Breaking News:

Palestinian Political Factions Agree to Reconciliation Government

Palestinian factions Hamas and Fatah…

Canada Set To Delay Trans Mountain Pipeline Sale After 2025 Election

Canada’s federal government plans to…

Goldman: The Fed Is Approaching A “Critical Inflection Point”

Cutting to the chase, ahead of the Fed's decision (due at 2pm, Powell press conference 2:30pm, no projections so no new dots so no way to push back more on market expectations for sub-5% terminal rate), the key question - as Goldman puts it - is "what the FOMC will signal about further hikes this year" since 25bps tomorrow is in the bag and what matters to stocks is i) will this be the final rate hike and ii) how long will the Fed keep rates here before starting to cut.

"The Fed is approaching a critical inflection point and whether they finish with 25bp tomorrow (at 4.75%) or 25bp on 3/22 (at 5%), the end is very much in sight (but what really matters is how long they hold this level which i am betting will be much longer than most currently expect)." - Goldman trader John Flood

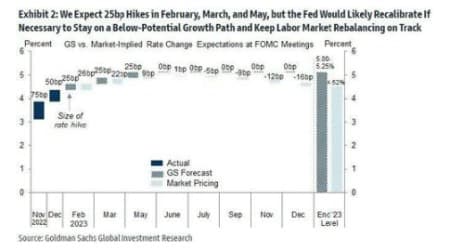

As Goldman further discusses in its FOMC preview (excerpted below, full note available to pro subs), "we expect two additional 25bp hikes in March and May, but fewer might be needed if weak business confidence depresses hiring and investment, or more might be needed if the economy reaccelerates as the impact of past policy tightening fades. Fed officials appear to also expect about two more hikes and will likely tone down the reference to “ongoing” hikes being appropriate in the FOMC statement."

Some more big picture observations from Goldman's David Mericle:

The FOMC’s goal for the year is clear. It aims to continue in 2023 what it began so successfully in 2022 by staying on a below-potential growth path in order to rebalance the labor market so that inflation will return to 2% sustainably. We agree with Fed officials that there is still a long way to go—after all, our jobs-workers gap is still about 3 million above its pre-pandemic level.

How many hikes will be needed to stay on this path is less clear. We expect two additional 25bp hikes in March and May, but fewer might be needed if weak business confidence depresses hiring and investment, or more might be needed if the economy reaccelerates as the impact of past policy tightening fades. Fed officials appear to also expect about two more hikes and will likely tone down the reference to “ongoing” hikes being appropriate in the FOMC statement.

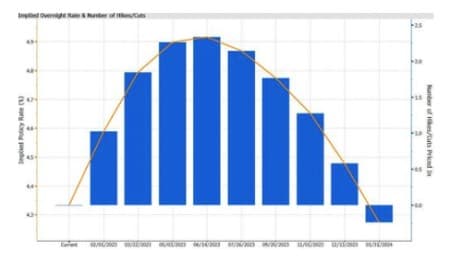

FWIW, the market gives just 2% odds of a 50bps hike tomorrow (i.e., 25bps tomorrow), and just 26% odds that there will be more than one more hike by May (i.e. another 25bps in March), at which point the Fed will be done and is then expected to start cutting as much as 50bps in the second half of 2023, and more in 2024. It is here that one should expect the most pushback from Powell tomorrow if indeed, as consensus overwhelmingly expects, the Fed Chair will be extra hawkish during his press conference.

But why just 25bps tomorrow? After all, if the Fed really wanted to punish stonks - as he clearly did at Jackson Hole with has hastily rewritten 8 minute speech, why not just do 50bps and crush risk? Here Goldman has an explanation too:

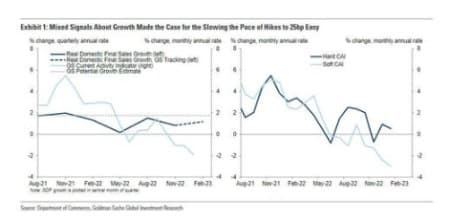

Since the FOMC last met in December, two trends in the economic data have made the case for slowing the pace of rate hikes to 25bp next week surprisingly easy.

- First, incoming data on wage growth and inflation have been encouraging, including a deceleration in average hourly earnings and the Atlanta Fed wage growth tracker, another round of soft inflation data, a continued collapse in alternative leading indicators of rent inflation, and a further decline in one-year Michigan consumer inflation expectations, which have now fallen 1.5pp since the Fed started hiking.

- Second, signals on activity growth have become more mixed and at times concerning. A large gap has opened up between GDP and our current activity indicator (CAI), and between the “hard data” components of our CAI and the “soft data” components like surveys. We suspect that nominal bias and negative sentiment driven by recession fears are depressing the survey data, similar to the pattern seen during the 2019 trade war, and that activity growth actually remains modest but positive. But uncertainty about the near-term outlook has risen.

While tomorrow's 25bps may be a done deal, where the Fed will clash with the market is how many more hikes are on the way. As noted above, the market now expects at most 1 more 25bps rate increase before May. However, the Fed December dots indicated that the median FOMC participant expects two additional 25bp hikes after tomorrow's rate hike. As a result, Goldman - if not the market - expects the FOMC will probably tone down the reference to “ongoing” hikes being appropriate in the FOMC statement, perhaps by replacing “ongoing” with “further.

