Breaking News:

Oil Moves Higher on Crude, Fuel Inventory Draw

Crude oil prices ticked higher…

Solar Companies Forced To Borrow To Finance Growth

Solar companies raised $12.2 billion…

Crude Inventory Draw Perks Up Oil Prices

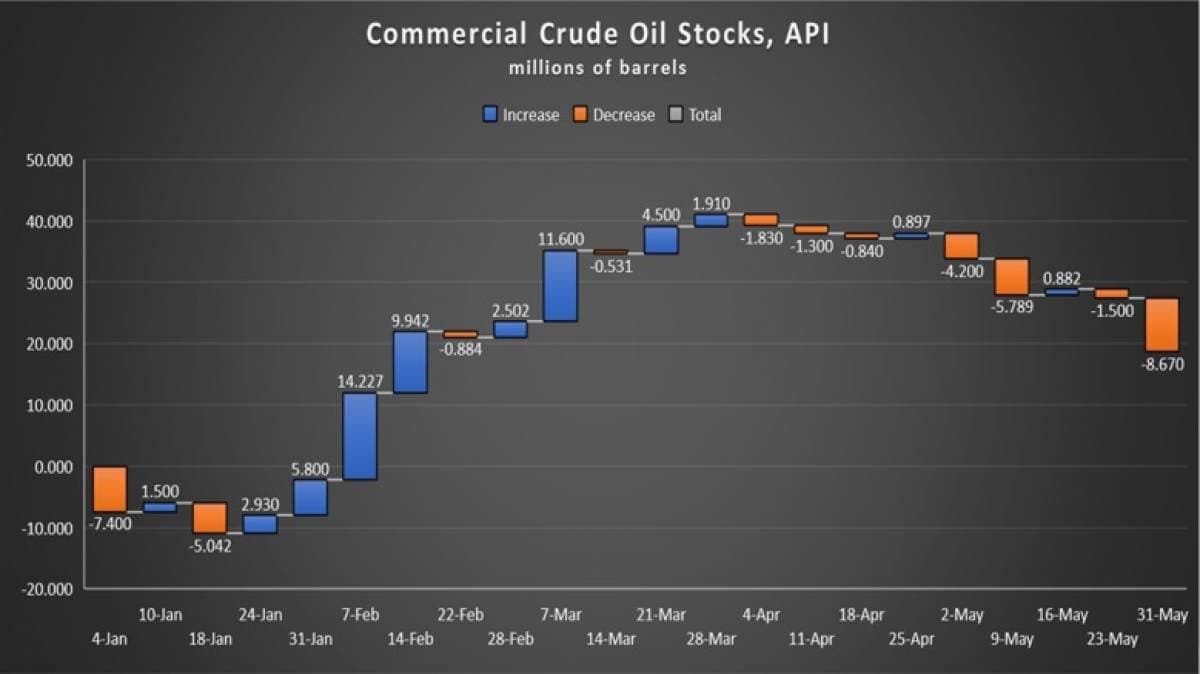

The American Petroleum Institute (API) reported a large draw in crude oil inventory of 5.265 million barrels for the week ending May 24, coming in over analyst expectations of a 857,000-barrel drawdown in inventories.

Last week, the API reported the latest in a string of surprise builds in crude oil inventories, the last of which was 2.4 million barrels. A day later, the EIA estimated that US inventories had increased by 4.7 million barrels.

Even with this week’s draw, the net build is still a significant 26.65 million barrels for the 22-week reporting period so far this year, using API data.

To compare, this is what the graph looked this this same week in 2017:

Oil prices rose briefly on Wednesday as news that flooding might impact oil flowing near Cushing, Oklahoma. But news of the escalating China/US trade dispute pushed prices lower, with WTI falling $0.31 (-0.52%) to $58.83, with Brent falling $0.80 (-1.16%) to $67.87 by 2:58pm EST. Prices continue to remain volatile in the wake of mounting tensions in the Middle East, supply disruptions in Venezuela and Iran, and the US/China trade dispute.

Both benchmarks are trading significantly down on the week.

The API this week reported a build in gasoline inventories for week ending May 24 in the amount of 2.711 million barrels. Analysts estimated a draw in gasoline inventories of 528,000 barrels for the week.

Distillate inventories fell by 2.144 million barrels for the week, while inventories at Cushing fell by 176,000 barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending May 17 rose slightly to 12.2 million bpd from the all-time high of 12.3 million bpd achieved during the week of April 26.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Thursday at 11:00a.m. EST due to the Memorial holiday.

By 4:45pm EST, WTI was trading down at $59.07 and Brent was trading down $68.07.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Russia Considers Accepting OPEC Cuts Extension

- Renewables Investment To Overtake Oil & Gas In Asia

- Peace And Oil: Trump’s Endgame In Saudi Arabia

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B