Breaking News:

Tesla to Focus on Autonomy and AI as Earnings Disappoint

Tesla is facing a slowdown…

Grid-Enhancing Technologies: The Answer to Growing Power Needs?

Grid-enhancing technologies offer interim solutions…

Crude Oil Sees Large Surprise Inventory Build

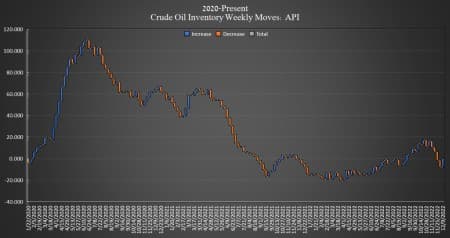

Crude oil inventories ended the four-week streak of draws this week, increasing by 7.819 million barrels, American Petroleum Institute (API) data showed on Tuesday, after dropping 6.426 million barrels in the week prior. Analysts anticipated a 3.913 million barrel draw.

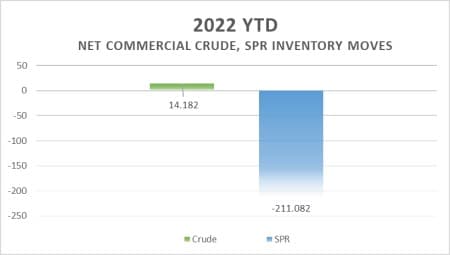

U.S. crude inventories have grown by 14 million barrels so far this year, according to API data. Meanwhile, crude stored in the nation’s Strategic Petroleum Reserves sunk by nearly 15 times that figure so far this year—by 211 million barrels.

The SPR now contains the least amount of crude oil since January 1984.

The build in commercial crude oil inventories came only as the Department of Energy released 4.7 million barrels from the Strategic Petroleum Reserves in the week ending December 9, leaving the SPR with just 382 million barrels.

In the week prior, the API reported a large draw in crude oil inventories of 6.426 million barrels.

WTI prices rose on Tuesday as the market reacted to OPEC’s falling crude production in November, per the organization’s Monthly Oil Market Report.

At 3:35 p.m. EST, WTI was trading up $2.43 (+3.32%) on the day to $75.52 per barrel. This is an increase of roughly $1 per barrel from the prior week. Brent crude was trading up $2.77 3.04 (+3.55%) on the day at $80.76—also an increase of roughly $1 per barrel on the week.

U.S. crude oil production rose to 12.2 million bpd—stopping a four-week streak of stagnate production. For week ending December 2, production increased by 500,000 bpd more than the levels seen at the start of the year, and a 900,000 bpd shortfall from the levels seen at the start of the pandemic.

The API reported a build in gasoline inventories this week of 877,000 barrels for the week ending December 9, on top of the previous week’s 5.93-million-barrel build.

Distillate stocks also saw a build this week, of 3.9 million barrels, on top of last week’s 3.55-million-barrel increase.

Cushing inventories rounded out this week’s gains, adding 640,000 barrels in the week to December 9, compared to last week’s reported increase of 30,000 barrels.

WTI was trading at $75.31 shortly after the data release.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Continue To Climb As China Reopens

- Is The Era Of Ever-Cheaper Lithium Batteries Over?

- Scientists Make Breakthrough In $40 Trillion Nuclear Fusion Push

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B