|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 3 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 11 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 11 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 11 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 11 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

A Volatile Week for Oil Prices

A very volatile week for…

Kazakhstan's Nascent Auto Industry Thrives Amid Controversy

Kazakhstan's controversial auto recycling fee…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Oil Prices Up As API Reports Massive Crude Draw

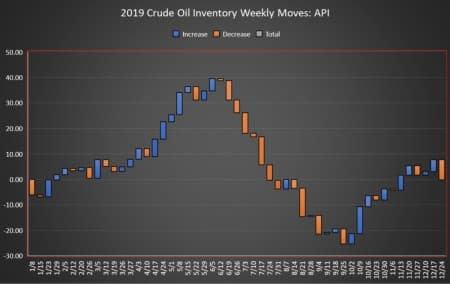

By Julianne Geiger - Dec 24, 2019, 4:05 PM CSTThe American Petroleum Institute (API) has estimated a large crude oil inventory draw of 7.9 million barrels for the week ending December 18, compared to analyst expectations of a much smaller 1.833-million-barrel draw in inventory.

Last week saw a build in crude oil inventories of 4.7 million barrels, according to API data. The EIA’s estimates reported a draw of 1.1 million barrels for that week.

After today’s reported inventory move, the net inventory moves so far this year—almost the end of the year--stand at a build of 3.22 million barrels for the last 51-weeks, using API data.

Oil prices had been up on the day prior to the data release. WTI was trading up over 1% on Tuesday. At 4:10 pm EST, WTI was trading up $0.62 (1.02%) at $61.14—roughly $0.25 per barrel above than last week’s levels. The price of a Brent barrel was also trading up, by $0.74 (+1.13%) at that time, at $66.16–flat from last week’s prices.

The API this week also reported a build of 566,000 barrels of gasoline for week ending December 18, compared to analyst expectations of a larger build in gasoline inventories of 1.959-million barrels for the week.

Distillate inventories saw a build of 1.68 million barrels for the week, while Cushing inventories fell by a sizable 2.2 million barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending December 13 stayed at 12.8 million bpd off the all-time high of 12.9 million bpd..

At 5:03 pm EDT, WTI was trading at $61.14, while Brent was trading at $66.16.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Did Scientists Just Crack The Solar Code?

- Don’t Bet On A Natural Gas Rebound

- Expect More Writedowns From Oil Majors

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com