Nickel prices are proving a headache for miners across the world: oversupply of the metal plus low electric vehicle (EV) demand has created a profit-stealing two-year price slide.

Anglo American’s nickel revenues fell by around 23 percent in 2023, according to its latest earnings report. The EBITDA for nickel at Vale fell by 56 percent over the same period, from £1,924mn to £668m.

The nickel price is down 27 percent year on year.

How have prices fallen so far, so quickly?

Oversupply from Indonesia

Part of the reason nickel prices have been sliding is oversupply in the market.

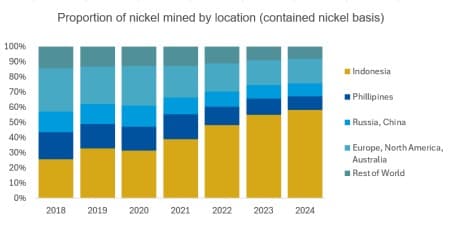

Indonesia has been the “main [source] of supply growth in the last few years” due to a lack of investment from the traditional players in the nickel market, Nikhil Shah, nickel analyst at CRU, said.

This glut of nickel has pushed the price down, Shah said, adding that prices will “remain under pressure throughout 2024.”

Indonesia now accounts for over half of global nickel supply and is set to increase its market share further this year.

Benchmark has forecast Indonesian nickel production for the battery industry to grow by over 600% by 2030, thanks to significant Chinese investment in processing plants.

Source: CRU

Steering away from EVs

On the other side of the equation, demand for EVs is weakening, pulling nickel prices even further down. Nickel is a key component in EV batteries.

After a frenzy of activity and hype in the last few years, sales of EVs slowed in 2023 and are likely to slow further.

China, which is forecast to account for a majority of global EV sales in 2024, had an “underwhelming performance” in 2024, which hit supply chains and “impacted investor sentiment toward [EVs]”, according to Global X ETFs.

Similarly, the amount of US consumers planning to buy an EV has fallen by around a fifth in the last year, according to Deloitte’s 2024 Global Automotive Consumer Study.

A “variety of challenges continue to stand in the way” of EV adoption, according to the report, including high prices, charging time, and availability of charging infrastructure.

The market value of Tesla, which has 19.1 percent of the EV market, has fallen by 27.3 percent in the year to date.

“Many governments have been scaling back subsidies, and that’s added to the slowdown in EV sales,” Shah said.

Shah split EV adoption into two phases and said that while the initial adoption of EVs into the consumer had taken place, the second phase has been held back by high prices and the cost-of-living crisis.

Related: Two Countries That Could Break Putin's Gas Grip On Europe

Destocking by Chinese battery raw materials companies after a bumper 2022 has also pulled prices down, according to Shah.

However, the problems nickel faces may be short term.

Despite the oversupply of battery raw materials and demand uncertainty in the short term, the fundamental shifts which have encouraged EV adoption in recent years are “intact” and this is a “bump in the road”, according to Global X.

Next-generation technology will improve charging time, safety, and affordability of EVs, they added.

“In our view, the EV industry has a long runway for growth ahead,” Global X said.

By City AM

More Top Reads From Oilprice.com:

- This Could Be A Gamechanger For Natural Gas In Europe

- Oil Prices May Yet End the Week on a High Note

- Norway’s Energy Major Equinor Starts Up Solar Plant in Brazil