Breaking News:

Kuwait Looks To Nearly Double Production After Major Oil Find

Sheikh Nawaf al-Sabah, CEO of…

Unaffordable Prices and Elevated Interest Rates Impact New Car Demand

Amid rising inventories and lackluster…

Beijing To Allow Free Market Forces To Dictate Coal Power Prices

Beijing said on Tuesday it would allow price fluctuations of power derived from coal-fired plants to improve the country's power market as shortfalls in power generation have sparked an energy crisis.

According to a notice from National Development and Reform Commission (NDRC), electricity prices generated by coal-fired plants will be permitted to rise and fall by 20%. That compares with the prior upside limit of 10% and the lower limit of 15%. The reform would take effect from Oct. 15

NDRC requested provincial governments to require industrial and commercial users to purchase power at market prices. The agency added liberalization of the power market would help prevent price manipulation and monopolistic practices.

Power plants in the country have struggled to meet post-pandemic demand, and record-high coal costs have rendered many power operations uneconomical. NDRC said by allowing market forces to dictate power prices in a range of 20% will increase power generation by making loss-making generators profitable and bring online generators that were once deemed uneconomical.

NDRC official Peng Shaozong said the reform was "designed to reflect power demand and consumption, and to some extent to ease operation difficulties of power firms and encourage plants to increase power supply."

Frederic Neumann, co-head of Asian Economic Research at HSBC, told Reuters that liberalization of "thermal power pricing is a positive for growth by reducing power outages."

"Still, this comes with a further rise in price pressures, as power companies can now pass on higher input costs to their commercial and industrial customers," Neumann said.

However, Lara Dong, senior director of IHS Markit, said, "power prices at 20% above coal-fired power benchmark will not be sufficient to help coal plants break even at current fuel prices."

And she warned that energy-intensive sectors would face record-high power prices, which is pushing up the producer price index (PPI).

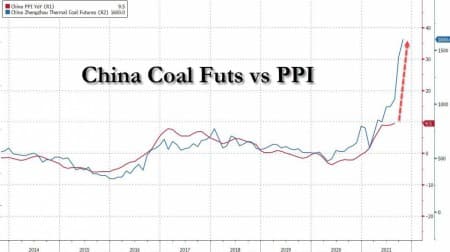

Historically, Chinese coal prices - due to their core role as the anchor of China's energy-intensive economy - have been the commodity that most closely has correlated with PPI. And while we wait to get the latest Chinese CPI and PPI print later this week, we can already predict what will happen this winter.

"Higher electricity price in China will add to the worry of rising global inflation," Kevin Xie, senior Asia economist at Commonwealth Bank of Australia, warned.

The reform comes as the Northern Hemisphere's winter fast approaches, and China is facing an energy shortage of fossil fuels, including coal and natural gas.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Will The U.S. Be Spared From The Global Energy Crisis?

- Canada’s Oil Stocks Are Trading At Bargain Basement Prices

- This Key Indicator Is Pointing To Higher Oil Prices

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B