Breaking News:

The Plot to Further Disrupt Russian Oil Flows Proves That Sanctions Don’t Work

Russia’s oil revenues are still…

Oil Moves Higher on Crude, Fuel Inventory Draw

Crude oil prices ticked higher…

Surprise Crude Build Threatens Oil Rally

The American Petroleum Institute (API) has estimated a crude oil inventory build of 1.41 million barrels for the week ending December 4, compared to analyst expectations of a 2.763-million-barrel draw in inventory.

Last week saw a draw in crude oil inventories of 3.72 million barrels, according to API data. The EIA’s estimates reported a larger draw of 4.9-million barrels for that week.

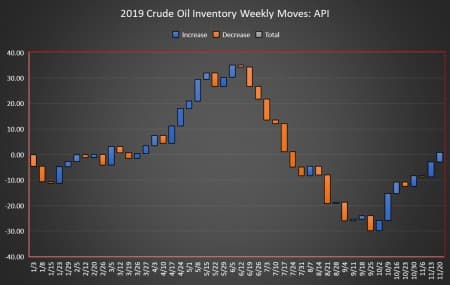

After today’s reported inventory move, the net inventory moves so far this year—almost the end of the year--stand at a modest draw of 1.41 million barrels for the 50-week reporting period so far, using API data.

Oil prices were up on the day, albeit just slightly, but both WTI and Brent are up more than $3 per barrel over last week’s prices at this time, after OPEC+ managed to seal a deal to cut its oil production even deeper.

WTI spot prices were trading up moderately on Tuesday prior to the data release. At 3:01 pm EST, WTI was trading up $0.23 (0.39%) at $59.25—more than $3 per barrel above than last week’s levels. The price of a Brent barrel was also trading up, by $0.10 (+0.16%) at that time, at $64.35—also well over $3 per barrel over last week’s prices.

The API this week reported a build of 4.9 million barrels of gasoline for week ending December 4, compared to analyst expectations of a build in gasoline inventories of 2.533-million barrels for the week.

Distillate inventories saw a large build of 3.2 million barrels for the week, while Cushing inventories fell by 3.5 million barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending November 29 stood at a high of 12.9 million bpd for the second week in a row—1.2 million bpd more than at the start of the year, completely undoing OPEC’s 1.2 million bpd production cut quotas for all of 2019.

At 4:39pm EDT, WTI was trading at $59.31, while Brent was trading at $64.39.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Goldman Sachs Sees Higher Oil Prices In 2020

- Israel's Plan To Bypass The World's Most Critical Oil Chokepoint

- Libya Declares Force Majeure On Loadings From El-Feel Oilfield

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B