Breaking News:

Coal Share of China's Power Output Drops to Record Low

China reached a momentous milestone…

China's Rare Earths Strategy, Explained

China's recent discovery of new…

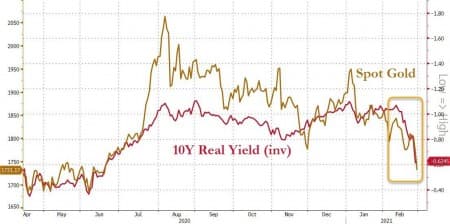

Gold Plunges As Real Yields Surge

Having broken below $1800 earlier in the week, after suffering a 'death cross', gold prices are plunging this morning - on heavy volume - as real yields soar.

This is the lowest in 8 months...

As real yields surge...

When will people stop selling gold and silver and realize that rising inflation is not a one-time threat that the Fed will stomp out by raising rates and tightening monetary policy? Peter Schiff explains:

"They [The Fed] are going to do nothing. The dollar is going to collapse, which is the mother of all tailwinds for gold. And so, at some point, it’s going to happen. But in the meantime, they’re simply creating more buying opportunities for people who have been really slow to pull the trigger on getting their precious metals, getting their mining stocks.”

In effect, Powell this week was telling the market, “Don’t worry, we won’t be tightening monetary policy for years.” This despite the fact that the commodity markets are screaming inflation. Oil, industrial metals, grains, beans – they are all making big gains. The only thing that’s not catching a bid is gold.

"For some reason, people are still thinking that rising interest rates are bad for gold and silver, but they’re bullish for everything else. But the reality is — they’re not. They’re more bullish for gold and silver than any of these other commodities... In fact, here is the reality that nobody wants to acknowledge: as interest rates are moving up, rather than raising rates and reducing the size of its QE program, it is going to increase the size of its QE program.”

Silver is also getting clubbed like a baby seal, back to pre-Reddit-Raiders' levels...

February looks set to be Gold's worst month since Nov 2016 (Trump's election), which also saw rates surge.

By Zerohedge.com

More Top Reads From Oilprice.com:

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B