Breaking News:

The Plot to Further Disrupt Russian Oil Flows Proves That Sanctions Don’t Work

Russia’s oil revenues are still…

China's Rare Earths Strategy, Explained

China's recent discovery of new…

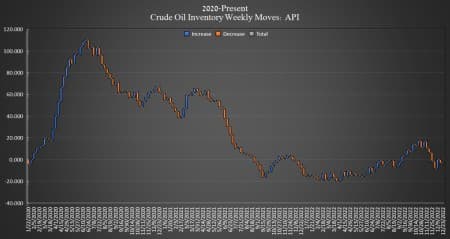

Crude Oil Inventories Fall Again Even As SPR Inventory Draws Continue

Crude oil inventories fell by 1.3 million barrels, American Petroleum Institute (API) data showed on Wednesday, after dropping 3.069 million barrels in the week prior.

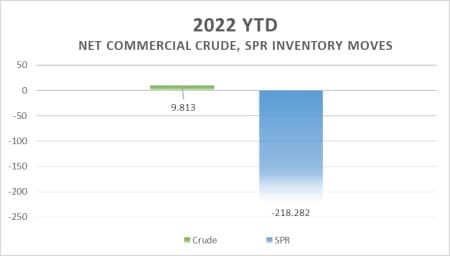

U.S. crude inventories have grown by fewer than 10 million barrels so far this year, according to API data. Meanwhile, crude stored in the nation’s Strategic Petroleum Reserves sunk by nearly 23 times that figure so far this year—by 218 million barrels.

The SPR now contains the least amount of crude oil since December 1983.

The draw in commercial crude oil inventories comes as the Department of Energy released 3.5 million barrels from the Strategic Petroleum Reserves in the week ending December 23, leaving the SPR with just 375 million barrels.

WTI prices crashed on Tuesday as the market braced for potentially weak oil demand from China—the world’s largest oil importer—as its Covid-19 cases surged as it relaxed its pandemic restrictions in the country.

At 11:30 a.m. EST, WTI was trading down $1.91 (-2.40%) on the day to $77.62 per barrel. This is an increase of roughly $1.50 per barrel from the prior week. Brent crude was trading down $2.10 (-2.49%) on the day at $82.23—also an increase of roughly $1.50 per barrel on the week.

U.S. crude oil production stayed at 12.1 million bpd for the week, a level that is just 400,000 bpd more than the levels seen at the start of the year, and on par with early 2019 figures.

The API reported a build in gasoline inventories this week of 510,000 barrels for the week ending December 23, on top of the previous week’s 4.51-million-barrel build.

Distillate stocks also saw a build this week, of 38,000 barrels, on top of last week’s 830,000-barrel increase.

Cushing inventories saw a draw, falling 338,000 barrels in the week to December 23, compared to last week’s reported increase of 840,000 barrels.

WTI was trading at $78.82 shortly after the data release.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- The Era Of Cheap Oil Has Come To An End

- Yergin: Oil Prices Could Break $120 If China Overcomes Covid

- Credit Suisse Predicts $63 Oil

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B