|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 3 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 11 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 11 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 11 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 11 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

Goldman Sachs: Next President Will Have Limited Tools to Raise U.S. Oil Supply

According to Goldman Sachs, the…

Rystad: OPEC's Oil Reserves are Much Lower Than Officially Reported

Rystad Energy’s latest research shows…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

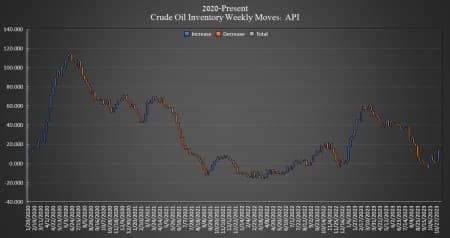

Crude Inventories See Another Build

By Julianne Geiger - Nov 14, 2023, 3:54 PM CSTCrude oil inventories in the United States rose again this week, adding 1.335 million barrels into inventory for week ending November 10, according to The American Petroleum Institute (API), after a 11.9-million-barrel rise in crude inventories in the week prior, API data showed. Analysts had expected a 1.4 million barrel build.

API data now shows a net build in crude oil inventories in the United States of 11.9 million barrels so far this year.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) stayed the same for the sixth week in a row, with the SPR inventory still sitting at a near 40-year low of 351.3 million barrels, with total purchases for the SPR coming in at less than 4 million barrels since the Biden Administration began its buyback program.

Oil prices were trading down ahead of API data release, with Brent trading down 0.06% at $82.47 at 4:03 p.m. ET—a roughly $0.70 increase week over week. The U.S. benchmark WTI was trading down on the day by 0.01%, at $78.25. WTI is up nearly $0.75 per barrel from this same time last week.

Gasoline inventories rose this week by 195,000 barrels, partially offsetting the 400,000 barrel decrease in the week prior. Distillate inventories fell this week, by 1.022 million barrels, on top of the 2.0-million-barrel draw in the week prior, while Cushing rose by 1.136 million barrels.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- IEA Raises Oil Demand Outlook For 2023 And 2024

- Nigeria Looks To Attract Saudi Investment In Downstream Sector

- Floating Cities And Climate Visas: Solutions To The Looming Climate Crisis?

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com

I'm surprised....