Breaking News:

Venezuela Has a Natural Gas Problem

Venezuela's natural gas production has…

U.S. Commands Higher Prices for Crude Amid Growing Global Oil Market Influence

Increased domestic offtake capacity and…

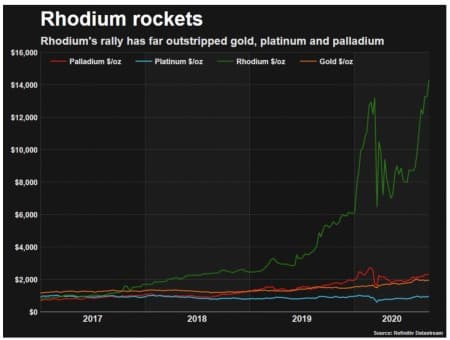

Tightening Supply Pushes Rhodium Prices To All-Time High

The rhodium price has been on a stomach-churning ride this year, rocketing from $6,050 an ounce at the start of 2020 to a high of $13,800 an ounce by March 10, only to plummet to $7,800 an ounce before the end of that month as covid-19 spread around the world.

This week it hit a new all time high of $14,490 an ounce before slipping to just below $14,000 on Wednesday.

Like its sister metals palladium and platinum, rhodium’s main application is to clean vehicle emissions, and surging demand amid tighter pollution regulation, particularly in Europe and China, and supply shortfalls from top producer South Africa could see the metal rally further.

South African PGM producers extract a mix of metals comprising roughly 60% platinum, 30% palladium and 10% rhodium and supply from the African nation would likely be a fifth below 2019’s total.

Insufficient supplies meant producers short of metal to honour contracts had been buying in the spot market, a rhodium trader told Reuters:

A 17% slump in rhodium supply to 945,000 ounces will leave the market with a 55,000-ounce deficit this year, Heraeus and SFA (Oxford), a research house, said in a recent report.

Heraeus and SFA expect prices to fall back below $10,000 within six months as supplies normalize, but the market could remain volatile, according to Reuters.

Rhodium is also alloyed with platinum to make reinforcement fibre for the high-tech glass on consumer electronics, and used as a catalyst to make certain chemicals.

Due to rarity, the small size of the spot market (all of which is over the counter) and concentrated supply, prices are typically volatile.

Rhodium had a stunning run in 2019, rewarding investors with steady gains ending in 150% in annual returns, but there are few commodities as volatile as PGMs.

In 2008, rhodium touched $10,025 an ounce just before the global financial crisis hit, but the metal would drop 90% before the end of that tumultuous year.

By Mining.com

More Top Reads From Oilprice.com:

- Oil Prices Rise On Hurricane Outages

- Natural Gas Industry Sees Support From U.S. Voters

- Why GM’s Wireless Battery Could Be A Gamechanger

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

-

A little known property of Ruthenium, another PGE, is its ability to split water when sunlight hits it. If it can be electroplated onto a base metal or graphite substrate, imagine how far an ounce would go, how much area could be covered and how much water could be split, submerged and in direct sunlight.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B