Breaking News:

Coal Share of China's Power Output Drops to Record Low

China reached a momentous milestone…

Chinese Mining Operations in Tajikistan Spark Environmental Backlash

Chinese mining and agricultural companies…

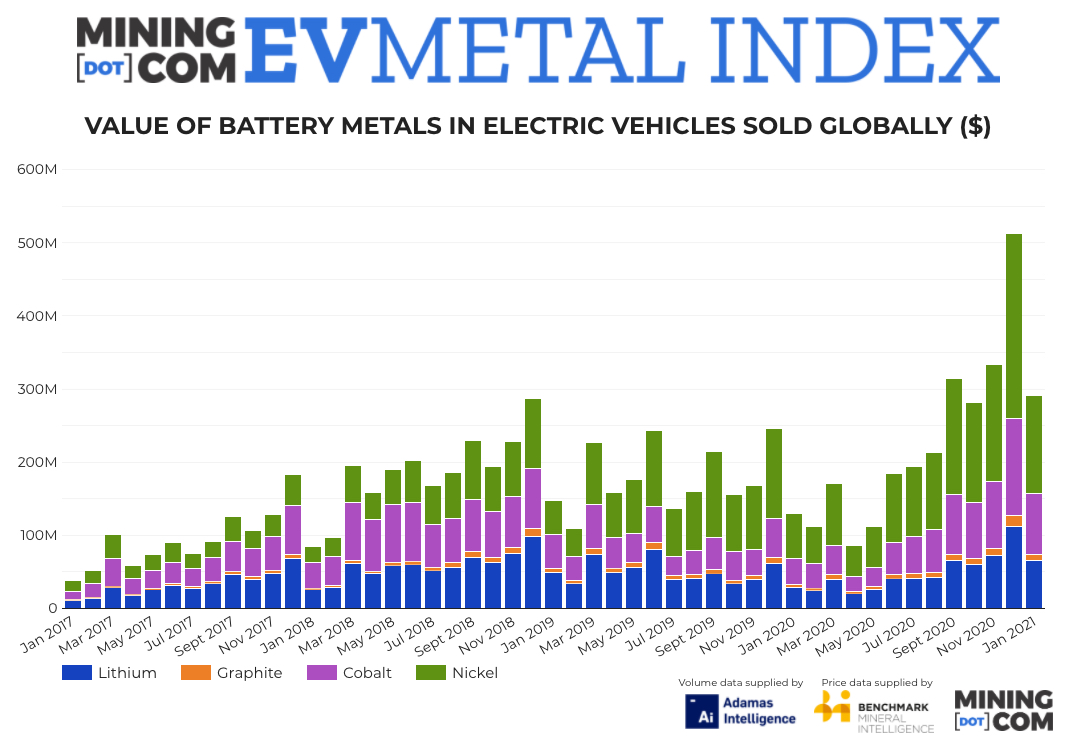

EV Metal Index Doubles As Lithium And Cobalt Prices Explode

Despite a 43% drop from December’s record, largely due to seasonal factors, the January 2021 MINING.COM EV Metal Index, which tracks the value of battery metals in newly registered passenger EVs (including hybrids) around the world, still ranks as the fourth-best month on record.

Just over $290.5 million worth of lithium, cobalt, nickel and graphite hit roads in January, up 124.6% from the same month last year, when the global impact of the coronavirus was not yet being felt.

Total battery capacity of EVs sold during the month increased 107% year-on-year to close to 13 GWh, according to Adamas Intelligence, which tracks demand for EV batteries by chemistry, cell supplier and capacity in over 90 countries.

To produce the most accurate data, the monthly battery capacity deployed numbers in the MINING.COM EV Metal Index do not include cars leaving assembly lines, those on dealership lots or in the wholesale supply chain, only end-user registered vehicles.

LFP on the up

Tesla was number one in terms of battery capacity deployed, accounting for 1 out of every 5 MWh in January, and also led in the deployment of lithium, nickel and cobalt.

That’s despite the fact that in January, the cobalt and nickel free version of Tesla’s most successful vehicle, the Model 3, made up nearly half of Model 3s sold and 27% of the company’s total sales in terms of battery capacity.

By itself, the LFP (lithium-iron-phosphate) battery equipped Model 3 manufactured and sold in China cornered 6% of the global market in terms of battery capacity deployed.

Related: Biden’s Energy Agenda To Reduce Oil Production And Boost Prices

Other LFP models like BYD’s Han EV, which has overtaken the Model 3 in terms of sales inside China, is likely to further boost the technology for mainstream adoption.

