Breaking News:

European Natural Gas Prices Fall as Freeport LNG Resumes Operations

European natural gas prices are…

Solar Surplus: California's Renewable Energy Dilemma

California's excess solar power production,…

Developing The Low-Carbon Trade Route Of The Future

A report published by market analyst Lux Research states that companies looking to decarbonize their energy trade routes have about 10 years to do so.

According to Lux, by 2030, imported electricity via new high-voltage direct current (HVDC) power lines is likely to become cheaper than low-carbon natural gas turbines. This means that corporations that have renewable energy import infrastructure in place by then, will be able to take advantage of the low prices.

The market analyst’s document states that there will be another tipping point in 2040 when imported liquid hydrogen is expected to be cheaper than low-carbon steam methane reformation.

With these developments around the corner, companies should “develop the partnerships and pilot projects necessary to demonstrate such a transformative energy paradigm,” the report reads.

In Lux’s view, this is particularly the case for enterprises operating in countries such as Singapore, Japan and the Netherlands, which cannot satisfy their own demand for energy with domestically produced renewable energy because they simply lack the land area and resource potential to power their energy-intensive economies.

“Countries representing $9 trillion of global GDP would face difficulties in meeting energy demand with domestic renewable production alone, requiring the import of future energy carriers,” the paper states.

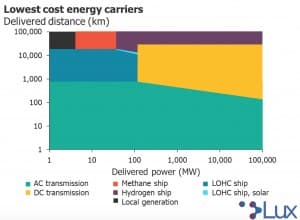

By comparing the lifetime costs of 15 different renewable energy carriers such as electricity and vanadium, Lux’s analysis shows that across all renewable energy carriers, low-cost solar energy can be delivered to resource-constrained regions at 50% to 80% lower cost than generating that solar energy locally under less favourable conditions.

(Graph by Lux Research).

The study presents data that supports the idea that the expanded buildout of AC and DC power lines — which are currently the only way to connect wind and solar generation to end-users — will be the most cost-effective way of importing low-cost solar energy from distant regions, though only up to roughly 1,000 kilometres. At farther distances, other renewable energy carriers like synthetic fuels are less expensive.

“Delivering energy via land-based infrastructure like powerlines or pipelines becomes expensive at long distances due to the inefficiencies of power lines and capital costs of pipelines,” the report reads. “Delivery via ship, on the other hand, is much more cost-effective at long distances, whether it be LOHC [liquid organic hydrogen carriers] delivered by tanker or liquid hydrogen delivered by cryogenic carriers like LNG.”

Even though at present no current energy carrier can offer costs low enough to completely replace liquid natural gas or oil, Lux believes that imported energy costs can be competitive against other zero-carbon technologies.

By Mining.com

More Top Reads From Oilprice.com:

- Russia Overtakes Saudi Arabia As The Largest Oil Exporter To China

- The State Of Texas Collected Huge Royalty Check Before Price Crash

- Trump Wants To Mediate In Escalating Conflict Between Asian Superpowers

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B