Breaking News:

Turkey Willing To Boost EU Gas Exports If Bloc Guarantees Demand

Turkey has said it is…

Physical Oil Market Hints at Potential Upswing

Oil prices could break to…

Putin Bans Oil Sales To Countries That Comply With G7 Oil Price Cap

Having promised that it would reveal its response to the recently implemented by the G7 price cap on Russian oil exports, moments ago the Kremlin did not disappoint, and as the WSJ reports, Russian President Vladimir Putin banned the supply of Russian oil and oil products to countries that impose a price cap, allowing deliveries to those nations only on the basis of a special permission from the Kremlin leader.

According to the decree, the retaliatory measures are scheduled to come into effect Feb. 1 and last through July 1, 2023.

Russia’s actions are a response to what the decree described as unfriendly actions of the U.S., foreign states and international organizations that contradict international law, and are designed “to protect the national interests of the Russian Federation,” the decree said.

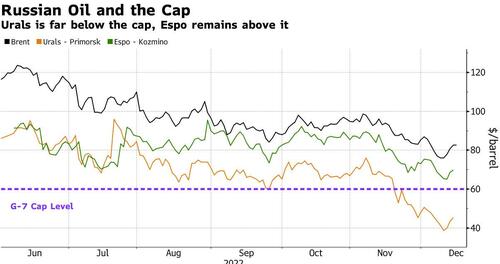

The European Union and the U.K. earlier this month banned the import of seaborne Russian crude, while the Group of Seven nations put a ceiling on other sales by barring Western companies from insuring, financing or shipping Russian crude at above $60 a barrel.

And now, Russia has flipped the story on its head, saying the not only will it not sell below $60, but it has banned the sale outright to all countries that engaged in this most glaring virtue-signaling exercise, one which paradoxically was not meant to punish Putin but to keep Russian oil flowing.

While the price cap has not seen a major impact on pricing so far, that will likely change soon: As shown below, Urals oil is trading with a generous discount to spot Brent, and was last seen around $50.

In other words, those nations buying Urals - mostly China and India - are not violating the G-7 pact... yet. However, once Urals follows Brent higher, and its price rises above $60/barrel that will change, and at that point it will be interesting to see how the G7 responds to the two fastest growing economies and two most populous nations openly defying the G7's Russian oil price floor.

The news, which was largely as expected, has not had an impact on the price of oil with WTI and Brent both trading at three week highs following news that China was ending zero-covid policies and reopening its economy.

As for the US stepping in a providing emergency cover to nations who may be caught in the crossfire, sorry - Joe already drained a third of the SPR to get Democrats reelected.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Yergin: Oil Prices Could Break $120 If China Overcomes Covid

- Russia's Baltic Oil Exports Could Fall by 20% Due To Sanctions

- Fears Of An Economic Slowdown Keep Oil Prices In Check

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

The price cap has already failed and soon will be consigned to a waste bin. The proof is that when the cap was launched on 5 December, Brent crude was $73 a barrel but since then it has risen to $85.43 today, a 17% rise.

Furthermore, Russia won’t lose. Its main buyers like China. India, Asian countries and Asian oil traders have already ignored the price cap and are continuing to buy Russian crude in increasing volumes. For instance, China alone has so far bought $89 bn worth of Russian oil, gas, LNG and coal this year equivalent to 89% of the entire EU’s purchases of Russian oil and gas in 2021.

Even if Russia sells 6 million barrels a day (mbd) of crude oil at today’s Brent price of $85.43, it gets more revenue that selling 7 mbd at $73.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert