Breaking News:

Net-Zero Targets Could Double Yearly Copper Demand by 2035

Copper shortage fears return as…

The Rise of the Middle Corridor Trade Route

The Ukraine war has catalyzed…

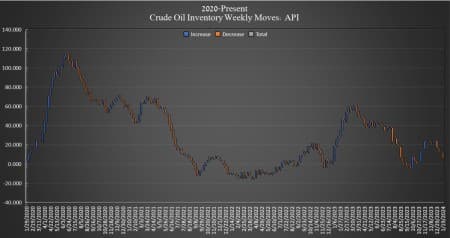

Large Rise in Gasoline Stocks Offsets Large Crude Draw

Crude oil inventories in the United States fell this week by 6.674 million barrels for the week ending January 19, according to The American Petroleum Institute (API), after analysts predicted a draw of 3 million barrels. The API reported a 483,000-barrel build in crude inventories in the week prior.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 0.9 million barrels as of January 19. Inventories are now at 365.5 million barrels.

Oil prices were down ahead of the API data release on reports of the lifting of the force majeure on Libya’s Sharara oilfield. At 3:50 pm ET, Brent crude was trading down 0.42% at $79.72—but up $1.60 per barrel compared to where it was this same time last week. The U.S. benchmark WTI was trading down on the day by 0.35% at $74.49, up about $1.70 per barrel compared to this time last week.

Gasoline inventories saw another large build this week, rising by 7.183 million barrels after rising by 4.86 million barrels in the week prior. As of last week, gasoline inventories were already slightly above the five-year average for this time of year, according to the latest EIA data.

Distillate inventories fell this week by 245,000 barrels, after rising by 5.21 million barrels in the week prior. Distillates are roughly 3% below the five-year average.

Cushing inventories fell by 2.031 million barrels after falling by 1.98 million barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Official Says Iran Is “Very Directly Involved” in Houthi Attacks

- U.S. Oil Industry Sets Record With $144 Billion of M&A Deals in Q4

- AI's Massive Power Consumption Demands Innovative Energy Solutions

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

The inventory build of nuclear weapons pointed at everyone quite suddenly also very impressively noted this week.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B