Breaking News:

Kazakhstan's Nascent Auto Industry Thrives Amid Controversy

Kazakhstan's controversial auto recycling fee…

Grid-Enhancing Technologies: The Answer to Growing Power Needs?

Grid-enhancing technologies offer interim solutions…

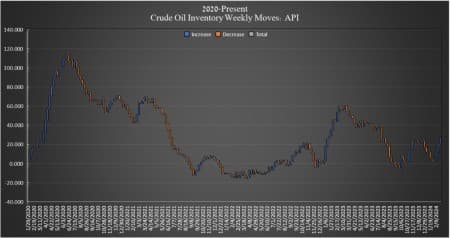

Surprise Crude Build Weighs on Oil

Crude oil inventories in the United States rose this week, by 8.428 million barrels for the week ending February 23, according to The American Petroleum Institute (API). The API reported a 7.168-million-barrel rise in crude inventories in the week prior.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 0.8 million barrels as of February 23. Inventories are now at 360.3 million barrels—the highest level since May 2023.

Oil prices were up ahead of the API data release on reports from anonymous OPEC+ sources that the group could extend their voluntary production cuts into next quarter—adding that they could keep them in place through the end of the year.

At 4:25 pm ET, Brent crude was trading up 1.04% on the day at $83.39, up just $1 per barrel compared to this time last week. The U.S. benchmark WTI was trading up on the day by 1.35% at $78.63, up nearly $1 per barrel compared to last Tuesday.

Gasoline inventories fell this week by 3.272 million barrels, compared to the small 415,000 barrel build in the week prior. As of last week, gasoline inventories were about 2% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories also fell this week, by 523,000 barrels, on top of last week’s 2.908 million barrels drop. Distillates were already 10% below the five-year average for the week ending February 16, the latest EIA data shows.

Cushing inventories rose again this week, by 1.825 million barrels after rising by 668,000 barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Texas Bitcoin Miners File Lawsuit Against Government Over Energy Data Collection

- New Expansion Project Could Give Qatar 25% Share of Global LNG Supply

- Pakistan Considers Iran Gas Pipeline Restart Despite U.S. Sanctions

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

They are part and parcel of US manipulation of the global oil market in order to depress oil prices for the benefit of the US economy and the refilling of the SPR.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert