Breaking News:

COP29 Host Aims to Raise $1 Billion for New Climate Fund

Azerbaijan is proposing a new…

Geomagnetic Storms Could Devastate Washington DC's Power Supply

New research shows Washington DC…

European Refiners Brace For Coronavirus Impact

Given the rapidly evolving situation, our short-term data shows indications of changes, or sometimes potential delayed impacts, in behaviour, pricing dynamics, and associated opportunities. Traders are quick to react to profitable situations. Even if some of the major oil trading companies are scaling back, other independent traders are only a mobile phone call away from securing a lucrative arbitrage cargo or a storage play that locks in some revenue for the next few months.

Crude Storage Opportunities

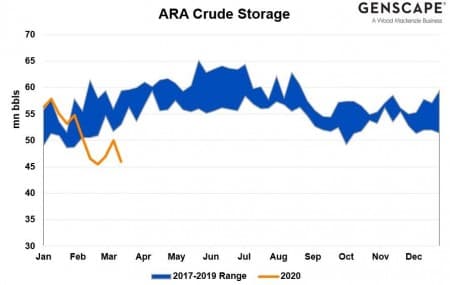

One of the first opportunities was the opening of storage economics, both onshore and offshore in most locations. As European derivative benchmarks switched into contango over the last few weeks, reports suggest crude storage continues to be the primary focus. Perhaps this is because crude prices fell faster and sooner than in the product markets.

Longer-term storage has more favorable economics, with Very Large Crude Carrier (VLCC) rates over a six-month period returning a profit compared to the futures price curve over the same period.

ICE Brent spent most of late February in backwardation and only moved into contango in early March. Initially, our vessel tracking noticed three aframax-sized cargoes delaying movement from the North Sea during the week ending March 13. Our data showed crude oil inventories in ARA declined over 4mn bbls, or, eight percent of the total measured volumes, in the week ending March 13. Unused, operations shell capacity we monitor is an additional 40mn bbls.

Figure 1: Storage in the ARA region. Source: Genscape

Likewise, crude inventories at Dalmeny, where Forties oil is stored in Scotland prior to vessel loading, were also low, although it has started to build between March 15 and March 18. There remains over 1.5mn bbls of ullage at this location. Forties crude is also supplying INEOS’ 210,000 bpd Grangemouth refinery, which took an additional 300,000 bbls between March 16 and March 18, as well as loading onto ships at Hound Point where cargoes were loaded for long-haul destinations in South Korea and China, according to our Supply Chain monitoring.

Related: Saudi Arabia’s Oil Price War Is Backfiring

Izki Loaded March 11 to March 15 with ~1,977,000 bbls to Rizhao, China

Elandra Everest Loaded March 3 to March 7 with ~ 1,857,000 bbls to Yeosu, South Korea

Additionally, one vessel, the Front Jaguar, was stopped, potentially indicating floating storage. The Front Jaguar loaded approximately 565,000 bbls of Forties crude on February 28 with Rotterdam as the declared destination, but the vessel had not departed the Port area, as of March 19, according to our data.

Stateside, our Cushing storage data showed inventory levels at the lower end of last year’s range, measuring just under 50 percent capacity utilization, for the week ending March 13.

Long haul freight rates are spiking higher, having been relatively low over recent weeks. The demand from Asia is recovering to an extent, and the western hemisphere is now starting to see extreme demand erosion. Long-haul economics make more sense in contango markets, and there are reports of trading houses chartering large vessels for storage. Glencore is said to have chartered an Ultra Large Crude Carrier (ULCC) to store 3mn bbls of crude oil and Shell to have chartered at least two VLCCs. There may be enough available ullage in shore tanks, but it will soon dissipate with very low crude demand and increasing output from Saudi Arabia and Russia continues unabated. The use of floating storage is mostly expected to be in Asia.

Refined Product Economics

ICE Gasoil futures were backwardated for the last month and flipped to contango on Thursday, March 12, too soon for the economics to be reflected in our storage data for the week ending March 13. Genscape-monitored Gasoil/ULSD inventories in ARA fell 330,000 MT, or seven percentage points, dipping to a relatively low 52.6 percent capacity utilization. Our waterborne analysis expects gasoil/ULSD volumes arriving from the Baltic region to fall again next week, further driving inventory declines in the ARA region. Our shipping analysis predicted stock draws at Rotterdam and Antwerp, as regional exports outpaced imports in the week ending March 13, which gave a timely insight that measured storage volumes would fall in these locations.

However, volume net flow into Amsterdam rose in the week of March 4, resulting in a small stock build in this location. Barge volumes from ARA to inland Germany were higher recently, perhaps a sign of households looking to restock as outright prices fall. A total of 343,000 MT of gasoil/ULSD from ARA entered the Rhine by barge on March 13. There appear to be no significant delays caused by coronavirus (COVID-19) at this time, according to our Rhine Barge Report.

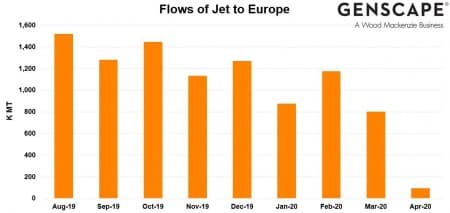

ARA jet storage was below 2019 levels year-over-year, and stocks drew a further 48,000 MT to 761,000 MT for the week ending March 13, leaving 47 percent of operational capacity unused. Reports suggest continued inflows to Northwest Europe are expected for the time being, despite huge cuts to aviation travel in recent days. Although some of these volumes may be blended into other distillate grades like gasoil and ULSD, long-term storage economics are challenging. Jet degrades faster than other oil products, and the assumption is that after about three months the product cannot be used for aviation. We will continue to closely monitor stocks in ARA as they are likely to build faster and sooner than offshore storage.

Figure 2: Jet loadings to Northwest Europe and the Mediterranean by loading month. Source: Genscape

Gasoline time spreads only slipped into contango on March 12. We reported ARA gasoline stocks rose 29,000 MT, or 1.6 percent, for the week ending March 13. Capacity utilization was around 58 percent, while stocks increased over recent weeks as summer grade product is stored in preparation for a seasonally higher demand period. Our waterborne analysis continued to observe reasonable flows of gasoline heading trans-Atlantic, with 600,000 MT moving that way in the week to March 13, only marginally lower than the previous week.

Gasoline volumes to West Africa fell from their elevated levels of the past few weeks. Our latest data shows less than 400,000 MT loaded for this region in the week of March 13. Storage volumes offshore West Africa rose slightly to just over 1.1mn bbls, according to our European Waterborne Products report. The excess volumes from the middle of February were cleared as crack spreads began to fall, and the crude-for-product swap contracts looked enticing to African importers of gasoline.

Refinery Behaviour

Refinery maintenance has gathered pace in Europe since the start of March. However, there is still little evidence in this region that turnaround projects will be altered due to coronavirus or finance-related issues. In the United States, there are several delays from this year to next for these reasons. Another possibility we are looking out for in our data is evidence of reduced refinery runs if workers are unable to be on site. This was evident in China as the outbreak of coronavirus began, but for now, we have yet to hear of such in Europe.

Related: Oil Majors Are Preparing For $10 Oil

Our data reported unit outages at 15 of the monitored sites as of March 18 All but three of these outages were in line with expected maintenance programs reported by the companies or media sources. Two large maintenance programs slated for early May remain on schedule as of now, at Neste’s 206,000 bpd Porvoo refinery in Finland, and Shell’s 404,000 bpd Pernis refinery in the Netherlands.

Total announced they were suspending maintenance work at their 117,000 bpd refinery in Feyzin, France due to COVID-19. If others follow suit or postpone upcoming maintenance, then refinery runs could increase in the coming weeks. However, with refinery margins around breakeven, this would be short-lived as less profitable refineries cut runs and close units.

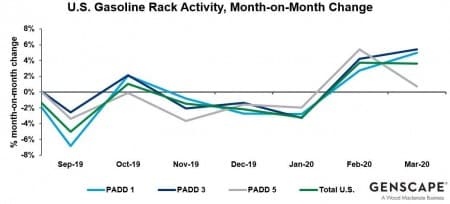

Whilst there is no reliable short-term refined products demand data available in Europe, our Supply Side data reports daily and hourly rack activity (transacted liftings from secondary terminals to retail stations) across the United States. Some effects on demand from coronavirus were observed in the U.S. West Coast (PADD 5) throughout the first half of March, where containment efforts started earliest. Interestingly, no significant downturn was observed in the other large markets of the U.S. at that time. As precautions to avoid large crowds are increasingly taken, early data indicates a time lag before such containment changes daily driving behavior, and the degree of response varies among cities.

Applying similar logic to Europe implies that mainland European demand would have started falling last week, and that product demand in the United Kingdom would not be impacted to any great extent until this week.

Figure 3: U.S. average weekly month demand. Source: Genscape, Wood Mackenzie

By Genscape

More Top Reads From Oilprice.com:

- Largest Oil Glut In History Could Force Crude Prices Even Lower

- The Great U.S. Shale Decline Has Already Begun

- Oil Plunges As Saudis Boost Exports To Record High

Genscape

With the world’s largest network of patented and proprietary monitoring technologies, Genscape delivers unique, real-time fundamental data to provide market insight and intelligence. Visit Genscape.com…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B