Breaking News:

Harris Presidency Will Be Bad News for Oil

In the case of a…

U.S. Refiners Q2 Results Expected to Dull on Dampening Demand

U.S. oil refiners are expected…

Rystad: Oil Wells To Be Drilled To The Moon And Back

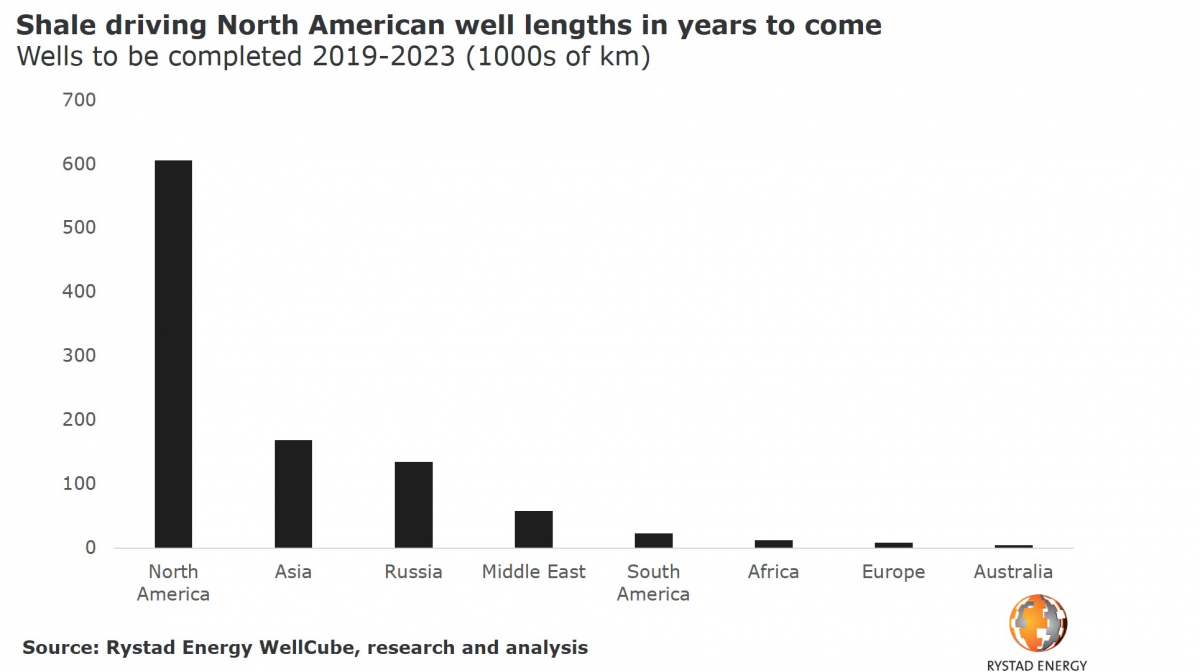

A new study published today by Rystad Energy forecasts that there will be more than a million kilometers of new oil and gas wells drilled by 2023 globally; the distance of these wells combined is more than the distance to the moon and back.

Behind this push for oil and gas wells is North American shale, which, Rystad says, is expected to account for 600,000 kilometers of the million.

(Click to enlarge)

Rystad’s Head of Consulting, Erik Reiso, refers to the drilling onslaught to be seen in North America as “in a league of its own thanks to the shale boom,” with six of ten of the new wells in North America drilled in shale basins—wells that are typical longer than other types of wells.

Related: ‘’The Fat Margins Have Disappeared’’ - Big Oil Disappoints

While the top four offshore operators are expected to account for a quarter of the new offshore wells, the top ten onshore operators will account for only a third of the new wells in the next five years.

Discoveries of conventional resources on a global scale in Q1 2019 hit 3.2 billion barrels of oil equivalent, Rystad said in a separate statement to Rig Zone on Monday, with February seeing 2.2 billion boe of that. More than 2.4 billion boe of that was discovered by oil majors, with ExxonMobil coming out on top.

“If the rest of 2019 continues at a similar pace, this year will be on track to exceed last year’s discovered resources by 30 percent,” Rystad Upstream Analyst Taiyab Zain Shariff said in a company statement sent to Rig Zone.

This search for new discoveries is as of yet not expected to slow this year, with another 35 high-impact exploration wells already planned, that if successful, will make 2019’s total discovered resources “the largest since the downturn of 2014,” Shariff added.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Is This A Gamechanger For The Lithium Industry?

- A New Middle East Mega-War Is Unfolding Right Before Our Eyes

- Saudi Arabia’s Dream Of $85 Oil Is Closer Than Ever

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

1. Regarding new discoveries of oil reserve, we shall understand one basic fact about oil - Not all oils are created equal. This basic fact entails in two aspects: first, the cost of extraction is vastly different depending on different geological locations where those oil reserves are found, some might cost $78 a barrel, some might cost $350 a barrel; second, oil found at different geological location is of different grades and qualities, so they have different commercial value for refineries.( shale oil is lest valuable as it is ultra light oil, useless for refineries) So you can talk about the enormous amount oi reserve we have discovered, however without specifying the different cost of extraction and qualities, you waste your time to create illusion that we have so much reserves to be extracted.

2. To produce so much oil as claimed by drilling to the moon, it requires astronomical amount of new capitals. Considering energy E&P is the most unpopular and worst investment performing sector, my question is where will be the money coming from? Most shale producers in USA still have no positive cash flow, their share price at their historical low since 2014, it is absurd to make such a claim that we are taking off to drill oils well to the MOON.