There is more in the full Goldman note available to professional subs.

One more point from Goldman economist Zach Pandl, and this has to do with today's Employment Cost Index, which came in softer than expected, and which sparked today's frenzied rally as it hinted potential dovishness from Powell tomorrow, to wit:

Zach Pandl on ECI: “Clear deceleration in ECI; even larger downshift than in average hourly earnings growth during the quarter; very big drop in one of the underlying series that people focus on (wages ex-incentive paid occupations); more good news for soft landing camp/team transitory; on the margin I would think this raises odds of more dovish message from Powell tomorrow, although employment report on Friday will still have a lot to say about their overall read of labor market.”

Away from GS, here is what JPM thinks, starting with today's powerful rally following the weaker than expected ECI, and culminating with a warning that even a hint that Powell may not keep rates at 5% through year-end "could be enough to lead to a market rally. "

Stocks rallied as Employment Cost Index came in cooler than expected this morning, which provides more comfort on slowing wage inflation. While expectations on Fed’s terminal rates remains stable, equities and bonds are rallied on optimism around a Fed pause in May and potentially rate cuts in 2023. Despite recent Fedspeaks all supports holding terminal rate at 5% for the entire year, the OIS market currently expects the FFR to be around 4.5% by YE, implying a 50bp cut in 2H23. Will tomorrow’s meeting reshape this expectation? Feroli expects Powell’s speech to remain hawkish to push back against the easing financial conditions, but given this consensus view, any pivot from the view of holding FFR at 5% till YE could be enough to lead to a market rally.

As usual, much more from JPM - and other Wall Street firms - to pro subs in the usual place.

JPM is not the only one listening closely to what Powell will say: Jeff Gundlach just tweeted that he expects the Fed to "push back against the pivot narrative and thereby current bond market pricing." Which of course they will: the question is all about the nuances.

Finally, here is a quick and dirty FOMC preview snapshot from our friends at Newsquawk:

- OVERVIEW: The analyst consensus sees the FOMC lifting its Federal Funds Rate target by 25bps to 4.50-4.75%, with a small minority noting the potential for a larger 50bps hike increment. Money markets are pricing the smaller move with almost certainty, but further through the year, are underpricing the December SEP-implied terminal rate of 5.1% and are even pricing risks of Fed easing at the back half of 2023. Chair Powell is likely to stay the course around the fight against inflation not being over and the "higher for longer" policy stance, guiding to more hikes in the future despite the latest encouraging disinflationary data, but it's seen as unlikely that any efforts to jawbone tighter financial conditions will be successful barring a change in the data, with markets themselves in data-dependency mode. Meanwhile, Powell may provide the Fed more optionality to cater for a 'soft landing' by leaning into recent Fed Speak regarding the potential for disinflation absent a meaningful rise in unemployment.

- STATEMENT: The Fed is priced with almost certainty for a 25bps hike to take the FFR to 4.50-4.75%, with a less than 5% chance of a 50bps hike implied by money market pricing. The statement is expected to be updated to reflect the deceleration in the hiking pace and acknowledge the cumulative tightening already in place. With speculation building over whether the Fed will follow through with its guided rate hike path to 5.00-5.25%, it's worth keeping an eye out for any adjustments to its line that "ongoing increases in the target range will be appropriate", albeit it's probably a bit premature.

- POWELL: The Fed Chair is likely to reaffirm the party line of more work needing to be done on inflation. He likely highlights the promising string of declines in the inflation data, but also warns that it is still far above the 2% target, whilst expressing concerns over the stubbornly high services inflation. Perhaps more interestingly will be if Powell warms further towards the possibility of falling inflation without the need to cool the labour market. Members of the Board, from dove Brainard to hawk Waller, have recently alluded to the possibility of such. So, if Powell looks to cement that line of thinking, that the Fed doesn't require rising unemployment to bring inflation back down, recession risks/pricing are likely to reduce greatly, something that could be a driving factor in the recent pick-up in stock appetite given the data lately has evolved in favour of a 'soft landing'.

- DATA: Core PCE Y/Y has now declined for three consecutive months, sitting at 4.4% in December, and down from cycle peaks of 5.4% in February 2022, building belief that the peak may be in. A lot of that decline has been spurred by falling goods prices, asking the continued strength in the services sector, particularly core services ex-housing, which many Fed officials keep pointing to as an area that needs to be addressed. That decline has also come against the backdrop of initial jobless claims reaching 9-month lows and limited progress in JOLTS job openings falling to support a loosening in the labour market, but at the same time, wage growth data has shown some signs of cooling, with Tuesday's Employment Cost Index for Q4 a key focus after the promising wage data in the BLS employment report. Meanwhile, fears over an imminent recession have abated, with US GDP rising again in Q4 (+2.9%), and despite the dip in November and December real personal consumption, as well as December retail sales, real-time credit card data has picked up again into January and earnings commentary has been sanguine on the consumer.

By Zerohedge.com

More Top Reads From Oilprice.com:

- European Natural Gas Prices Surge Ahead Of Cold Spell

- Germany’s $2 Trillion Economic Miracle at Risk

- Chinese Demand Will Drive Oil Prices This Year

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B