Oil and gas exploration is off to a flying start in 2019, with majors taking a bigger bite of the conventional resources discovered in the first quarter, according to Rystad Energy.

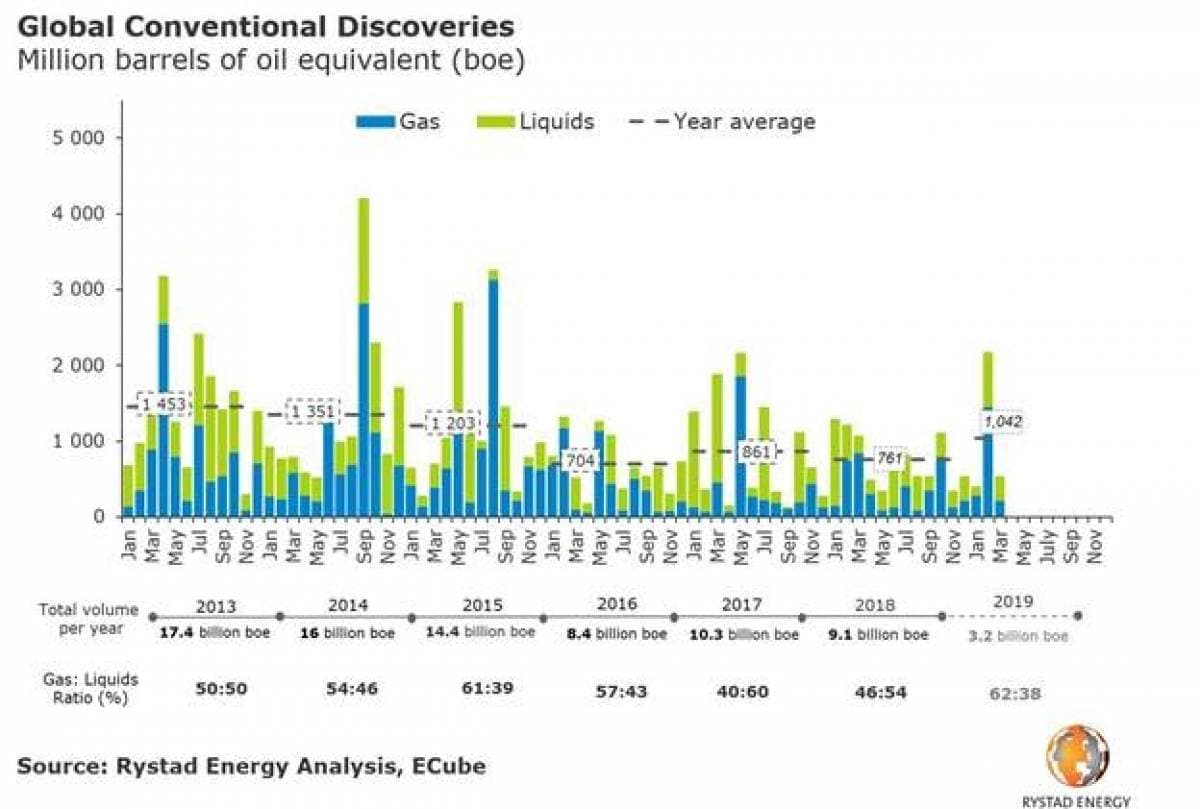

Global discoveries of conventional resources in the first quarter reached a robust 3.2 billion barrels of oil equivalent (boe). Most of the gains were recorded in February, posting 2.2 billion barrels of discovered resources – the best monthly tally on record since August 2015.

“If the rest of 2019 continues at a similar pace, this year will be on track to exceed last year’s discovered resources by 30%,” says Taiyab Zain Shariff, Upstream Analyst at Rystad Energy.

Majors are leading the charge in exploration, reporting more than 2.4 billion boe of discovered resources. The six largest discoveries by the majors each exceed 150 million boe, and the top three could even hold more than 300 million boe apiece.

ExxonMobil was the most successful, with three significant offshore discoveries accounting for a whopping 38% of total discovered volumes. European majors Total and Eni are also in the fold with successful offshore wells in South Africa, the United Kingdom, Angola and Egypt.

Meanwhile, Repsol’s operated Kali Berau Dalam gas find in Indonesia takes the prize for the largest onshore discovery of the quarter.

From a global perspective, the push for substantial new discoveries shows no signs of slowing down, with another 35 high impact exploration wells expected to be drilled this year, both onshore and offshore. Three such highly prospective wells are already underway: the Shell-operated Peroba well, off Brazil, with pre-drill prospective resource estimates of 5.3 billion boe; Eni’s Kekra well in Pakistani waters, with pre-drill prospective resource estimates of 1.5 billion boe; and the Total-operated Etzil well off Mexico, with pre-drill prospective resource estimates of 2.7 billion boe.

“If these wells prove successful, 2019’s interim discovered resources will be the largest since the downturn in 2014,” Shariff remarked.

By Rystad Energy

More Top Reads From Oilprice.com:

- Nigeria Boasts Oil Production Cost of $23 Per Barrel

- Oil Markets On Edge As Military Clash Looms In Libya

- Goldman: The Renewables Revolution Is Good For Big Oil

Such a depression will soon collapse the highly indebted financial system, like nearly happened in 2008. Total global debt is now over $245,000,000,000,000, and rising fast.

A meltdown of the banking/financial system will starve billions of people, since so many people live in cities which depend on electricity, fuel, and imported food, for their very survival.

Subsistence farmers are few and far between these days. And many of them now use diesel or gasoline engines. Can you grow your own food and live without electricity, or without using banks, money, and credit?

These aren't just estimates based on geology-based guesswork or even seismic surveys. They are based on drilled wells. They've actually drilled into the oil-bearing rock, and they've assayed it and know how thick the oil-bearing rock is.

I'll concede, they are merely estimates. But they're not just holding a wet finger in the wind to see which way it's blowing. They're based on good engineering and good science, and investors can and do trust them. That's why the government gets testy if they think the estimates haven't been done honestly.

Sorry to rain on your parade.

My comment is provided in light of the countless overestimation of reserves provided on a regular basis by those courting investment capital. Reality rarely, if ever, reflect the hype.

Do I believe we would be better off if we ran out of oil? Absolutely not. I have come to understand how much we depend on this resource for our current lifestyles and way of life. But I am also aware that it is a finite resource that we are using up probably far too quickly in an effort to keep our complex societies expanding and growing. Pre/history and biology suggests this will not end well.