Breaking News:

Oil Prices Tank on Fears China’s Rate Cuts Herald Demand Weakness

Oil prices fell significantly in…

European Natural Gas Prices Fall as Freeport LNG Resumes Operations

European natural gas prices are…

Brent Crude, WTI Sink Back To Pre-Invasion Levels

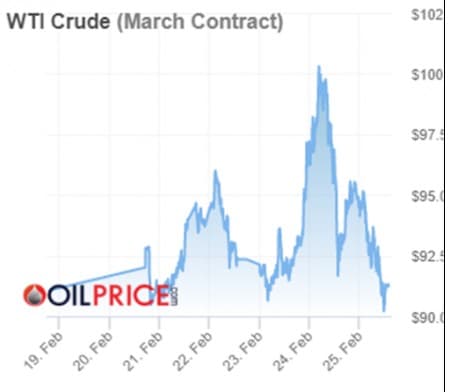

Both crude oil benchmarks had slipped back to pre-invasion levels on Friday afternoon, dashing the predictions of some that the oil markets would see “apocalyptic” pricing.

As Russia moved into Ukraine on Thursday by land, air, and sea, crude oil prices shot up in an already volatile oil market. Fears that Russia—the world’s third-largest crude oil producer and exporter of 6-8 million barrels per day of crude oil and refined products—may find itself unable or unwilling to supply its usual customers with crude oil and natural gas.

The price of Brent crude oil reached $105.79 on Thursday, after rising more than $8 per barrel after Putin declared that Russia had engaged in a “special military operation” in Ukraine that the rest of the world quickly labeled as an invasion. WTI crude oil topped $100 per barrel earlier on Thursday.

But by Thursday afternoon, prices had begun to recede after President Biden announced a second wave of sanctions that did not include any energy-related sanctions—Russia’s bread and butter.

On Friday, prices slipped even further, with Brent eventually falling back to $96.99 (-2.23%) at 2:00 p.m. ET, back the levels seen prior to the invasion.

The path that WTI crude oil prices took was similar. By Friday, WTI had slipped back to $91.22 per barrel at 2:00 p.m. ET—a price that was down $1.59 (-1.71%) on the day and below the levels seen prior to the invasion.

The price of Russia’s Urals grade, on the other hand, is trading at a substantial discount to Brent crude as traders are cautious about trading in a grade that could eventually come with sanctions. Also contributing to a steeper Urals discount are higher insurance premiums on cargoes sailing into the Black Sea, along with difficulties in obtaining letters of credit for Russian crude.

Late Friday afternoon, Urals was reportedly trading at a $12 discount to Brent. It is the largest Urals discount in years.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Don't Count On OPEC To Bring Oil Prices Down

- Russia Has $630 Billion To Spare As It Considers Cutting European Gas Flows

- Oil Prices Retreat As Biden Leaves Energy Out Of Sanctions Package

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B