Breaking News:

Palestinian Political Factions Agree to Reconciliation Government

Palestinian factions Hamas and Fatah…

Oil Prices Tank on Fears China’s Rate Cuts Herald Demand Weakness

Oil prices fell significantly in…

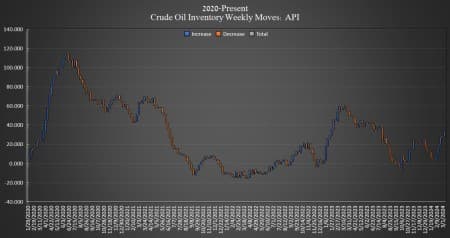

Inventory Draws Across The Board Jolt Oil Prices

Crude oil inventories in the United States fell this week by 5.521 million barrels for the week ending March 8, according to The American Petroleum Institute (API), largely contradicting analysts, who had predicted a 0.4 million barrel build. The API reported an 423,000-barrel rise in crude inventories in the week prior.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 0.6 million barrels as of March 8. Inventories are now at 361.6 million barrels.

Oil prices were down ahead of the API data release as the EIA increased slightly its forecast U.S. crue oil production.

At 3:58 pm ET, Brent crude was trading down 0.16% on the day at $82.08, up just 5 cents per barrel compared to this time last week. The U.S. benchmark WTI was trading down on the day by 0.22% at $77.76 $78.17, down nearly $0.41 per barrel compared to last Tuesday.

Gasoline inventories also fell this week, adding to the bullish sentiment. Gasoline inventories fell 3.750 million barrels, on top of the 2.8 million barrel inventory drop in the week prior. As of last week, gasoline inventories were about 2% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories also fell this week, by 1.162 million barrels, on top of last week’s 1.8 million barrel drop. Distillates were already 10% below the five-year average for the week ending March 1, the latest EIA data shows.

Cushing inventories rounded out the losses this week, falling 998,000 barrels after rising by 500,000 barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- This Could Be A Gamechanger For Natural Gas In Europe

- Oil Prices May Yet End the Week on a High Note

- Russia’s Coal Exports to Asia Slump Amid Intense Competition

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B