Oil prices have fallen back slightly on the news that the U.S. plans to ease sanctions on Venezuela's oil exports, but geopolitical tension in the Middle East will keep oil markets on edge.

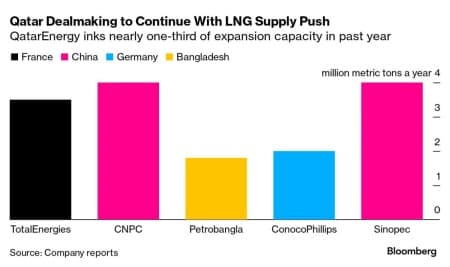

Chart of the Week

- Qatar has been actively leveraging fears over energy security in the long run with decades-long term LNG supply deals still only covering a third of its incremental production from the North Field East and North Field South expansions.

- Once the world’s largest gas exporter dethroned by the US, Qatar is expected to regain that spot again by ramping up its LNG production capacity by 64% to 126 mtpa by 2027.

- However, up until now Qatar has only contracted 15.3 mtpa of future production out of the total 48 mtpa of total capacity, with Shell, ExxonMobil, and ENI (all minority stakeholders in the expansion project) still waiting for their respective shares.

- The Russia-Ukraine war has put the continent’s gas supply front and center to EU policy, which is why Qatar has been making inroads into infrastructure, too – it booked regasification capacity in France, Belgium, and the UK until 2050, seeking to squeeze out US LNG volumes that currently account for 43% of the European market.

Market Movers

- Canadian oil producer Tourmaline Oil (TSE:TOU) agreed to buy rival firm Bonavista Energy for $1.1 billion in cash and stock, bringing its total production to more than 600,000 boe/d.

- The world’s largest energy trader Vitol will invest around $1 billion, half of its capital expenditure this year, into its burgeoning renewable energy and electricity portfolio.

- Italy’s oil major ENI (BIT:ENI) started drilling one of the most anticipated exploration wells this year, the Orion-1X wildcat in Egypt’s part of the Eastern Mediterranean, brushing aside war risks in adjacent Gaza.

Tuesday, October 17, 2023

Whilst the reported deal between the United States and Venezuela on the relaxation of sanctions has driven Brent back below the $90 per barrel threshold, tensions in the Middle East continue to keep the oil market on tenterhooks. Now the attention is on US President Joe Biden traveling to Israel on Wednesday, a move that could either mark the launch of a full-blown offensive or, alternatively, cool tensions in the region and push oil prices lower.

US to Announce Venezuela Sanctions Deal. The White House and Venezuela’s Presidential Office are expected to announce a deal as early as Tuesday, easing US sanctions on the embattled Latin American country’s oil sector in return for freer 2024 presidential elections.

Saudi Calls for More Focus on Emissions. Speaking at the Energy Intelligence Forum in London, Saudi Aramco CEO Amin Nasser said the COP 28 climate conference should focus on cutting emissions from hydrocarbons rather than aim to cut supply of conventional energy sources.

Albemarle-Liontown Megadeal Falls Apart. US lithium miner Albemarle (NYSE:ALB) abandoned its $4.2 billion buyout bid for Australia’s Liontown Resources after Australia’s richest person Gina Rinehart raised her stake in Liontown to 19.9%, seeking to block the A$3 per share takeover.

Lebanon Block 9 Sees No Gas Discoveries. Lebanon’s energy minister confirmed that exploratory drilling at the country’s offshore Block 9 yielded no hydrocarbon discoveries, pouring cold water on the plans of TotalEnergies (NYSE:TTE) and ENI (BIT:ENI) in the Eastern Mediterranean.

NY Rejects Majors’ Request for Higher Prices. The regulator of New York state NYPSC denied requests from oil majors BP (NYSE:BP), Equinor (NYSE:EQNR), and Orsted to renegotiate power supply contracts to include inflation and other cost increases on new wind power plants.

Kazakhstan Wants Billions from Oil Producers. Following a failed attempt to sue an international consortium managing the Kashagan oil field for $5 billion over excessive sulfur deposits, Kazakhstan’s Ecology Ministry has appealed the decision and seeks another court battle.

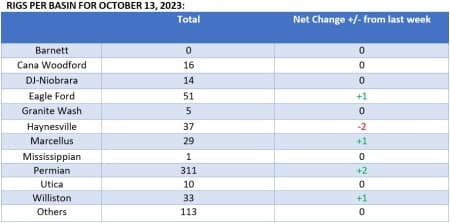

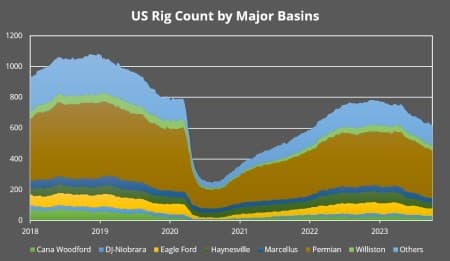

Shale Output to Continue Falling in the US. The US Energy Information Administration (EIA) expects US shale production from the country’s leading producing regions to decline for a third month in a row in November, falling to 9.533 million b/d from 9.604 million b/d this month.

Germany Starts Up Coal Generation for Winter. As heating season started in Germany, the country’s authorities have decided to fire up a 500 MW coal-fuelled power plant in the State of Brandenburg to cope with this winter season’s first cold snap in northern Europe.

VLCC Freight Rate Soar to Strength. Freight rates for VLCC tankers from West Africa to Europe soared to a 16-week high as the market assessed early November-loading fixtures at w75 thanks to strong demand, a sea change compared to the 19-month low w41 seen as recently as October 6.

Brazil Prepares Huge Offshore Auction. Brazil’s oil regulator ANP has allocated 33 oil and natural gas leases in its upcoming December auction, the fourth lease sale that would use the concession model (considered to be more market-friendly than PSAs) generally applied for onshore and post-salt fields.

EU Tries to Settle Franco-German Dispute. EU energy ministers will convene in Luxembourg this week to resolve an ongoing spat between France and Germany regarding state aid allowed to fund power projects, with Berlin still fearing the French nuclear fleet will allow Paris to subsidize other sources of energy.

India Uneasy About Using Yuan in Oil Trade. Payment in Chinese yuan for at least seven cargoes of Russian crude imported by state-owned Indian oil refineries is being held up over Delhi’s hesitancy to accept such transfers as Russian exporters are increasingly demanding a dollar-to-yuan switch.

Suez Canal Clinches Major Chinese Deals. Egypt’s Suez Canal Economic Zone signed a $6.75 billion with China Energy to produce green ammonia and hydrogen at the entrance of the canal in Ain Sukhna, concurrently signing a $8 billion deal with Hong Kong’s United Energy to produce potassium chloride.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Carmakers Slam Biden’s Fuel Efficiency Plans

- Oil Poised To Become U.S.’ Single Largest Export Product

- Low Natural Gas Demand Helps Europe Boost Inventories