|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 6 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 13 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 13 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 13 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 13 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

Stock Market’s Short-Term Focus Threatens Energy Transition Goals

The problem that most companies…

Oil Prices Under Pressure Despite Bullish Catalysts

Oil prices are under pressure…

Goldman Sachs Downgrades Shell For “Above-Average” Valuation

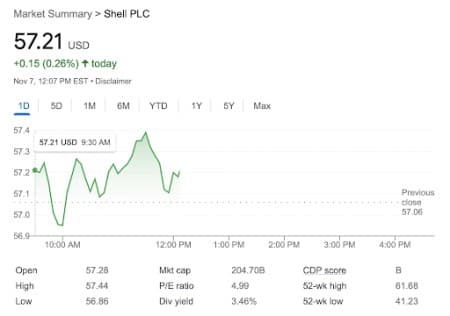

By Charles Kennedy - Nov 07, 2022, 2:30 PM CSTGoldman Sachs on Monday downgraded Shell over what it views as overvaluation compared to its supermajor peers.

The European Union’s big oil sector, SXEP, has generated what Goldman Sachs referred to as a “strong” free cash flow of $44.8 billion in the most recent quarter, yet Shell’s “outperformance” has resulted in “a relatively expensive valuation vs peers”.

In a research report, Goldman Sachs downgraded Shell from “buy” to “neutral”, citing “above-average” valuation compared to competitors.

Shell (SHEL) saw its share price shed 2% on Monday immediately after the downgrade, before recouping losses for a 0.26% gain on the day as of 12:08 EST.

Goldman Sachs’ Michele Della Vigna’s new 12-month price target for Shell is now 38 euros, down from 40 euros.

The downgrade and the price target drop, however, do not take away from the fact that Goldman Sachs still views Shell “very favorably” for this year, particularly in light of its massive buyback program of $18.5 billion, combined with its dividends.

Goldman Sachs estimates that shareholders of Shell will see 8.7% in total returns in dividends and buybacks this year. Compared to Shell’s peers, that number is less impressive when the average is 11.6%.

“In this context, we find more attractive combinations of dividends and buybacks across our coverage,” MarketWatch cited Della Vigna as saying in the report, highlighting that lower prices, unanticipated CAPEX increases and any unforeseen changes in offshore recovery rates could result in further assessments of ratings.

By Charles Kennedy for Oilprice.com

More Top Reads From Oilprice.com:

- Guyana’s Offshore Drilling Bonanza Is Just Getting Started

- Oil Shortage Forecasts Clash With Grim Economic Projections

- Big Oil Is Not Dancing To Government Tunes. Period.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com