Breaking News:

European Natural Gas Prices Fall as Freeport LNG Resumes Operations

European natural gas prices are…

Oil Moves Higher on Crude, Fuel Inventory Draw

Crude oil prices ticked higher…

Oil Wobbles After API Reports Crude, Gasoline Build

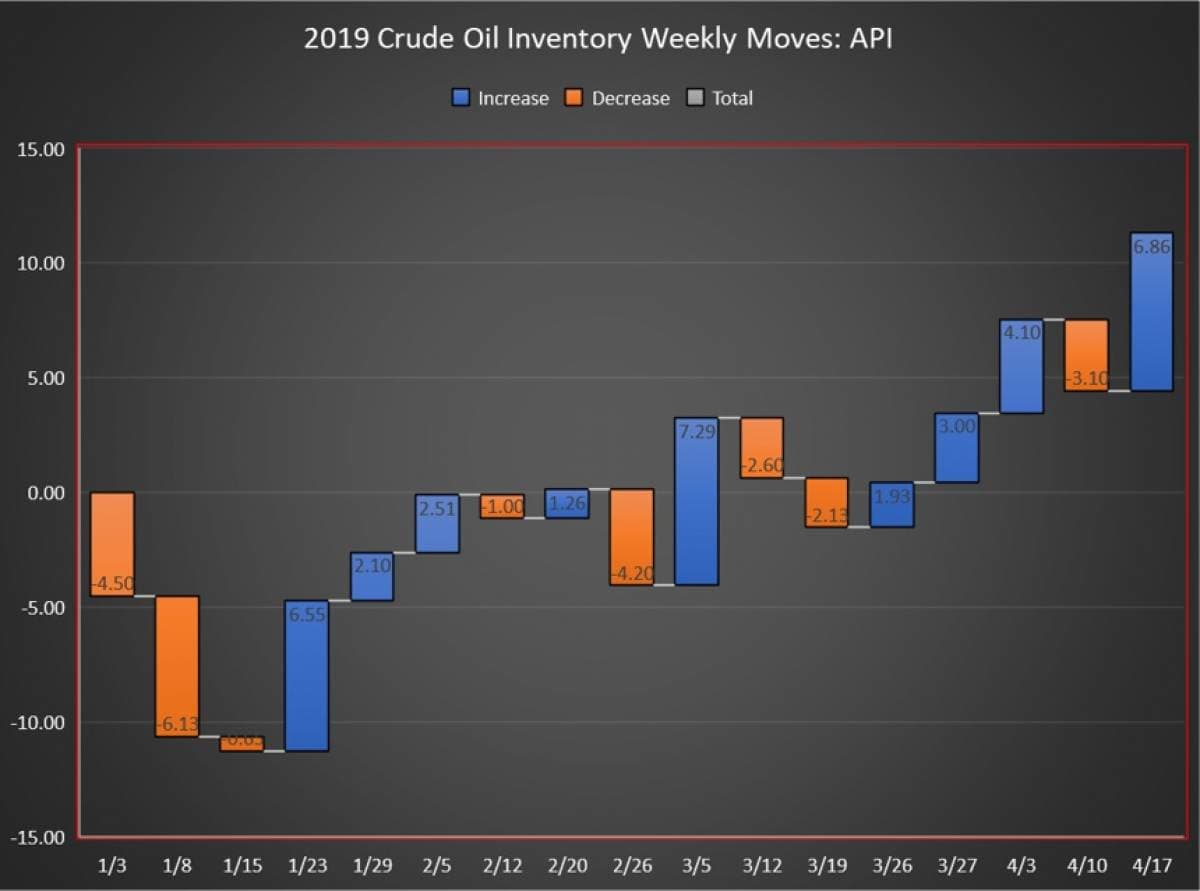

The American Petroleum Institute (API) reported a build in crude oil inventory of 6.86 million barrels for the week ending April 19, coming in over analyst expectations of a 167,000-barrel drawdown.Last week, the API reported a draw in crude oil of 3.096 million barrels.

A day later, the EIA confirmed the draw with a report of a 1.4-million-barrel drop in inventory. Including this week’s data, the net build is now 11.30 million barrels for the 17-week reporting period so far this year, using API data.

(Click to enlarge)

Oil prices ticked higher on Tuesday as the United States announced that it would not be extending any of the waivers that it had previously granted purchasers of Iranian oil.WTI was trading up on Tuesday before the data release at $66.15, up $0.60 (+0.92%) on the day at 1:03pm, also up week on week by more than $2 per barrel. The Brent benchmark was also trading up on the day at $74.21, up $0.17 (+0.23%) at that time.

The Brent benchmark was up week on week by almost $3 per barrel.The API this week reported a draw in gasoline inventories as well for week ending April 19 in the amount of 1.82 million barrels. Analysts estimated a draw in gasoline inventories of 333,000 barrels for the week.Despite the bearish crude and gasoline builds, the API did, however, report a small draw to the amount of 865,000 barrels, largely in line with analyst predictions of 712,000 barrels.

The Cushing storage hub in Oklahoma saw a draw of almost 390,000 barrels according to the API.US crude oil production as estimated by the Energy Information Administration showed that production for the week ending April 12—the latest information available—came in just off its all-time high, at 12.1 million bpd.The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.By 4:42pm EST, WTI was trading up at $66.33 and Brent was trading up at $74.50.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- The ‘CIA Man’ In Libya Securing Oil Supply

- The Firm Floor Under Oil Prices

- Saudi Arabia, Iraq Prepared To Reverse Oil Production Cuts

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

How about everyone get with the program of conservation of our environment, the Green/Clean energy stocks and companies, offshore companies that people risk putting out of business when the price goes down (back to disclosing short positions people). Let me just guess - we have big oil, etc. shorts we are covering, yes? If you all want cheap oil, an unliveable enviornment, a future with no oil, bankrupt green/clean energy companies, bankrupt offshore companies - then we will all send the short positions a bill. Think....All the best, Tripp

-

To OPEC/ARAMCO/SAUDI - Apparently there is so much oil available that everyone feels the price is indicative of "oversupply" - in watching the current reporting that means no reason to increase production - same goes for all of the U.S. Oil producers (at least the ones i'm voting shares on this week or so). Thanks and I appreciate the attention to the environment and being responsible for "balancing world oil supply". All the best (I heart Saudi!) Tripp

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B