Breaking News:

Tesla to Focus on Autonomy and AI as Earnings Disappoint

Tesla is facing a slowdown…

Oil Prices Tank on Fears China’s Rate Cuts Herald Demand Weakness

Oil prices fell significantly in…

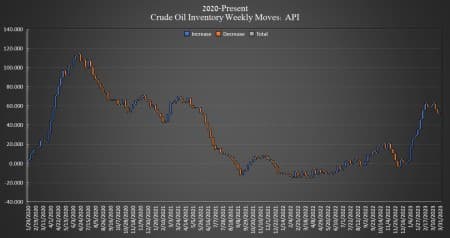

Oil Unmoved By Small Inventory Build

Crude oil inventories in the United rose this week, adding 377,000 barrels, the American Petroleum Institute (API) data showed on Tuesday, with analysts expecting a 1.3 million barrel draw.

The total number of barrels of crude oil gained so far this year is still more than 49 million barrels.

This week, SPR inventory dropped for the second week in a row losing 1.6 million barrels for the week to reach 369.6 million barrels—the lowest amount of crude oil in the SPR since November 1983.

U.S. crude oil production stayed the same for the week ending March 31, at 12.2 million bpd. U.S. production is now 900,000 bpd lower than the peak production seen in March 2020, but 400,000 bpd higher than this time last year.

The price of WTI traded up sharply on Tuesday in the run-up to the data release and is now back to where prices were immediately following OPEC+’s surprise production cut that will start in May. Brent crude was also trading up on the day.

By 3:45 p.m. EST, WTI was trading up $1.74 (+2.18%) on the day to $81.48 per barrel, a gain of about $2 per barrel on the week. Brent crude was trading up $1.39 (+1.65%) on the day at $85.55—up roughly $.60 per barrel from this same time last week.

WTI was trading at $80.57 shortly after the data release.

Gasoline inventories rose by 450,000 barrels after falling in the week prior by 3.970 million barrels. Distillate inventories fell by 1.98 million barrels after decreasing by 3.693 million barrels in the week prior.

Inventories at Cushing, Oklahoma, decreased by 1.36 million barrels—after falling 1.035 million barrels last week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Recession Fears Loom Over Oil Markets Once Again

- OPEC+ Oil Production Sees Biggest Drop In 10 Months

- Russia Delivers 30,000 Tons Of Fuel To Iran Via Rail

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B