Breaking News:

Grid-Enhancing Technologies: The Answer to Growing Power Needs?

Grid-enhancing technologies offer interim solutions…

Stock Market’s Short-Term Focus Threatens Energy Transition Goals

The problem that most companies…

Oil Erases Gains After API Reports Inventory Build Across The Board

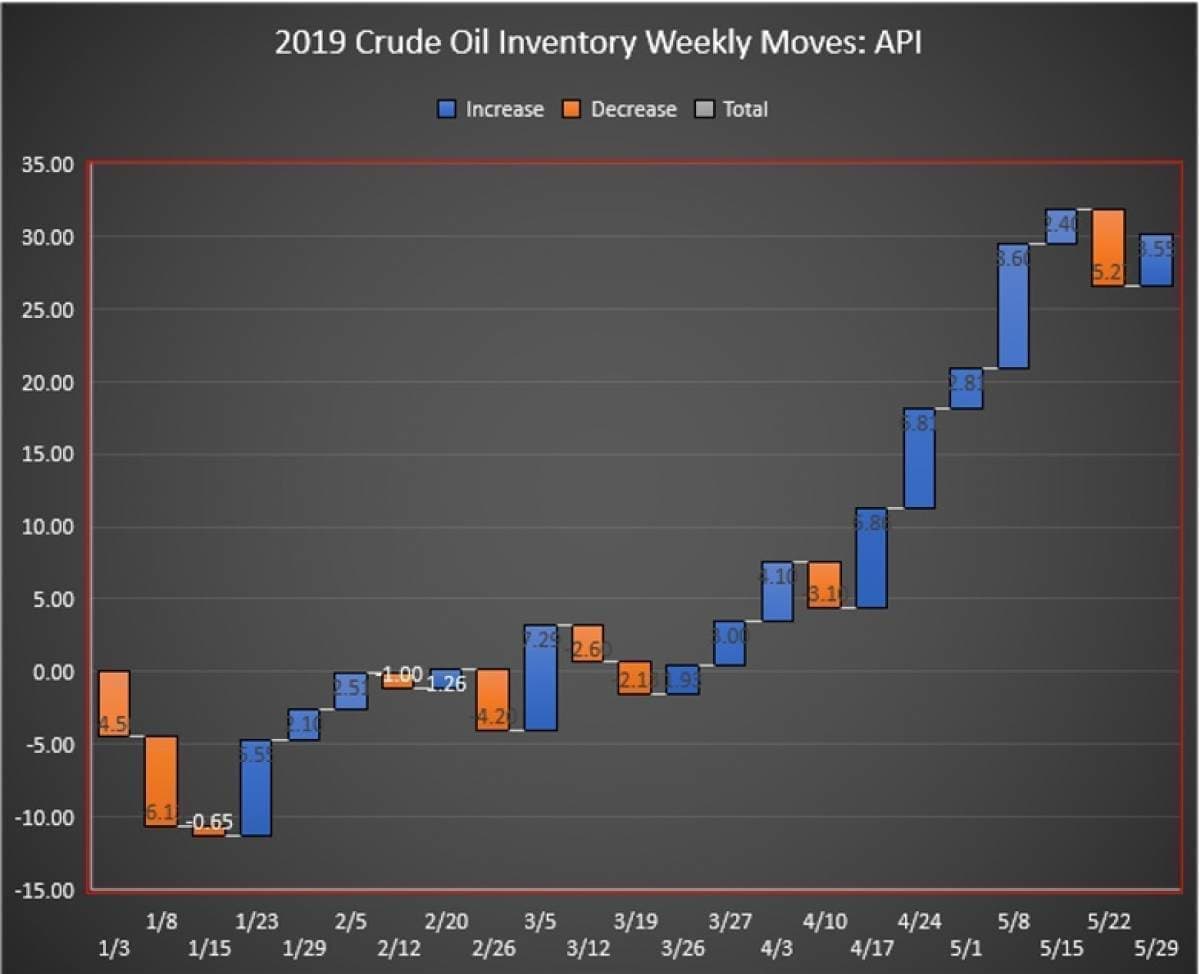

The American Petroleum Institute (API) reported a surprise build in crude oil inventory of 3.545 million barrels for the week ending May 31, coming in over analyst expectations of a 208,000-barrel drawdown in inventories. The build came as a blow to oil prices, with inventory gains seen in Cushing inventory too, as well as builds in gasoline and distillates.

Last week, the API reported that the string of surprise inventory builds had stopped, reporting a draw in crude oil inventories of 5.265 million barrels. A day later, the EIA estimated that US inventories had decreased by 300,000 barrels.

The net build is still a significant 30.20 million barrels for the 23-week reporting period so far this year, using API data.

Oil prices rose earlier on Tuesday as Saudi Arabia moved to reassure the oil market once again that it would do whatever it takes to rebalance the oil market. On the more bearish side, trade tensions between the United States and China and between the United States and Mexico have made the market skittish, fearing a decrease in demand as a result.

Related: Is Trump Reversing Course On Iran?

At 12:51pm EST, WTI was trading up slightly by $0.05 (+0.09%) at $53.30—more than $5 dollars lower than last week. Brent was trading up $0.43 (+0.70%) to $61.71--$6 below last week levels.

The API this week reported a build in gasoline inventories for week ending May 31 in the amount of 2.696 million barrels. Analysts estimated a build in gasoline inventories of 711,000 barrels for the week.

Distillate inventories rose by a staggering 6.314 million barrels for the week, while inventories at Cushing rose by 1.408 million barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending May 24 rose to 12.3 million bpd, resuming its all-time high that was originally hit the week of April 26.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.

By 4:40pm EST, WTI was trading up at $53.41 and Brent was trading up at $61.97.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Australia Remains Dividend On Roaring LNG Sector

- OPEC+ Has Only One Choice As Oil Prices Slide

- Iraq’s Ambitious Oil Plan Faces One Major Problem

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B