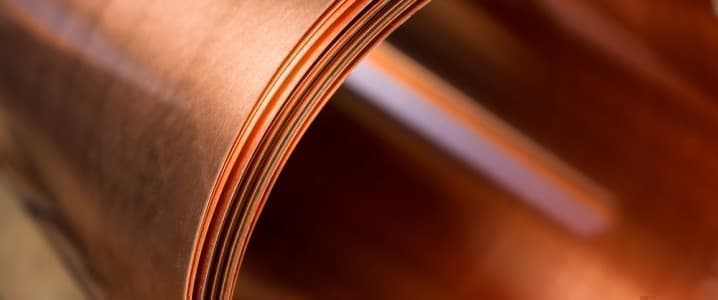

Via AG Metal Miner

The copper industry showed resilience through many market challenges throughout 2022. Despite dropping prices and demand, copper continues to fight against obstacles ranging from Europe’s energy crisis and smelter shutdowns to China’s property crisis and shrinking demand. As MetalMiner noted earlier this month, copper markets do remain particularly volatile. And while prices traded sideways in MetalMiner’s September Monthly Metals Index, the potential for future price increases remains high.

Copper Within Resistance Zones for The Moment

Copper experienced its fair share of ups, downs, and growth over the past two years. Despite this, recent price action saw copper breaching its short-term ranges. This caused a long-term resistance and demand zone to solidify, which made it appear that copper will continue the decline or reverse back to the upside at historical ranges.

In terms of manufacturing, copper markets have recently dealt with smelter shutdowns in places like China. However, demand for copper in places like Europe, where energy remains in short supply, has dropped. All of these factors seem determined to keep the copper market in volatile territory.

Copper Prices and Inventory Levels

With low demand for copper across Europe, many companies find themselves with an excess of copper inventory. For example, warehouses approved by the LME watched stocks surge over the past few months. The strong U.S. dollar only complicates this further by making these commodities more expensive for holders of other currencies, subduing demand.

Inflation also continues to impact commodity markets as a whole, copper included. After a recent U.S. report indicating that core inflation remains on the rise, copper dropped in price. This also raised fears there will be another interest rate hike by the Fed, which could cause buyers to stock up even more.

By The MetalMiner Team

More Top Reads From Oilprice.com:

- China Replaces Russia As Dominant Force In Central Asia

- Emerging Tech Could Create A Greener Global Shipping Industry

- The U.S. Dollar Is Showing Strength As A Safe Haven Asset

The economics is very important to explain as known *AND* understood as well as I think few if any understand in the least. Anyhow in good news for US economy no Railroad Strike. That does support a price for oil that is less than zero imo.