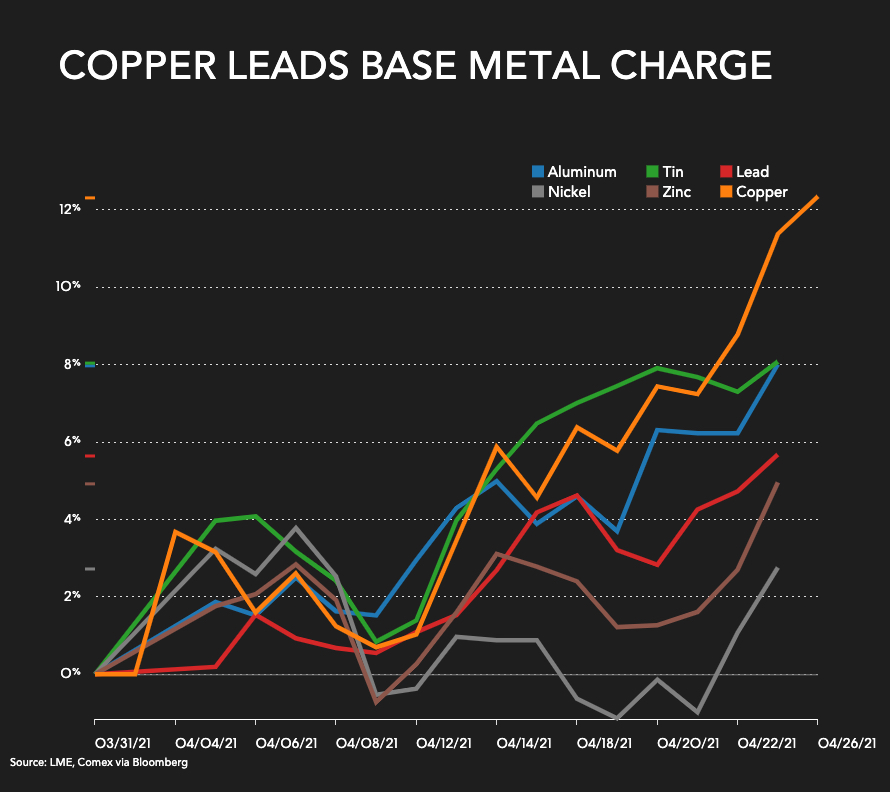

Copper was once again approaching the pivotal $10,000 a tonne level on Tuesday, jumping to over $4.50 a pound, or $9,940 a tonne in New York amid über bullish sentiment and renewed supply worries in the world’s top producing region.

The rally in copper, which has more than doubled in price from its covid-lows, has been fuelled by a widely-held belief that demand for the bellwether metal will receive a massive boost, not just from post-pandemic economic stimulus, but also from a worldwide push for decarbonisation.

Everything to do with the green energy transition requires more copper – notably the electrification of the global vehicle fleet and massive investment electrical grids, renewable energy infrastructure and storage.

While almost all agree copper’s longer term future is bright, there is much less consensus on how much the price of the metal will shine in the next few years.

A monthly poll conducted by FocusEconomics shows wide disparities in forecast prices by the investment banks, brokers, economists and governments in the survey compiled April 13–18.

The lowest forecast among the more than two dozen participants for the average price in the fourth quarter this year is by BMO Capital Markets, which predicts copper to retreat to the $7,000 a tonne level.

Other notable bears are JP Morgan, Societe Generale, BBVA and Capital Economics which also see the price in the $7,000s with further declines in 2022.

That’s a big gap to the most bullish forecaster – Goldman Sachs sees prices averaging $10,620 a tonne in Q4. Goldman, the number one proponent of the existence of a supercycle in commodities, sees more gain in 2022, predicting prices to reach $12,250 by the end of next year.

The only other participant expecting the copper price to reach five digits is Singapore’s United Overseas Bank. Only ABN Amro, Citi and ANZ see copper above $9,000 in Q4, but apart from ABN, also see a retreat back below that level a year later.

The consensus forecast for the Q4 average is $8,340, sliding to $8,130 in Q4 2022.

FocusEconomics notes that in its April survey more than half of panelists adjusted predictions upward (and four became less bullish) from the forecasts compiled in March.

While the underlying copper market is moving fast at the moment, unless more market analysts come around to the idea of a supercycle in coming months, Goldman looks set to continue to be a lone voice.

By Mining.com

More Top Reads From Oilprice.com:

Precious and strategic metals particularly copper have gone through the roof this year and may still have more room to run. Copper, arguably the most critical of industrial metals, is approaching $10,000 a tonne for the first time in a decade amid bullish sentiments and renewed supply worries in the world top producing regions.

There is a risk copper could more than quadruple in value, taking oil prices into triple digits.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London