Breaking News:

Kazakhstan, Azerbaijan, and Uzbekistan Forge Green Energy Export Alliance

Kazakhstan, Azerbaijan, and Uzbekistan join…

Volatility Dominates Oil Markets Amid Mixed Signals

It's been a rollercoaster of…

Oil Prices Rise As Crude Oil Inventories Build, Products Fall

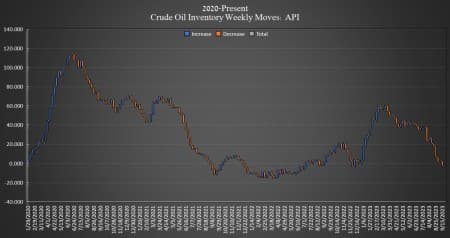

The American Petroleum Institute (API) has reported a build of 1.586 million barrels in U.S. crude inventories, compared to last week’s large 5.25-million-barrel draw.

Analysts were expecting an inventory draw of 1.650 million barrels for the week. The total number of barrels of crude oil moves so far this year is – 4 million, according to API data, and there is a net draw in crude inventories since April of more than 51 million barrels.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 300,000 barrels last week, with the SPR inventory still sitting at a near 40-year low of 351.5 million barrels, with total purchases for the SPR coming in at less than 4 million barrels since the Biden Administration began its buyback program.

Oil prices were trading up on Tuesday ahead of API data release, with Brent trading up 0.75% at $93.99 at 12:50 p.m. ET—a $0.65 dip week over week, while WTI was trading up on the day at 0.88%, at $90.47. WTI is down more than $1 per barrel from this same time last week.

Gasoline inventories fell this week by 70,000 barrels, compared to the 732,000 barrel build in the week prior. Gasoline 732,000 inventories are roughly 3% less than the five-year average for this time of year. Distillate inventories fell by 1.698 million barrels, on top of the 258,000 barrel dip in the week prior, and are about 14% below the five-year average for this time of year.

Cushing inventories fell by another 828,000 barrels, after falling 2.564 million barrels last week, leaving less than 22 million barrels in Cushing.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Energy Fund Manager Predicts Major Upside For Oil Equities

- Russia’s Oil Export Revenues To Rise This Year As It Evades The G7 Price Cap

- Gas Production From Giant Groningen Field To Halt Completely On October 1

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

Short Wolfspeed strong sell.