Breaking News:

Kazakhstan's Nascent Auto Industry Thrives Amid Controversy

Kazakhstan's controversial auto recycling fee…

COP29 Host Aims to Raise $1 Billion for New Climate Fund

Azerbaijan is proposing a new…

Renewables Investment Spikes, But The Oil Age Isn’t Over Yet

The new energy order will show fossils its position in the room, there is a hostile takeover of oil by renewables, but none can oust oil from the room.

The dynamics of the energy industry coupled with vigorous socio-politico developments are fast changing. The U.S. by the end of this decade may well turn out to be the biggest hydrocarbon producer by a distance, a big step towards energy independence. While Vision 2030, the Saudi government's initiative to diversify its economy away from oil, presumably to be followed by other oil dependent nations is another big step towards oil independence. OPEC might find it more difficult to influence markets as big corporations and fund managers are investing heavily in renewables and clean energy. The tables are slowly turning, and what difference will that make for the planet?

The last few decades saw a number of global high level summits and protocols in favor of saving the planet, giving a fairly predictable future of where non-fossil fuels will continue to take away significant market share from fossil fuels in the next couple of decades. Developing countries, led by India and China, see the Intended Nationally Determined Contributions (INDCs) pledged at CoP-21 at Paris as a responsibility and a market opportunity rather than as a liability. At the same time, the Trump administration has shown little interest in the Paris agreement, and instead plans to open vast ocean acreage to offshore exploration and to allow drilling in the Arctic National Wildlife Refuge.

As a result of shale revolution and critical stance on climate change, the U.S. is emerging as a disquiet energy giant. The withdrawal of the U.S. from the Paris agreement and previously from Kyoto Protocol during the Bush regime can actually turn out to be a blessing. Local initiatives are increasingly successful and this bottom-up approach essentially serves the big purpose.

Global banks are also making a move, the World Bank and EXIM (export-import) banks of many countries have limited their funding to coal fired plants in favor of renewable energy. Fund managers worldwide are including green bonds in their portfolio as they often enjoy tax-exempt status. And even big oil companies are making significant strategic bets. Oil giant Royal Dutch Shell has invested in renewables across the board and is building an offshore wind farm in the North Sea, large solar farms in Oman and California, and recently it has bought one of Europe’s biggest electric-car-charging firms: NewMotion.

Related: How The Fed Could Hammer Oil Producers

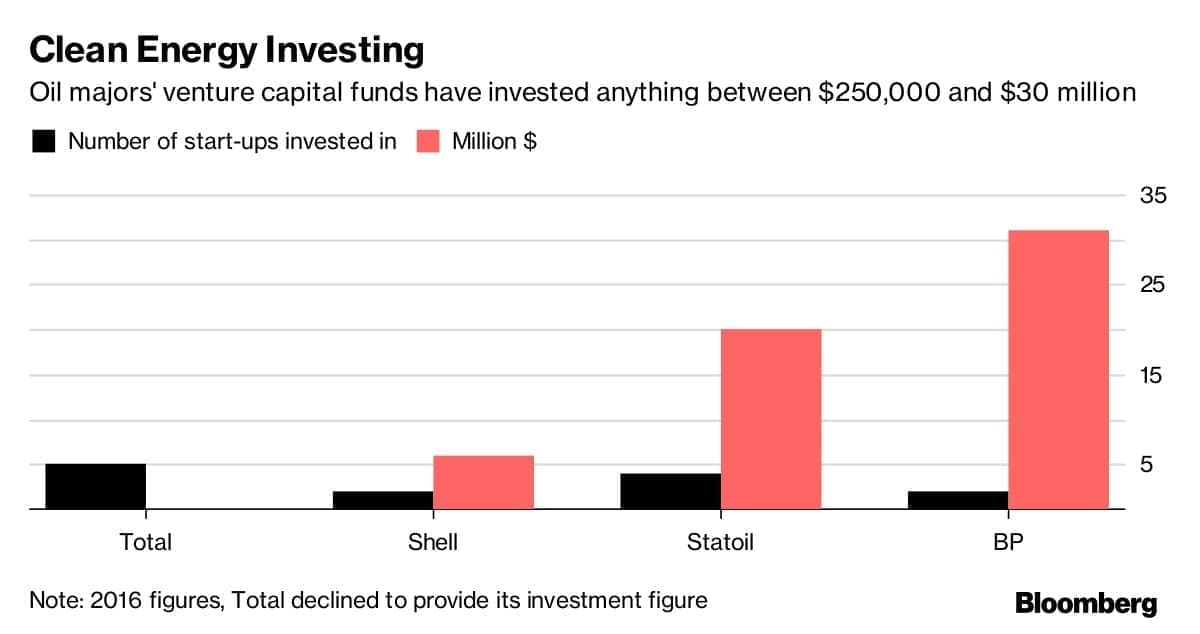

The table below depicts the time demand driven new ventures of oil giant corporations towards clean energy. British Petroleum, which is still haunted by the 2010 Deepwater Horizon catastrophe expeditious in shifting its core competencies towards cleaner energy sources.

(Click to enlarge)

Altogether it sounds like oil is rapidly losing market share, but wait! Oil & gas is found in the numerous plastics, chemicals, synthetic materials around you, the paint on the wall, your eye lenses, pen and ink in the pen itself, lubricants, waxes, roads, etc. – oil & gas are omnipresent. No single energy source can substitute oil altogether from the energy mix. While oil might be losing the race on a number of fronts, Hydrogen and lithium are not energy sources; they are energy carriers. The International Energy Agency says that global oil demand could somewhere in the next decade if governments adopt particularly green policies, predicting that even if it happened, oil still would account for 23 percent of total global energy in 2040, down from 32 percent in 2016.

Major oil exporters and corporations are preparing themselves for the new energy landscape and don’t want to find themselves saddled with large stranded assets in the future. Oil might find its new equilibria lower forever in a decade or so. The cleaner sources particularly solar and wind have shown an unprecedented slump in cost of production, technology is the key, and they are seemingly successful in attracting capital. Eventually, Oil will silently find its new place in the room and let the youngster renewables takeover the charge of the energy industry.

By Shubham Saxena for Oilprice.com

More Top Reads From Oilprice.com:

- Crashing Cushing Inventories Boost Oil Prices

- Despair In Venezuela: “We Are Dying Of Hunger In The Oil Industry”

- Asia Set To Lose 3 Million Bpd Of Oil Production

Shubham Saxena

Shubham Saxena is an India based author who contributes in the field of energy (particularly oil & gas), developmental economics and finance. He advocates for sustainable development,…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

Oil majors like ExxonMobil and Chevron see oil demand rising steadily for the foreseeable future with no peak in sight. In fact, ExxonMobil projects in its 2017’s “Outlook for Energy: A View to 2040”, that oil will account for 33% of the global primary energy consumption in 2040. At the rate global oil demand is growing, we could see oil demand hitting 114 mbd by 2030. However, oil demand growth could be projected to decelerate a bit on the back of efficiency improvements driven by technological developments, a tightening of energy policies and a growing penetration of electric vehicles (EVs). Still, oil demand in 2040 will be higher than it is today.

Experts are now saying that widespread use of EVs could spell the end of oil. The tipping point, they reckon, is 50 million EVs on the roads. This they believe could be reached by 2024. Now BP is projecting 320 EVs by 2040. However, 50 million or 320 EVs on the roads could hardly make a dent on the global demand by then.

Currently, EVs and hybrid cars combined number under 2 million cars out of 1.477 billion Internal Combustion Engines (ICEs) on the roads worldwide, or a negligible 0.14%.The total number of ICEs is projected to reach 2.0 bn by 2025 rising to 2.79 bn by 2040 according to US Research.

In 2017 the world used 36 billion barrels of oil (bb) of which 66% or 24 bb were used to power 1.477 billion ICEs around the world. Bringing 320 million EVs on the roads will reduce the global oil demand by only 5.2 bb, or 6.9% by 2040. This will neither be the peaking of oil demand nor a tipping point.

A tipping point for oil could only be reached once 1.4 billion EVs (50% of the projected ICEs in 2040) are on the roads worldwide by 2040. This is impossible to achieve within that time frame.

And despite Vision 2030, For Saudi Arabia and other Gulf Cooperation Council (GCC) countries there would be no post-oil era ever.

Oil will remain an integral part of the Middle East economies throughout the 21st century and far beyond. Even if cheap alternatives to oil in transport, water desalination and electricity generation were to become readily available in the future, oil will not be left underground because the Arab Gulf oil producers will use it to power thousands of water desalination plants to generate enough water not only for drinking but also for irrigation to make the desert bloom again. They will also use it to dominate the global petrochemical industries and any industries in which oil is a feedstock.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London