Breaking News:

U.S. Electricity Prices Surge Amid Grid Strains and Rising Demand

The expected higher expenditures, as…

European Natural Gas Prices Fall as Freeport LNG Resumes Operations

European natural gas prices are…

Surprise Crude Draw Sends Oil Prices Higher

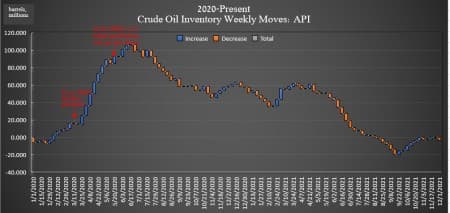

This week, the American Petroleum Institute (API) estimated the inventory draw for crude oil to be 3.089 million barrels.

U.S. crude inventories have shed some 60 million barrels since the beginning of the year.

Analyst expectations for the week were for a build of 2.093-million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 747,000 barrels, compared to the 1.667-million-barrel draw that analysts had predicted.

Oil prices had been trading up by more than 3% on Tuesday in the run-up to the data release as earlier concern about the Omicron variant faded into the landscape of OPEC+’s bullish outlook that prompted the group to plan on increasing production in January by another 400,000 bpd.

By 3:00 p.m. EST WTI had risen more than 3% to $71.96—a more than $5 per barrel increase since this time last week. Brent was trading up nearly 3% at $75.43 per barrel, nearly $5 higher

U.S. oil production for the week ending November 26—the last week for which the Energy Information Administration has provided data—rose by 100,000 bpd to 11.6 million bpd—the second such rise in as many weeks. Production is still off from the U.S. high of 13.1 million bpd prior to the pandemic.

The API reported a build in gasoline inventories of 3.705 million barrels for the week ending December 3—after the previous week's 2.2-million-barrel build.

Distillate stocks also saw an increase in inventory of 1.228 million barrels for the week, after last week's 800,000-barrel increase. Cushing saw a 2.395 million-barrel increase this week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- The Multi-Billion Dollar Start Of A Nuclear Fusion Boom

- Natural Gas Bulls Hit Hard By Warm Weather Reports

- The Oil Price Crash Has Taught U.S. Shale A Valuable Lesson

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

If President Biden’s announcement of a release of 50 million barrels from the SPR left the global oil market and prices unmoved, does anybody think that a draw of 3 million barrels will stir prices and market? I don’t think so.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London