|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 6 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 13 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 13 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 13 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 13 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

Palestinian Political Factions Agree to Reconciliation Government

Palestinian factions Hamas and Fatah…

China's Rare Earths Strategy, Explained

China's recent discovery of new…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

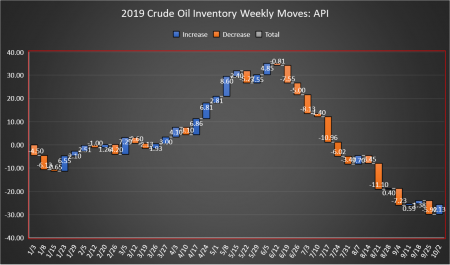

Big Crude Oil Build Largely Offset By Large Products Draw

By Julianne Geiger - Oct 08, 2019, 3:50 PM CDTThe American Petroleum Institute (API) has estimated a large crude oil inventory build of 4.13 million barrels for the week ending October 3—compared to analyst expectations of a 1.413-million-barrel build.

Last week saw a surprise draw in crude oil inventories of 5.92 million barrels, according to API data. The EIA estimated that week that there had been a build instead, of 3.1 million barrels.

After today’s inventory move, the net draw for the year is 25.72 million barrels for the 41-week reporting period so far, using API data.

Oil prices were trading down on Tuesday prior to the data release as economic growth outlooks dampen, threatening future oil demand growth. The EIA’s latest Short Term Energy Outlook on Tuesday adjusted down its estimate for Brent prices in 2020 by $5 per barrel, expecting it to average just $57 per barrel by the second quarter of next year.

At 3:04pm EDT, WTI was trading down $0.10 (-$0.19%) at $52.65—Almost $2 off last week levels. Brent was trading down $0.12 (+0.21%) at $58.23, roughly $1.00 per barrel lower than last week’s levels.

The API this week reported a draw of 5.94 million barrels of gasoline for week ending October 3. Analysts predicted a draw in gasoline inventories of 257,000 barrels for the week.

Distillate inventories fell by 3.98 million barrels for the week, while inventories at Cushing rose by 1.24 million barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending September 27 fell back slightly to 12.4 million bpd, just 100,000 bpd off last week’s levels and the all-time high.

At 4:46pm EDT, WTI was trading at $52.40, while Brent was trading at $58.00.

By Julianne Geiger for Oilprice.com

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com