Breaking News:

Net-Zero Targets Could Double Yearly Copper Demand by 2035

Copper shortage fears return as…

Why China’s Commodity Imports Rise amid Struggling Economy

Chinese purchases of LNG, coal,…

Commodities In Crisis As Geopolitical Turmoil Hits Key Markets

U.S.-China tensions have bubbled up again, and commodity markets could be caught up in the turmoil, not least LNG. Aviation activity and jet fuel are also in the mix this week, along with corn fundamentals in North and South America, and UK solar power.

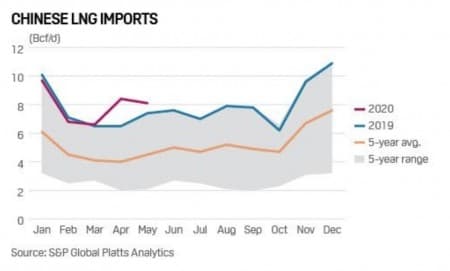

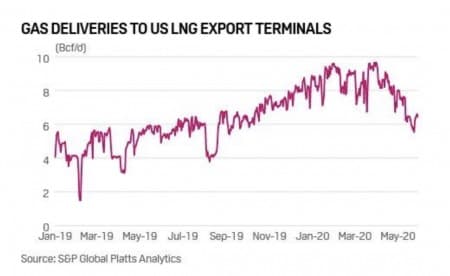

1. U.S. LNG exporters face new test as China tensions resurface

(Click to enlarge)

(Click to enlarge)

What’s happening? The U.S. move to no longer recognize Hong Kong’s independence from mainland China could lead to new tariffs and a potential collapse of the Phase 1 trade deal that promised $50 billion in U.S. energy purchases through 2021. That would be significant for U.S. LNG exporters, after deliveries to China resumed April 20 following a 13-month halt due to the impact of tariffs.

What’s next? Despite major coronavirus-related lockdowns earlier in the year, Chinese LNG demand has recovered fairly robustly this spring, with imports averaging over 8 Bcf/d in May, a year-on-year build of 9%, according to S&P Global Platts Analytics data. The global LNG market will continue to look to China to be an engine for demand growth this year, helping to balance a historic supply overhang. Normalizing LNG trade relations with China would be critical to efforts by U.S. exporters to benefit from that recovery and by developers of new liquefaction terminals to secure financing for their projects.

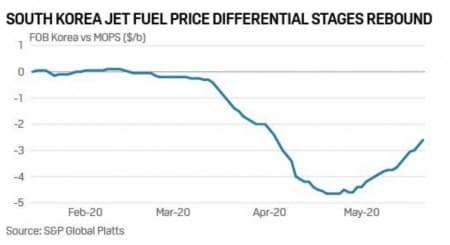

2. Asian jet fuel boosted by plans to ramp up flights from Korea’s Incheon

(Click to enlarge)

What’s happening? Jet fuel traders across Asia expect to see improved bids for June and July-loading cargoes after major South Korean airlines said they plan to resume international flights. Korean Air is adding 19 international routes on June 1 including U.S., Asian and European destinations. This will increase the airline’s operations to 32 international routes, with 146 flights a week from June 1. Asiana Airlines is eyeing similar moves. The airline will resume 13 international routes from June 1 – one to Seattle and 12 to Chinese cities – raising its services to 27 international routes versus 73 before the outbreak.

What’s next? South Korea’s Incheon airport is one of the busiest air traffic hubs in Asia alongside Singapore’s Changi airport. Re-opening of flight routes to and from Incheon should lift regional jet fuel demand and propel recovery in refining margin for the fuel. The FOB Singapore jet fuel/kerosene assessment rebounded by more than threefold from its trough of $13.06/b on April 22 to $37.79/b at the Asian close on May 26. Platts assessed the FOB Korea jet fuel cash differential at minus $2.20/b to the Mean of Platts Singapore jet fuel/kerosene assessments on May 28, a solid rebound from an all-time low of minus $4.65/b on April 22.

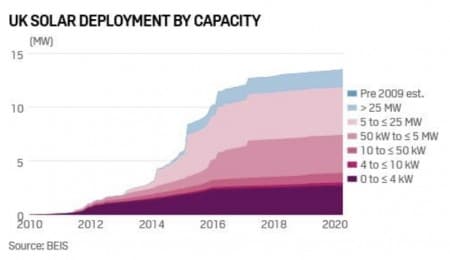

3. UK solar causing grid stability headaches – but it could be worse

(Click to enlarge)

What’s happening? The UK’s National Grid is seeking capacity turn-down offers from wind and, for the very first time, solar farms during weekends, in an emergency move to secure grid stability. This expensive last-resort action is necessary, the operator says, because of lockdown-affected electricity demand and, in part, rising seasonal solar output. Into this mix comes the announcement that the government has approved the UK’s largest solar scheme to date, the 350 MW Cleve Hill project in Kent, while a 500 MW project in Cambridgeshire is close to an application.

Related: Have Oil Traders Abandoned Fundamentals?

What’s next? As the lockdown eases, so working week electricity demand should recover, at last to some extent – but weekends will continue to challenge grid stability with low demand and surplus generation. UK solar capacity stands at 13.4 GW installed, with midday peaks forecast to approach 9 GW into early June. With demand falling below 20 GW at weekends, the grid’s challenge becomes clear if the wind blows. The real story, however, is that the midday peak problem would be much worse had solar subsidies not been withdrawn several years ago. Flagship projects like Cleve mask the fact that in the last year, just 195 MW of new solar have been added – an increase of less than 1.5% over the period.

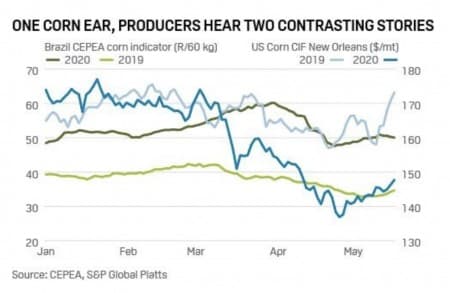

4. U.S.’s record corn acreage adds to price woes; Brazil sees more support

(Click to enlarge)

What’s happening? Prices of corn in Brazil, the world’s second-largest exporter of the coarse grain, hit record nominal highs this year as robust domestic demand, low stocks and favorable exchange rates boosted local prices. At the same time, producers in the U.S., the top exporter of corn, are seeing corn prices at breakeven levels due to the collapse in demand from ethanol sector, which accounts for the bulk of the consumption, following COVID-19 related restrictions on movement.

What’s next? Markets are keeping a close eye on Brazil, as corn prices are likely to ease when the harvest of second corn crop hits the market in June. However, Brazilian corn prices are still expected to be significantly higher than previous years even during the peak supply season, as most of the corn is consumed by the livestock industry, unlike the heavily ethanol-dependent U.S. corn market. U.S. corn prices have already hit multi-year lows recently, reaching $3.01/bu on April 21. The outlook for corn prices remains bleak in the U.S., as the corn planted area in the 2020-21 marketing season is projected to touch a new record, while corn stocks are seen at levels not seen since 1987-88.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Russia Overtakes Saudi Arabia As The Largest Oil Exporter To China

- The State Of Texas Collected Huge Royalty Check Before Price Crash

- Trump Wants To Mediate In Escalating Conflict Between Asian Superpowers

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B