Breaking News:

OPEC Oil Reserves in Decline

Rystad Energy disputes OPEC’s claim…

The Rise of the Middle Corridor Trade Route

The Ukraine war has catalyzed…

Tesla Faces $2 Billion Lawsuit From Semi-Truck Start-Up

A truck start-up founded in 2014 has filed a lawsuit against Tesla, seeking $2 billion in damages for what it claims to be copyright infringements.

At issue is Tesla’s all-electric Semi truck, which start-up Nikola Motor Company says copied from its patents for its hydrogen truck.

For now, Tesla is shrugging off the lawsuit, with a spokesperson telling the Verge that “it’s patently obvious there is no merit to this lawsuit”.

The lawsuit, filed in Arizona, follows a cease-and-desist letter from Nikola to Tesla in November last year, pointing out similar features, including a wraparound windshield, mid-entry door and aerodynamic fuselage. In the letter, Nikola demanded Tesla delay the public unveiling of its electric semi until infringement issues were settled.

The lawsuit is in response to Tesla’s failure to acknowledge the cease-and-desist letter, and its unveiling of the Semi at a California event that same month.

The lawsuit notes that Nikola received six design patents from the U.S. Patent and Trademark Office between February and April of this year for the ‘Nikola One’ truck.

In May 2016, Nikola unveiled its first two products to the public, including the hydrogen semi in question and an electric four-wheel off-road vehicle. The start-up now also boasts another semi-truck and is planning a $1-billion factory in the state of Arizona.

(Click to enlarge)

The Nikola One (Source: Nikola Motors)

(Click to enlarge)

Now, not only is Nikola claiming that Tesla has infringed on its designs; it’s also saying that the unveiling of Tesla’s semi is causing irreparable damage to Nikola’s outreach to investors:

“Tesla’s infringement has harmed Nikola’s ability to attract investors and partners because investors can now partner with Tesla to have an alternative fuel semi-truck.”

Related: Electric Planes Could Soon Be A Reality

Putting a price tag on that damage comes to $2 billion, according to the law suit.

The lawsuit arguably comes at a bad time for Tesla—even if it is publicly shrugging it off. Investors have lost patience over Model 3 production levels, and the media has been all over the possible role of Tesla technology in a fatal car crash. On top of this, everyone’s wondering if there will be enough cash.

And we’re about to find out because Tesla releases its earnings after the bells closes today. Analysts estimate we’ll hear about a loss of $3.37 per share on $3.27 billion in revenue. That’s a bigger loss proportionately than last year, if it happens. In the same quarter last year, Tesla reported a loss of $1.33 per share on sales of $2.7 billion.

Tesla stock was down in afternoon trading today, ahead of the earnings report:

(Click to enlarge)

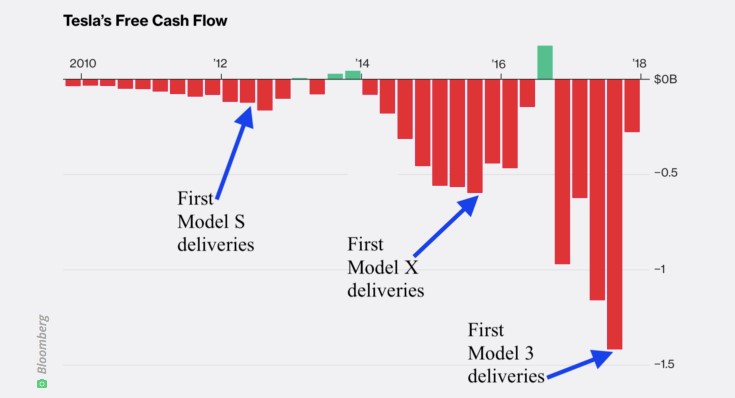

Still, plenty will argue that Tesla always come through, at the last minute, and this chart shows how cash flow might right itself soon enough:

(Click to enlarge)

Just last month, Moody’s predicted that Tesla would be forced to crawl back to investors for more money this year, and that the company needed $3 billion to cover it’s Model 3 production, which is lagging behind. The ratings agency then downgraded Tesla and lowered its outlook from stable to negative.

Related: Oil Prices Slip On Large Crude Inventory Build

Elon Musk wasn’t fussed about it, though, tweeting in response: “Tesla will be profitable & cash flow+ in Q3 & Q4. So obv no need to raise money”.

In the meantime, while Tesla’s market cap may have lost 20 percent since last year, it’s stock is still trading higher than it ever did prior to 2017. There’s still a lot of confidence in the electric vehicle maverick—even one with a $2 billion lawsuit now hanging over his head on top of everything else.

By Michael Scott for Safehaven.com

More Top Reads From Oilprice.com:

- How Oil Hedging Could Cost Companies $7 Billion

- Russian Oil Turns Its Back On Its Biggest Customer

- Oil Majors See Profits Spike, Exxon Lags Behind

Safehaven.com

Safehaven.com is one of the most established finance and news sites in the world, providing insight into the most important sectors in the business and…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B