Breaking News:

Kazakhstan, Azerbaijan, and Uzbekistan Forge Green Energy Export Alliance

Kazakhstan, Azerbaijan, and Uzbekistan join…

Oil Moves Higher on Crude, Fuel Inventory Draw

Crude oil prices ticked higher…

Atlantic Freight Rates Could Collapse As Carriers Ramp Up Trade Lane Capacity

While freight rates have been dropping consistently on most trades, they have remained at high levels on the Transatlantic due to capacity issues.

However, according to Sea-Intelligence, this is about to change, as carriers are injecting serious amounts of capacity into the trade lane.

From North Europe, capacity growth is scheduled to begin spiking from mid-December 2022, reaching a temporary apex at the end of the month, with capacity growth at 43% Y/Y. Once we head into February, the current deployment indicates a capacity growth of 48%.

Compared to 2019 (pre-pandemic), from mid-December 2022, the operating capacity on North Europe-North America East Coast will shift from being roughly at the same level as in 2019 to being 20% higher.

"And as we get into mid-February 2023, this is poised to jump even further to 30%. However, this is not even the largest increase, as capacity from the Mediterranean will grow at an average of 25% over 2019 in January-February 2023," said Sea-Intelligence's report.

This is at odds with demand growth (or lack thereof), as demand was down by 3.4% Y/Y in Aug-Oct 2022, certainly not warranting the level of capacity injection currently planned, according to the Danish maritime data analysis firm.

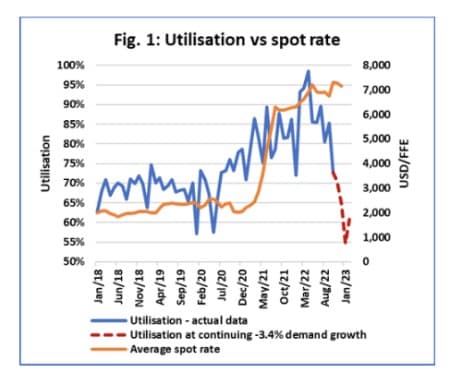

In accordance with the calculation of vessel utilisation by matching capacity and demand on the head-haul, (with the assumption that demand continues to decline at the same -3.4% rate), and then matching it against the spot rates, we get the data in figure 1.

"There is a link between spot rates and vessel utilisation, but what is also clear is that there is a time lag of several months," commented Alan Muprhy, CEO of Sea-Intelligence, adding that "given this time lag, and based on the current drop in utilisation, spot rates on the Transatlantic are primed to collapse in the coming months."

By Zerohedge.com

More Top Reads from Oilprice.com:

- Goldman Sachs Expects A Bumper Year For Commodities In 2023

- Russia’s Response To The Oil Price Cap Is Nearly Ready

- UK MPs Warn Hydrogen “Not A Panacea” For Emissions Problems

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

-

Recession combined with hyper-efficient trucking from entire US South moving from South to North can drive down the cost of moving goods into a massive economic zone that also doesn't have much demand for much at the moment as well very true.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B