Breaking News:

The Plot to Further Disrupt Russian Oil Flows Proves That Sanctions Don’t Work

Russia’s oil revenues are still…

Bad News From China Could Be The Harbinger For Lower Oil Prices

Despite some industrial sector gains,…

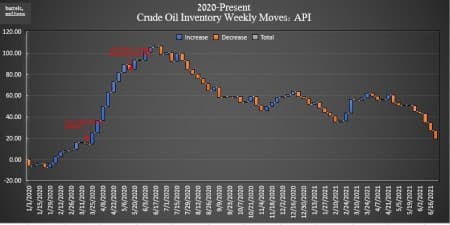

U.S. Oil Inventories Fall For Sixth Straight Week

The American Petroleum Institute (API) on Tuesday reported a draw in crude oil inventories of 8.153-million barrels for the week ending June 25.

Analysts had predicted a draw of 4.686 million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 7.199 million barrels after analysts had predicted a draw of 3.942 million barrels. Crude oil inventories have fallen by more than 37 million barrels since the start of 2021, according to API data, but are still up 19 million barrels since January 2020.

Oil prices were up on Tuesday after prices fell on Monday as OPEC+ was geared up to meet to discuss output.

At 3:31 p.m. EST, WTI was trading up $0.36 (+0.49%) at $73.27 prior to the data release—up just $0.20 per barrel on the week. Brent crude was trading up for the day at $74.96—essentially flat on the week.

While crude oil inventories fell again this week, U.S. oil production also slipped to an average of 11.1 million bpd for the week ending June 18, according to the latest data from the Energy Information Administration. This is down 100,000 bpd from the week prior.

Related: U.S. Shale Producers Stick To Output Discipline

The API reported a build in gasoline inventories of 2.418-million barrels for the week ending June 25—on top of the previous week's 959,000-barrel build. Analysts had expected a draw of 886,000-barrel for the week.

Distillate stocks saw an increase in inventories this week of 428,000 barrels for the week, on top of last week's 992,000-barrel increase.

Cushing inventories fell this week by 1.318 million barrels.

Post data release, at 4:45 p.m. EDT, the WTI benchmark was trading at $73.43 while Brent crude was trading at $75.14 per barrel.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- How Much Oil Can Saudi Arabia Really Produce?

- Reuters: U.S. Agrees To Lift Iran Oil Sanctions

- Can The Middle East Survive Without Oil?

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B