Breaking News:

Oil Prices Tank on Fears China’s Rate Cuts Herald Demand Weakness

Oil prices fell significantly in…

A Volatile Week for Oil Prices

A very volatile week for…

Across The Board Crude Oil, Products Inventory Draws Send Prices Higher

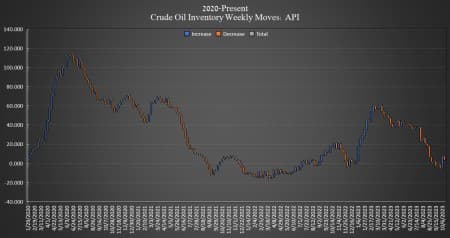

Crude oil inventories in the United States fell by 4.383 million barrels for week ending October 13, according to The American Petroleum Institute (API), countering the large 12.940-million-barrel rise in crude inventories in the week prior, API data showed.

Analysts were expecting a draw of 1.267 million barrels for the week.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) stayed the same for the second week in a row, with the SPR inventory still sitting at a near 40-year low of 351.3 million barrels, with total purchases for the SPR coming in at less than 4 million barrels since the Biden Administration began its buyback program.

Oil prices were trading up ahead of API data release, with Brent trading up 0.88% at $90.44 at 4:16 p.m. ET—a roughly $4 increase week over week. The U.S. benchmark WTI was trading up on the day at 0.78%, at $87.34. WTI is up nearly $4 per barrel from this same time last week.

Gasoline inventories fell this week by 1.578 million barrels, partially offsetting the 3.645 million barrel build in the week prior. Gasoline inventories are roughly 1% more than the five-year average for this time of year, EIA data shows. Distillate inventories also fell this week, by 612,000 barrels, on top of the 3.535-barrel draw in the week prior, and are now about 11% below the five-year average for this time of year.

Cushing inventories rounded out the inventory losses this week with a 1.005 million barrels decline, after falling by 547,000 barrels last week, leaving an estimated 20.7 million barrels in stock—the lowest point since 2014.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Low Natural Gas Demand Helps Europe Boost Inventories

- Oil Markets Remain On Edge As Biden Heads To Israel

- Stockholm To Ban Gas And Diesel Cars From 2025

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B