Breaking News:

What Does Von der Leyen’s Re-Election Mean for Europe’s Future?

Ursula von der Leyen, a…

U.S. Commands Higher Prices for Crude Amid Growing Global Oil Market Influence

Increased domestic offtake capacity and…

Strong Draw In Gasoline Stocks Dwarfs Crude Build

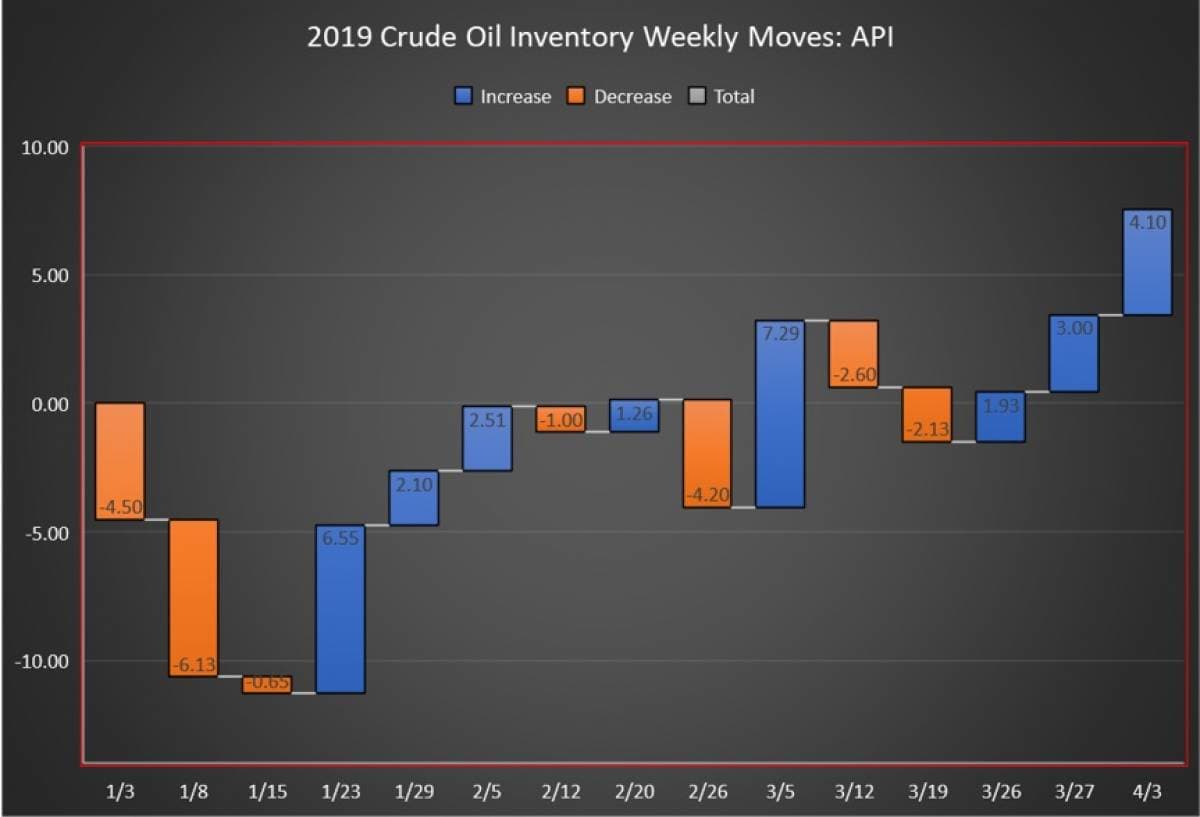

The American Petroleum Institute (API) reported a build in crude oil inventory of 4.1 million barrels for the week ending April 5, coming in over analyst expectations of a 2.294-million-barrel build.

Last week, the API reported a surprise build in crude oil of 3.0 million barrels. A day later, the EIA confirmed the build, but a much more significant, shocking markets with a report of a 7.2 million buildup in inventory.

Including this week’s data, the net build is now 7.53 million barrels for the 13-week reporting period so far this year, using API data.

WTI was trading down on Tuesday before the data release at $64.02, down $0.38 (-0.59%) on the day at 12:29pm, although up week on week. The Brent benchmark was also trading down on the day at $70.77, down $0.33 (-.46%) at that time. The Brent benchmark was also up week on week.

The recent string of price hikes has catapulted oil to near 5-month highs as US sanctions on Iran and Venezuela, unrest in Libya, and continued OPEC production cuts all factor into the mix. So much so, in fact, that high US production, as well US inventories—the market’s most transparent metric for oil inventories—have taken somewhat of a backseat.

The API this week reported a draw in gasoline inventories for week ending April 5 in the amount of 7.1 million barrels. Analysts estimated a much smaller draw in gasoline inventories of 2.009 million barrels for the week.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending March 29—the latest information available—rose to an average of 12.2 million bpd—another new all-time high for the United States.

Distillate inventories decreased by 2.4 million barrels, compared to an expected a draw of 1.3 million barrels for the week.

Crude oil inventories at the Cushing, Oklahoma facility fell by 1.3 million barrels for the week.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.

By 4:40pm EST, WTI was trading down at $64.10 and Brent was trading down at $70.66.

By Julianne Geiger for Oilprice.com

More Top Reads from Oilprice.com:

- The ‘Marginal’ Producer Driving The Oil Price Rally

- Oil & Gas Discoveries On The Rise As Oil Majors Dive In

- Shell Ventures Into China’s Shale Oil

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

The current conflict in Libya is really bad not to mentioned sanctions on Venezuela and Iran. Iran alone is the 3rd largest oil producer in the world if Trump decided to cancel waivers that's it; oil may even hit $75 before shoot to $90 in no time. the current rise in US Shale is nothing if the rest of the world is in turmoil; Lets be logical, how long can the US Keep up with that increase? they are currently wasting their reserves for the long run.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B