the €750 ($815) reported in May. Meanwhile, deals for the flat rolled product in southern Europe contracted at €670-680 ($730-740) in late June. There were even reports of one transaction from Hesteel Serbia for €660 ($715).

According to information from Metals Consulting International, the EU’s Q3 import quota on flat-rolled product, including hot and cold rolled coil and hot dipped galvanized sheet, increased by over 6.5% to 4.9 million metric tons. This is a significant jump from the 4.6 million metric tons for Q2.

One trader took a wait-and-see approach regarding how the news would impact steel prices within Europe this year.“Honestly, it can go in either direction,” the source told MetalMiner. “There are too many variables to know which way it will go.”

By Christopher Rivituso

More Top Reads From Oilprice.com:

- U.S. Natural Gas Loses Ground As Europe Leans On Solar Power

- The West Loses Grip On China's Auto Market As Domestic Carmakers Boom

- Lapis Lazuli Corridor Ushers In New Trade Opportunities For Eurasia