Breaking News:

U.S. Electricity Prices Surge Amid Grid Strains and Rising Demand

The expected higher expenditures, as…

What Would the Re-Election of Trump Mean for U.S. Energy?

A potential Trump re-election could…

Crude, Gasoline Draw Boost Oil Prices

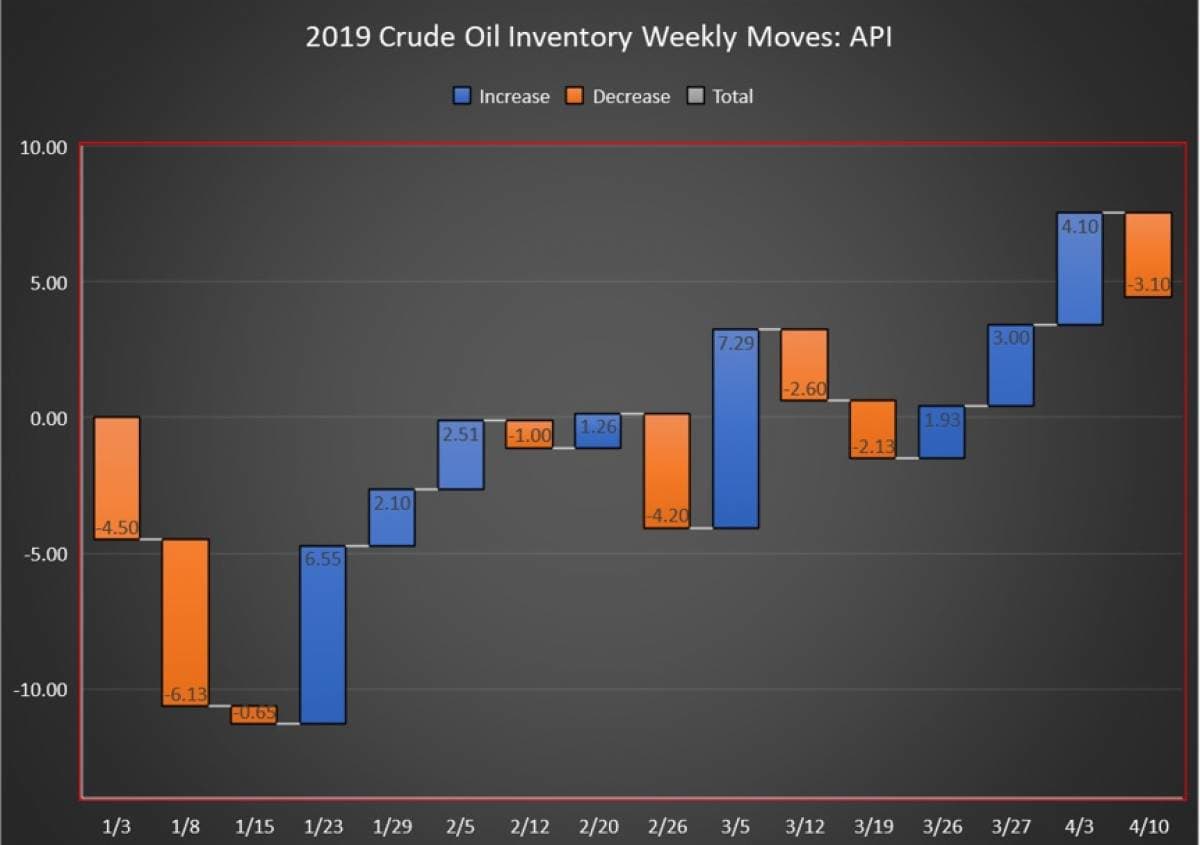

The American Petroleum Institute (API) reported a draw in crude oil inventory of 3.096 million barrels for the week ending April 12, coming in over analyst expectations of a 1.711-million-barrel build.

Last week, the API reported a build in crude oil of 4.1 million barrels. A day later, the EIA confirmed the build, with a report of a 7-million-barrel buildup in inventory.

Including this week’s data, the net build is now 4.44 million barrels for the 16-week reporting period so far this year, using API data.

WTI was trading up on Tuesday before the data release at $63.64, up $0.24 (+0.38%) on the day at 12:55pm, although down week on week. The Brent benchmark was also trading up on the day at $71.32, up $0.14 (+0.20%) at that time. The Brent benchmark was up week on week.

The API this week reported a draw in gasoline inventories as well for week ending April 12 in the amount of 3.561 million barrels. Analysts estimated a draw in gasoline inventories of 2.133 million barrels for the week.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending April 5—the latest information available—stood fast at an average of 12.2 million bpd for the second week in a row.

Distillate inventories increased by 2.33 million barrels, compared to an expected a draw of 846,000 barrels for the week.

Crude oil inventories at the Cushing, Oklahoma facility fell by 1.561 million barrels for the week.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.

By 4:40pm EST, WTI was trading up at $64.12 and Brent was trading up at $71.70.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Chevron To Buy Anadarko In $33B Deal

- The Secret Oil Plan That's Critical To Trump’s Reelection

- BP Pulls Out Of China’s Shale Patch

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

I see (WTI) out to 69.-- At 64.31 I doubt there will be a downside. (WRI) has come to far for the price to flux. between 60.-- and 64.-- . It may take a week to correct but I have been accurate thus far in my commenting. Gold on the other hand could be resized. I wouldn't mind seeing Gold drop to a level of 1230.-- per Troy Oz. then a nice outside rally into 1400.--. She's due her moment. Well , let The Middle East find new partners in India and elsewhere. OPEC does not dictate US Prices. We're self supported. Thanks.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B