Breaking News:

Oil Rig Count Jumps as Drilling Activity Picks Up

The total number of active…

Chinese Mining Operations in Tajikistan Spark Environmental Backlash

Chinese mining and agricultural companies…

Oil Heads Lower After API Reports Large Crude Build

The American Petroleum Institute (API) reported a large surprise build in crude oil inventories of 7.29 million barrels for the week ending March 1, coming in way over analyst expectations that predicted that crude oil inventories would build by 388,000 barrels.

Last week, the API reported a surprise draw in crude oil of 4.2 million barrels. A day later, the EIA reported a larger one of 8.6 million barrels.

Oil price movements were flat on Tuesday prior to the data release, with the WTI benchmark at 12:45 pm EST trading essentially flat on the day (-0.02%) at $56.58, about $1 over last week levels. The Brent benchmark, similarly, was trading perfectly flat at $65.67, less than $0.50 above last week’s levels.

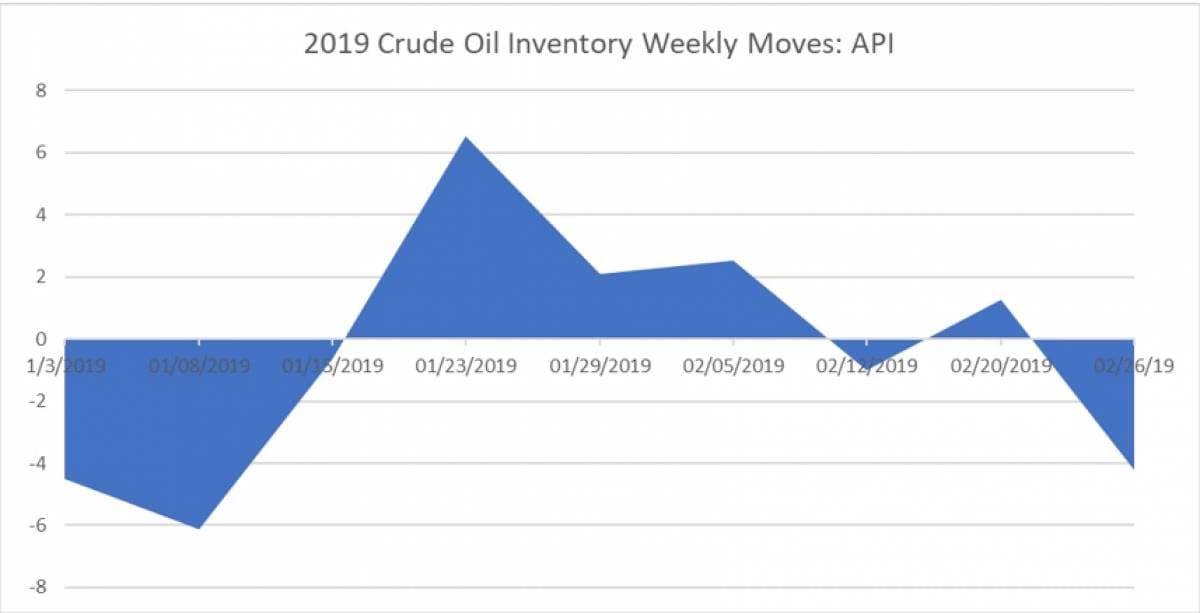

While 2019 has been a wild ride for oil prices, inventory moves for crude have been innocuous, with a net draw of just over 4 million barrels for the nine reporting periods prior to this week, using API data.

(Click to enlarge)

The API this week reported a draw in gasoline inventories for week ending March 1 in the amount of 391,000 barrels. Analysts estimated a draw in gasoline inventories of 1.97 million barrels for the week.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending February 22—the latest information available—averaged 12.1 million barrels per day –another high for the United States.

Distillate inventories decreased this week by 3.1 million barrels, compared to an expected draw of 975,000 barrels.

Crude oil inventories at the Cushing, Oklahoma facility grew by 1.1 million barrels for the week.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.

By 4:40pm EST, WTI was trading down at $56.43 and Brent was trading up at $65.76.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Activist Investors Force Change In The Oil Industry

- The Latest News From Tesla Is A Game Changer

- Global Oil & Gas Drilling Set To Surge In 2019

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B