Price rally

According to Benchmark Mineral Intelligence, lithium prices will continue to surge in 2021, and with the popularity of LFP batteries, the lithium subindex will likely increase its portion of overall value, which has declined from more than a third in 2017 to some 22% in January.

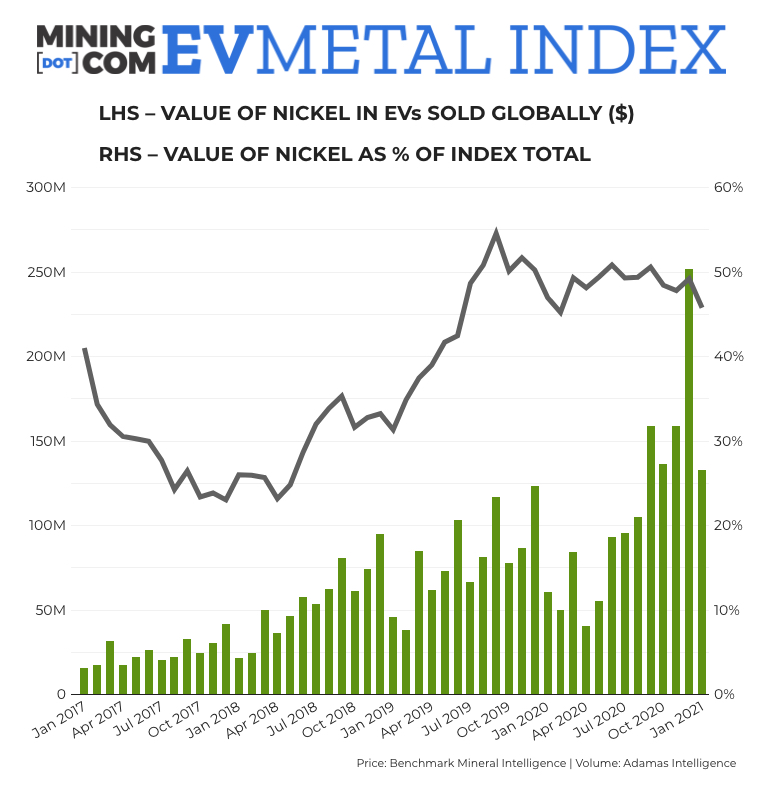

Deployment of cathode materials cobalt and nickel increased by two-thirds compared to January 2020. Nickel use in battery technologies has climbed steadily and now constitutes some 46% value of the index.

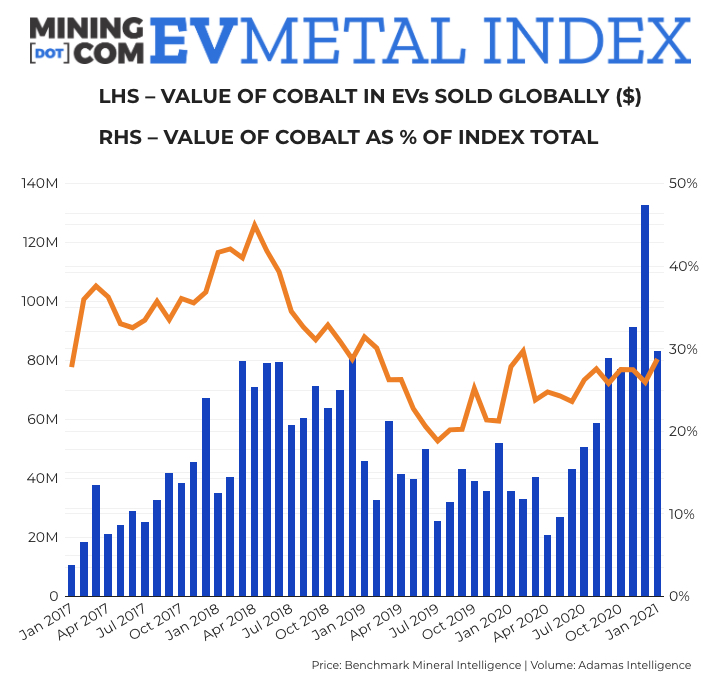

Cobalt’s share is climbing again, to nearly 30% thanks to a sharp rally in the priciest cathode material from a low of $30,000 a tonne in December 2019 to above $65,000 a tonne, according to Benchmark’s February price assessment.

Graphite index prices have also recovered from below $650 a tonne in September and October to nearly $720 a tonne this year.

By Mining.com

More Top Reads From Oilprice.com:

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B