Car sales are tanking the world over: Europe is likely to experience a 20–25% drop in overall sales, the US is running at an annualized rate of little over 12m units – 5m below last year’s total, while the Chinese market went into reverse long before covid-19.

For automakers burnishing their green credentials there is a positive spin: Electric vehicle sales – or better still – penetration rates. In Western Europe, according to Schmidt, a market researcher, for the first five months of 2020, 300,000 EVs (including plugin-hybrids) were sold, giving battery-powered cars a 8.3% penetration rate (in Norway it’s 69%).

In the UK and Ireland, it’s just below 7% and in the US, 4.5%. Globally, according to IHS Markit, one in 25 cars sold in the year to end May were battery powered.

But in absolute terms, the market for EVs remain in a deep slump.

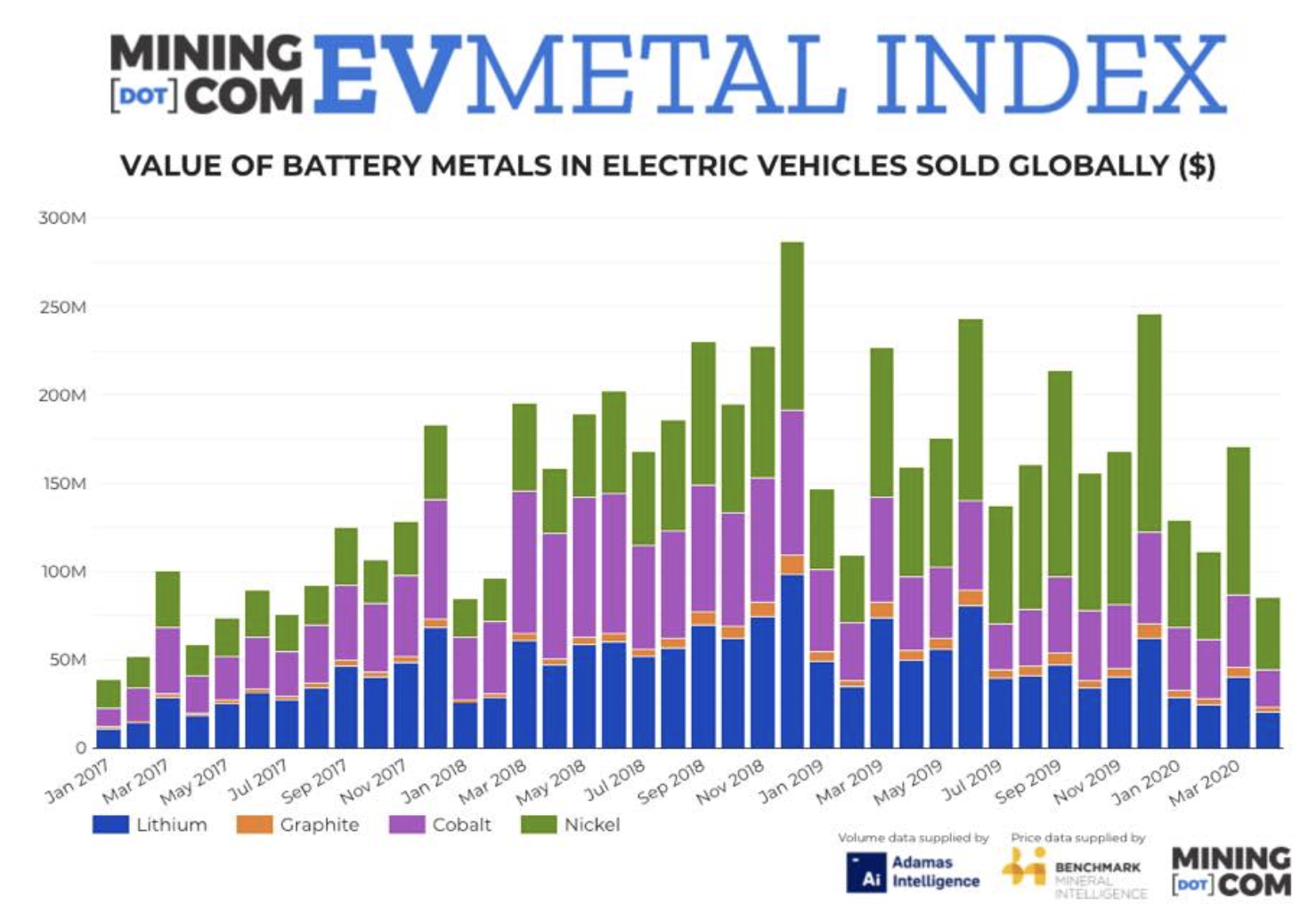

The MINING.COM EV Metal Index, which tracks the value of battery metals in newly sold EVs around the world has dropped to its lowest level since January 2018.

The decline is due to a combination of lower prices for the lithium, graphite, cobalt and nickel tracked by the index, but mostly due to the sharp fall in raw material deployed, which halved in April compared to the same month last year.

Year to date at a shade under $500bn, the industry has shrunk by 22.6%, the definition of a bear market. That leaves the remaining months of 2020 with a lot of heavy lifting to do for the market to recover.

Despite the sharp correction over the last two years, battery metal prices show little signs of improving. Coming close to the 2019 annual total of $2.1billion now seems a big ask.

More Top Reads From Oilprice.com:

- Oilfield Services May Not Recover Until 2023

- How Saudi Arabia Caused The Worst Oil Price Crash In History

- Pirates Threaten Oil Operations In Gulf Of Mexico